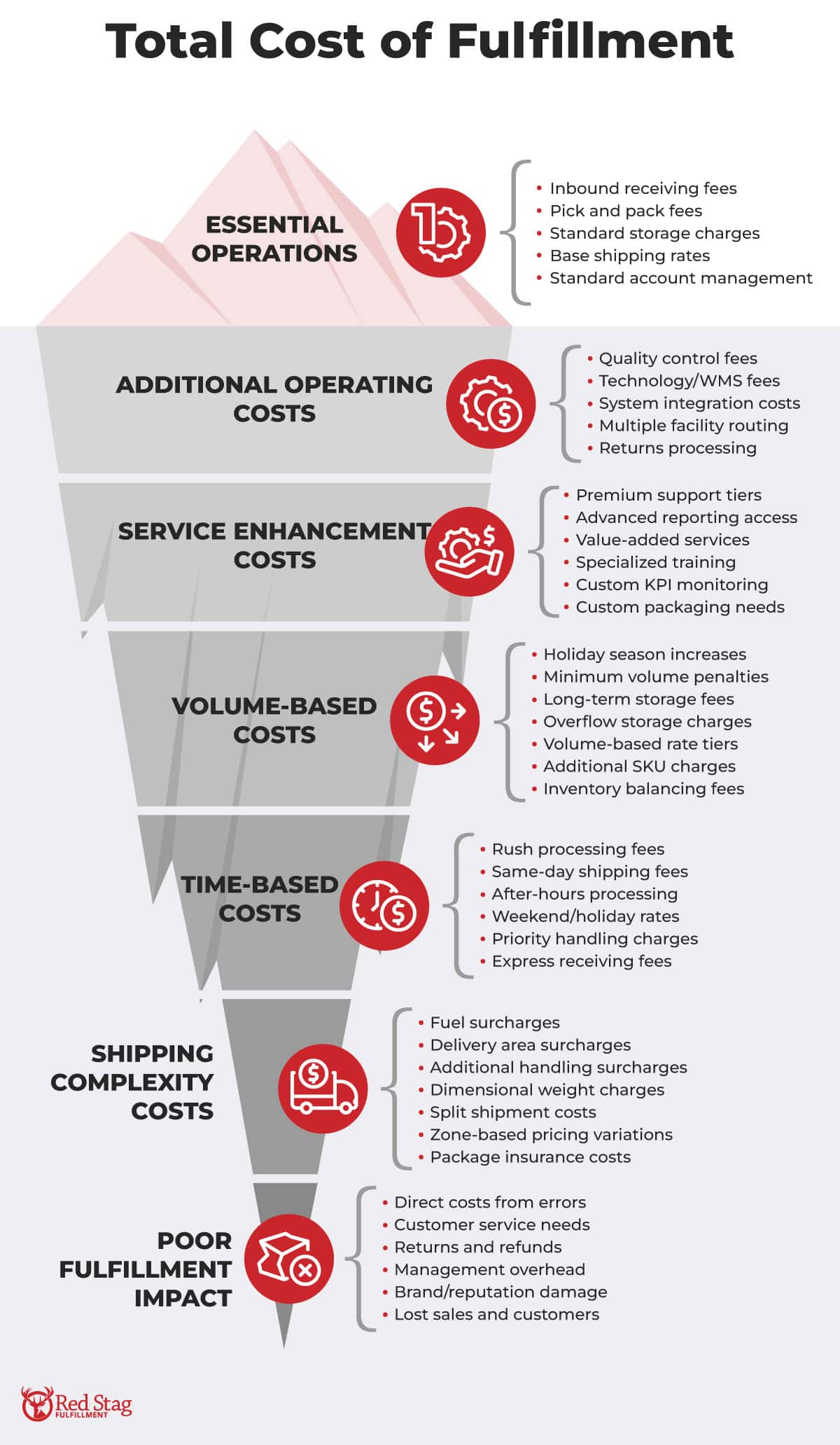

How much does a 3PL cost in 2025? Fulfilment fees can swallow 25-35 % of every order, yet most quotes hide as much as they reveal. Beyond headline rates, you’re paying for onboarding, storage fees, zone surcharges, even a weekly fuel index that moves with diesel prices.

This guide unpacks each charge, shows where the “gotchas” lurk, and offer current benchmarks so you can compare providers on the only metric that matters—total, all-in fulfillment cost.

