Our friends at TaxJar put together a useful guide to help eCommerce business owners navigate online sales tax a few years ago. We’ve updated the guide to reflect changes in online sales tax laws since we first posted it, and we think it’s still essential reading for anyone new to online retail.

Online sales taxes are one of the most confusing aspects of selling to customers all over the U.S. Many factors can affect where you owe sales taxes—even your eCommerce fulfillment. Fortunately, sales tax automation software can help you navigate this complex aspect of running an eCommerce business.

1. Sales tax is governed at the state level

There is no federal sales tax. Instead, sales tax is governed by each state’s taxing authority (this is usually called the [State] Department of Revenue, but sometimes goes by other names). Laws, rules, and regulations can vary from state to state.

Note: Delaware, Montana, New Hampshire, and Oregon don’t have any sales taxes. Your sales to customers in those states will always be tax free. Alaska doesn’t have a state sales tax, but there are some local sales taxes in the state.

2. You must register for a sales tax permit before collecting sales tax

If you have nexus in a state, you should register for a sales tax permit before collecting sales tax in a state. In fact, states consider it unlawful to collect sales tax without a permit because you could collect the money without passing it on to the state.

3. You only need to charge sales tax in states where you have nexus

In the past, sales tax nexus meant a “significant presence” in a state. Online retailers only needed to charge sales tax in states where they had a physical location such as an office or warehouse, personnel, or sales at a trade show, among other factors. Dropshipping does not give you sales tax nexus at the site of the drop shipper’s warehouse, because you don’t own the products that are stored there.

However, the definition of nexus for online sales tax changed in 2018. The Supreme Court decision in South Dakota vs. Wayfair et al opened the door to more online sales taxes. Even eCommerce companies with no physical presence in a state may need to collect state sales taxes. Now, all but two states with sales taxes have passed laws requiring remote sellers to collect online sales taxes. Most of these states have exemptions for smaller sellers. If you ship less than $100,000 in orders or have fewer than 200 sales in most states, you don’t need to collect sales tax.

The small business exemption to online sales taxes only applies to states where you don’t meet physical nexus conditions. If you have a physical presence in a state, you must collect sales taxes on all sales shipped to that state.

4. Figuring out where you have nexus can be tricky

There are further wrinkles to sales tax nexus for online sellers: order fulfillment warehouse locations and marketplace facilitator laws.

Many sellers use Amazon FBA for marketplace fulfillment. That means their products could be stored in any one of dozens of Amazon warehouses, often without their knowledge. A few FBA sellers got hit with massive back tax bills because FBA warehouses gave them hidden sales tax nexus. The sellers sued, arguing that Amazon should be responsible for online sales taxes. The courts agreed, and that led to marketplace facilitator laws.

By the end of 2020, all but three states that levy sales taxes had passed marketplace facilitator laws. These laws require eCommerce marketplaces to collect online sales taxes for their sellers. Marketplaces like Amazon, eBay, and Etsy must add state and local sales taxes to your sales, collect the tax, and remit it to the states.

Here’s the bottom line on sales tax nexus:

- Online marketplaces should handle tax collection for your sales on their platforms.

- You are responsible for collecting and remitting taxes on sales through your online store for states where you have nexus.

- You have nexus in every state where you have a physical presence, plus any additional states where you have remote seller nexus.