Key 3PL cost insights

Niche expertise matters: A fulfillment provider specializing in your product type often provides better shipping rates and fewer errors due to optimized processes.

Total fulfillment cost matters most: Don’t compare individual line items. Third party logistics providers structure fulfillment pricing differently, so calculate the all-in fulfillment cost for accurate comparisons between potential fulfillment partners.

“Budget” 3PLs can cost more: Hidden fees, high shrinkage allowances (up to 4% inventory loss), poor quality control, and limited peak capacity in their fulfillment centers can lead to lost inventory, damaged goods, and unhappy customers, negating initial cost savings.

Warehouse location impacts costs: Strategic fulfillment center location can decrease total costs. Multiple warehouses might increase inventory management complexity and inbound shipping expenses unless the ecommerce business has high volume (e.g., over 5 million GMV or 50-100+ orders daily).

Shipping costs are complex: Factor in dimensional weight, zones, residential/fuel surcharges, and peak shipping fees. Understanding these is crucial for managing logistics operations.

Meet the experts who contributed to this guide:

- Ryan Marine: Director of Sales, Red Stag Fulfillment

- Tony Runyan: Chief Client Officer, Red Stag Fulfillment

- Joe Spisak: CEO, Fulfill.com

- Jon Blair: Founder, Free to Grow CFO

- Donovan Sullivan: Operations Manager, NFI

While total fulfillment costs vary based on specific needs, typical ranges for fulfillment services include one-time setup fees from $150-$1,500+, monthly pallet storage fees around $15-$40, and per-order pick & pack fees often starting between $0.20-$2.00 plus additional item fees.

See the table below for common fee ranges, but remember calculating the total fulfillment cost is key.

| Fee Type | Typical Range (US$) | Notes |

|---|---|---|

| Account / Setup | $250 – $1,000+ | One-time setup fees; varies by inbound complexity and fulfillment center integration. Average ~$425. (Source: Warehousing and Fulfillment (W&F) 2025 Survey) |

| Inbound Receiving (per pallet) | $5 – $15 | Includes put-away into storage space. Average ~$10.52. (Source: W&F 2025 Survey) |

| Pick & Pack (per order) | $0.20 – $2.00+ | The pick and pack fee is often tiered (e.g., base fee + per item). Averages higher ($3.25+/order) common for ecommerce fulfillment. (Sources: Template Range; W&F 2025 Survey, Speed Commerce) |

| Storage (per pallet / mo.) | $15 – $40 | Average storage fee ~$20. Convert to cu-ft for small goods (~$0.46/cu-ft avg). Reflects warehousing costs. (Source: W&F 2025 Survey) |

| Shipping Mark-up / Discount | 0% – 12% Markup OR Discount | % over/under carrier negotiated shipping rates. Markups exist, but third party logistics providers often provide 10-30% discounts off standard rates, leading to cost savings. (Sources: Template Range; Speed Commerce, W&F 2025 Survey) |

Comparing individual line items between third party logistics providers is misleading. As Tony Runyan, Chief Client Officer at Red Stag Fulfillment, explains:

The only way you can really get to an apples-to-apples 3PL price comparison is to calculate the total cost of fulfillment.

Tony Runyan

Chief Client Officer

Red Stag Fulfillment

Joe Spisak, CEO and Founder at Fulfill.com, confirms:

You need to understand the full pricing structure—storage, pick-and-pack fees, shipping rates, and any potential surcharges. A clear view of your total costs can help avoid surprises and make sure the 3PL aligns with your budget.

Joe Spisak

CEO and Founder

Fulfill.com

Different fulfillment companies use varying pricing models and terminology, sometimes hiding fulfillment costs in unexpected places. Focusing only on one low fee (like storage) might blind you to higher costs elsewhere (like handling or surcharges). Always model your fulfillment cost based on your specific order volume, inventory profile, and service needs to get an accurate picture and calculate fulfillment cost effectively.

A complete breakdown of 3PL pricing components:

Initial setup & integration fees

These involve integrating your systems (ERP, WMS) with the fulfillment partner’s platform. Standard integrations are often low-cost, but custom solutions for your online store incur IT labor costs and licensing additional fees.

Receiving and inbounding

This covers the cost of accepting deliveries from your manufacturers or existing facilities.

NOTE: The proximity of your 3PL’s warehouse to your manufacturer or port of entry significantly impacts inbound costs. Choosing a warehouse close to your product’s origin point can slash your inbound transportation costs, though this benefit may be offset by higher outbound shipping to customers.

Once your shipment has arrived at the warehouse, a variety of factors can affect cost:

Container unloading requirements: Are your containers palletized or floor-loaded?

SKU organization: Are your SKUs in single pallets or mixed pallets?

Unit preparation needs: Will the 3PL need to break down cases into individual units?

Product modification requirements (barcode application, special labeling)

Additional product alterations (needed upon arrival)

PRO TIP: Understanding these fees can allow you to work with your manufacturing partner to lower receiving and inbounding costs—it may be cheaper to pay your supplier more to save you money with your 3PL.

Storage and warehousing

Pricing Models: Pricing models for storage space vary.

Per unit/case/pallet: Common but can be more expensive, especially with oversized items or hidden costs from consolidation. Pallet-based storage can inflate warehousing costs by 40-60% as 3PLs may not consolidate partially empty pallets.

Per square/cubic foot: Charges based on actual storage space used (how much inventory occupies), consistent rates across product types, good for varied sizes. High-SKU businesses often save money with cubic foot pricing.

| Scenario | Monthly Cost (US$) | Notes |

|---|---|---|

| Half-full pallet (charged per pallet) | $20.00 | 1 pallet billed at the average pallet rate of $20. |

| Same inventory billed by cubic-foot (26 cu-ft) | $12.00 | 26 cu-ft × $0.46 avg/cu-ft rate. ≈ 40 % lower than pallet pricing. (Rates from W&F 2025 Survey) |

*Assumes a pallet rate of $20 and a cubic-foot rate of $0.46 (2025 W&F survey average). Result: 40 % lower monthly cost when billed by actual volume.

Bottom line: If you move high-SKU or partially-palletised inventory, cubic-foot pricing can slash storage cost by ~40 % vs. flat pallet charges.

Planning: Brands often overlook inventory management needs like average levels and turnover rates.

How much inventory would you require the 3PL to hold on average, and how quickly do you turn your inventory? Are your sales consistent year-round, or do storage requirements fluctuate depending on the season?

Jon Blair

Founder

Free to Grow CFO

Common Fees: Long-term storage fees, peak season rates, minimum storage requirements, special handling surcharges. Specialized storage (e.g., climate-controlled) incurs higher costs. Understand your monthly cost for storage.

Handling (Pick and Pack)

Covers picking items, moving to packing, basic packaging materials, and labeling – core parts of order fulfillment.

Fee Structures: The pick and pack fee can be per order (flat rate), per unit (charge per item), per SKU (varied rates), or use tiered pricing (volume discounts).

Alert: Watch for order minimums or surcharges for low order volume.

Special Handling: Heavy, bulky, fragile, or hazardous materials often incur extra pack fees due to special equipment or labor costs.

Multi-unit Orders: May trigger extra pick and pack fees, consolidation charges, special packaging, or quality control steps. Ask about volume discounts.

Kitting: Pre-assembling frequently sold bundles can reduce per-order handling fulfillment costs and speed up the fulfillment process.

Packaging

Standard Materials: Basic boxes, mailers, void fill, tape, labels. Often included in handling fulfillment fees, but watch for upcharges.

Custom Packaging: Branded materials, inserts, special protection. Custom packaging often requires minimum orders and longer lead times.

Specialized Protection: Extra cushioning, double-boxing, temperature control, anti-static packaging materials.

Cost Comparison: Compare providing your own packaging materials vs. using the 3PL’s. Using the fulfillment provider leverages their bulk purchasing power but might incur storage fees for your materials.

Impact: Excess packaging increases dimensions and weight, driving up storage costs and shipping costs significantly.

The dimensions and weight of the packages make such a difference on the pricing strategy. Even an inch of unnecessary space can drive up storage and shipping costs significantly.

Tony Runyan

Chief Client Officer

Red Stag Fulfillment

Value-Added Services (VAS)

Premium fulfillment services beyond basic order fulfillment include:

Gift wrapping

Custom packaging/inserts

Assembly

Quality inspection

FBA prep

Kitting/bundling

Serial/lot tracking

Custom labeling

These typically cost extra (additional fees) through per-unit fees, hourly labor charges, or project pricing. You should calculate ROI before adding VAS and ensure clear pricing communication to avoid hidden costs.