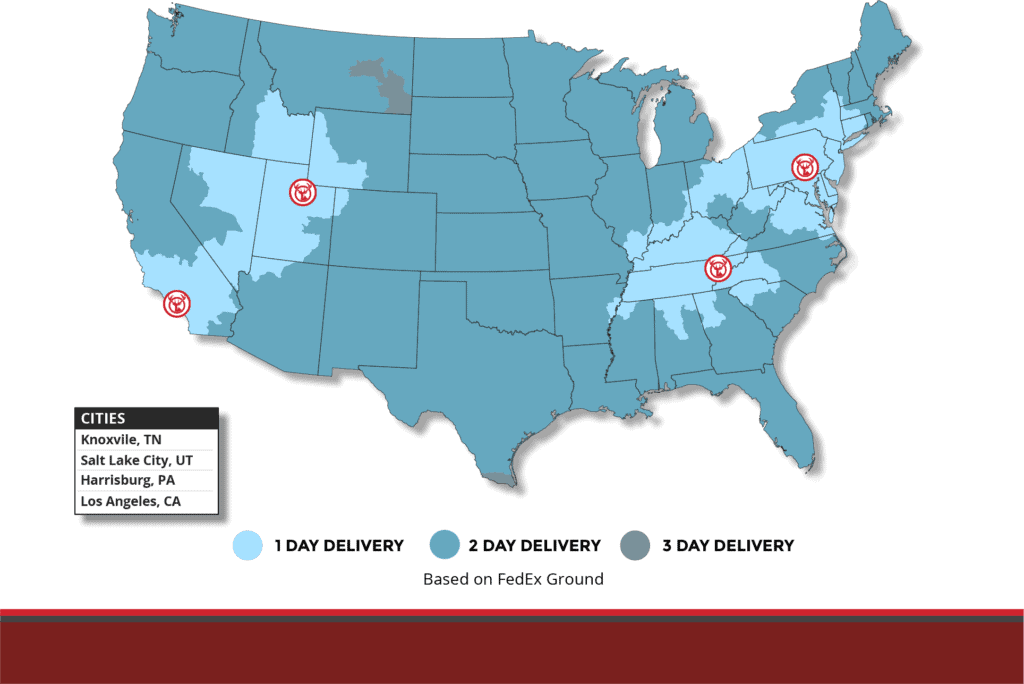

- When you use an FBA alternative, such as Red Stag Fulfillment, you always know where your inventory is stored. Therefore, you never have to worry about hidden nexus.

Don’t forget to collect sales taxes for every state where you have nexus on all your omnichannel sales unless a marketplace collected taxes on the sale. Missing taxable sales from different channels is one of the biggest nexus mistakes that TaxJar sees.

5. Some items are not taxable

Generally, if you sell “tangible personal property,” you should charge sales tax to your customers when you sell it. But states make exceptions for certain types of items. You might find that, in one state, clothing is tax-exempt, while another state adds sales tax for clothing purchases over a certain amount. A third state might tax all clothing sales. Also, some products may be taxed at a lower rate in one state than in another. If you sell items that are taxed differently from one state to another, compile a cheat sheet for all your tax rates.

6. Sales tax rates vary

As a consumer, you’ve probably noticed that you pay different sales tax amounts depending on where you make a purchase. Some states only have one statewide rate, while most others allow local areas to levy add-on sales taxes. When you are charging online sales tax, you may be required to charge a state rate + county + city + special taxing district rate. TaxJar’s sales tax calculator lets you look up local rates.

To make life simpler for eCommerce sellers, some states set a single online sales tax rate for the whole state.

7. Sales taxes in some states are “origin-based” while others are “destination-based”

How much you, as an online seller, charge buyers in your home state depends on if you live in an origin-based or a destination-based sales tax state. In origin-based states, all your online sales tax is calculated at the rate for your location (your home or warehouse—wherever the order originates). But most states are destination-based, meaning that you are required to charge sales tax based on your buyer’s ship-to location. This can make matters complicated! You need accurate tax district information in the shopping carts for all your eCommerce platforms.

8. Your online sales tax filing frequency depends on your sales volume

As a general rule, the more sales volume you have in a state, the more often that state will want you to file a sales tax return. Most states will assign you either a monthly, quarterly, or annual filing frequency.

9. Sales tax due dates vary

Because sales tax is governed at the state level, the actual day of the month that your online sales tax returns are due may differ from state to state. Many states want you to file on the 20th day of the month after the taxable period, but some have filing deadlines on the 15th, the 25th, or the last day of the month. You can check your state’s sales tax due dates with TaxJar’s handy sales tax deadline calendars.

10. Always file “zero returns”

If you are registered for a sales tax permit in a state, you should always file a sales tax return by your due date, even if you didn’t collect any sales tax. States consider filing these “zero returns” to be your check-in, and if you fail to file, the consequences can include everything from a $50 fine to the cancellation of your sales tax permit. You definitely don’t want to pay a fine when you didn’t owe any sales tax in the first place.

These 10 sales tax facts should start to demystify the sales tax process. For more about sales tax, check out TaxJar’s Sales Tax 101 for Online Sellers guide or join their Sales Tax for eCommerce Sellers Facebook group.

TaxJar is a service that makes sales tax reporting and filing simple for over 5,000 online sellers. Try a 30-day-free trial of TaxJar today and eliminate sales tax compliance headaches from your life!

Learn more about sales taxes and the nuts and bolts of running a successful eCommerce business:

- 3 Things You Need to Know about Internet Sales Tax after Wayfair

- Understand Your Sales Tax Nexus with National Fulfillment Services

- 5 ECommerce Business Lessons to Know for a More Successful Store