Runyan notes:

When the price structure of value-added services isn’t clearly communicated upfront, they can feel like ‘gotchas.

Tony Runyan

Chief Client Officer

Red Stag Fulfillment

Account Management

Ranges from shared support teams to dedicated managers. Account management fees are often negotiable, especially with significant order volume. Tiered options available; understand the account management fee structure.

Reverse Logistics (Returns)

Reverse logistics are often an afterthought for 3PLs but critical for the supply chain. Costs include restocking fees, inspection/repackaging charges, storage for returns, handling damaged goods. Many fulfillment providers charge premium rates or avoid returns. Specialized returns providers might be cost-effective.

How to decode (and reduce) your shipping fees

Major carriers (UPS, FedEx, USPS, etc.) constantly update shipping rates and cost structures. Managing shipping costs is key.

- Package Weight and Dimensions:

Carriers charge based on the higher of actual weight or dimensional weight (calculated from dimensions). Large, light packages can cost more than small, heavy ones. Per Tony Runyan: 3PLs specializing in certain product sizes negotiate better rates accordingly.

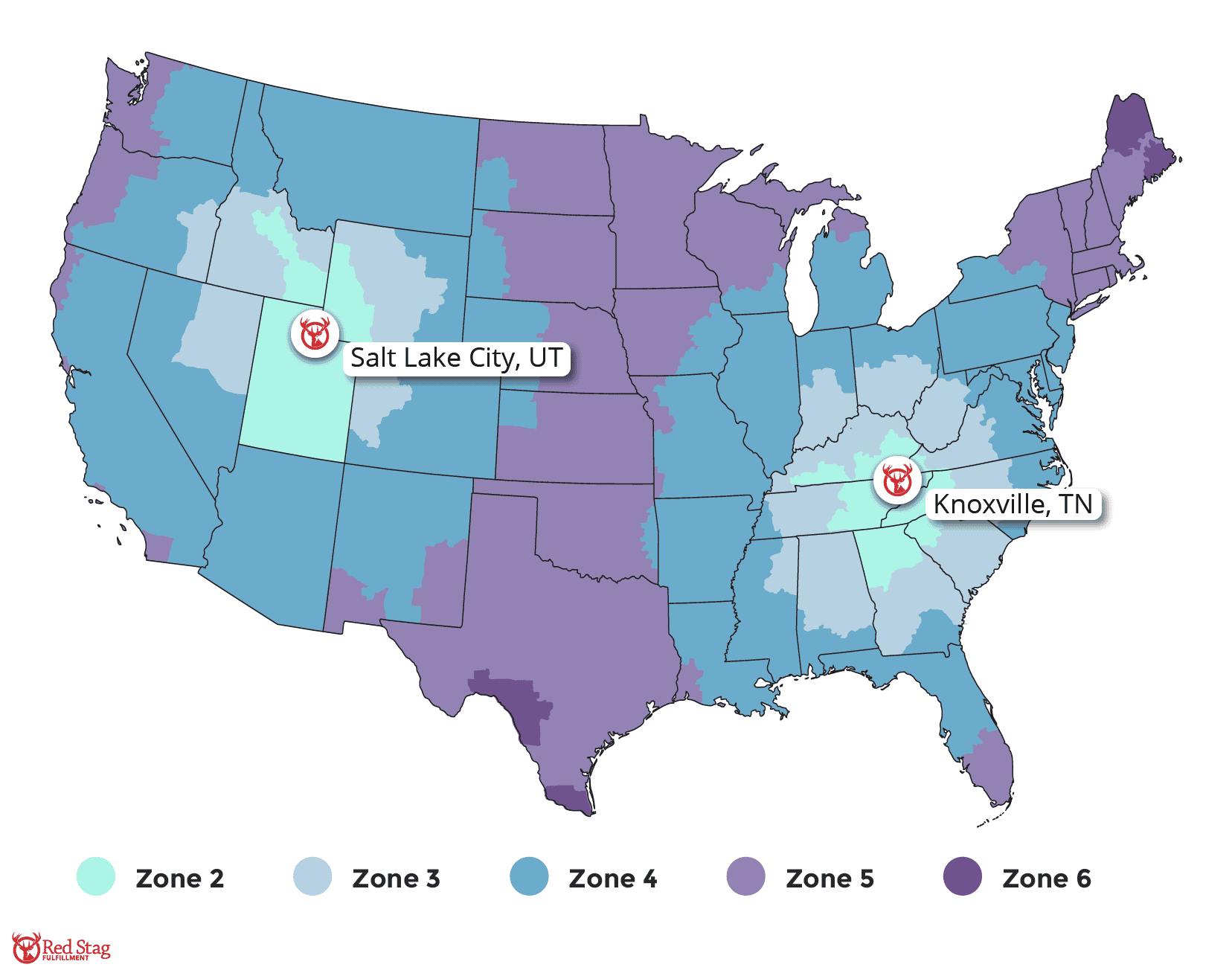

- Distance and Zones:

Carriers use shipping zones (e.g., Zones 2-8 in the US) based on origin-destination distance. Higher zone = higher charge.

The further we’re shipping away, the higher the zone and the higher the charge.

Tony Runyan

Chief Client Officer

Red Stag Fulfillment

- Residential Surcharges:

Delivering to homes incurs additional fees due to lower delivery density and higher time/fuel per package.

Typical 2025 charges: carriers update fees each January and sometimes mid-year, but the ranges below are accurate as of April 2025:

| Surcharge type | 2025 typical amount | When it triggers |

|---|---|---|

| Residential delivery fee | $4.00 – $5.35 (UPS/FedEx) |

Any shipment to a home address |

| Fuel surcharge | 10 – 15 % of label cost | Applies to every parcel; updated weekly |

| Delivery Area Surcharge (DAS) | $3.20 – $6.50 | Rural or hard-to-reach ZIP codes |

| Extended Area Surcharge (EAS) | $35 – $40 | Remote islands, Alaska, Hawaii, territories |

| Additional Handling Surcharge (AHS) | $15.75 – $33.50 | Packages > 50 lb, > 48″ long, or irregular shape |

| Peak/Demand surcharge | $1.60 – $3.50 per parcel (varies by season & volume tier) |

High-volume periods (BFCM, Q4, promo spikes) |

Sources: 2025 UPS & FedEx service guides, plus ShipMatrix Q1-2025 averages.

- Fuel Surcharge:

Fluctuates with diesel prices, calculated as a percentage (often 10-15%) of the base shipping rate plus other charges. Runyan elaborates:

The fuel surcharge is piled on top of everything else… Your base rate—plus anything related to that particular package and its delivery—you have to multiply that by 10-15%.

Tony Runyan

Chief Client Officer

Red Stag Fulfillment

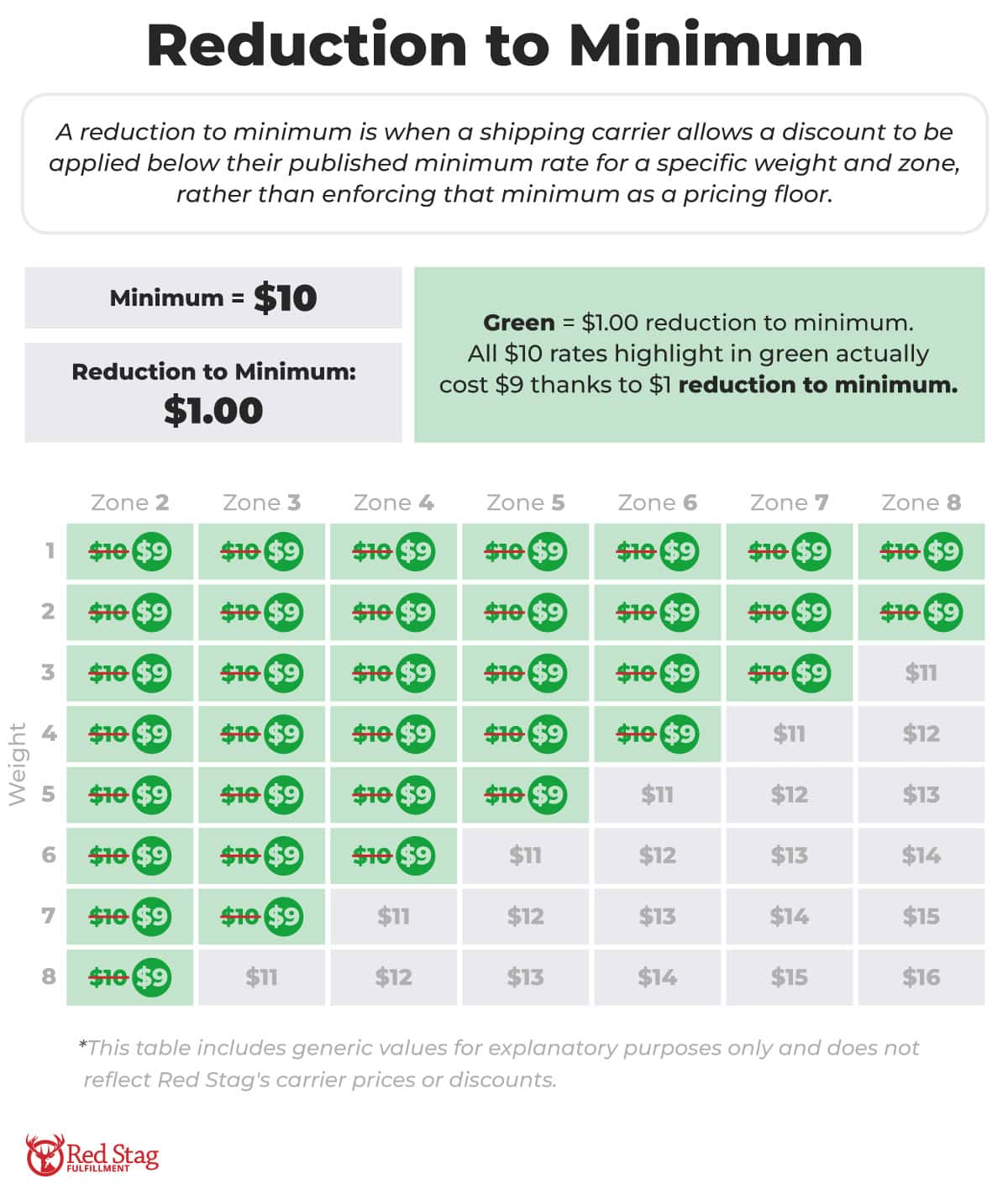

- Minimum Charges:

A baseline charge applied to every shipment, regardless of size/weight, covering fundamental operational costs. Vary depending on service level, carrier, and negotiated rates. Negotiable point with carriers.

The minimum is the lowest base rate a carrier will charge you on a package no matter what.

Tony Runyan

Chief Client Officer

Red Stag Fulfillment

- Location-Based Surcharges:

Delivery Area Surcharge (DAS): For harder-to-reach areas.

Extended Area Surcharge (EAS): Premium fee for remote locations.

Can significantly increase average shipping fees per package if many orders go to these zones. Review ZIP code lists, as zones expand.

- Demand and Peak Surcharges:

Applied during traditional peak seasons (BFCM) and other high-volume periods or due to network constraints. Factor into fulfillment pricing, especially for peak periods. Accurate forecasting can help 3PLs negotiate better rates.

Since the pandemic, UPS and FedEx have kept demand surcharges through much of the year due to the large influx of packages they receive across many seasons.

Tony Runyan

Chief Client Officer

Red Stag Fulfillment

- Service Speed:

Faster shipping speed (overnight, 2-day) has higher base rates and surcharges than slower options (ground, economy). Strategic warehouse placement and fast order fulfillment (same-day shipping) can achieve quick delivery using economical methods, meeting customer expectations.

- Carrier Rates and Discounts:

Third party logistics providers leverage combined client volume to negotiate deeper discounts (cost savings) on base rates and surcharges than individual ecommerce businesses usually get (often 10-30% off standard rates). Key negotiable elements include base shipping rates, residential/DAS/AHS surcharges, and minimum charges.

Runyan states regarding Red Stag’s approach:

We’ll negotiate directly with the national carriers on our clients’ behalf to reduce surcharges… We’re able to get some of the best rates for our clients. It’s almost always better than they can get on their own.

Tony Runyan

Chief Client Officer

Red Stag Fulfillment

- Additional Handling Surcharges (AHS):

Fees for large, heavy, or irregularly shaped packages. If multiple AHS fees apply, carriers charge only the single most expensive one.

Other factors affecting pricing

- Order Volume and Frequency: Patterns impact staffing, labor costs, and service level agreements. Share historical order volume data for accurate quotes.

- Product Characteristics: Size, weight, fragility, handling needs, and hazardous materials nature influence storage costs, shipping costs, labor, and equipment costs.

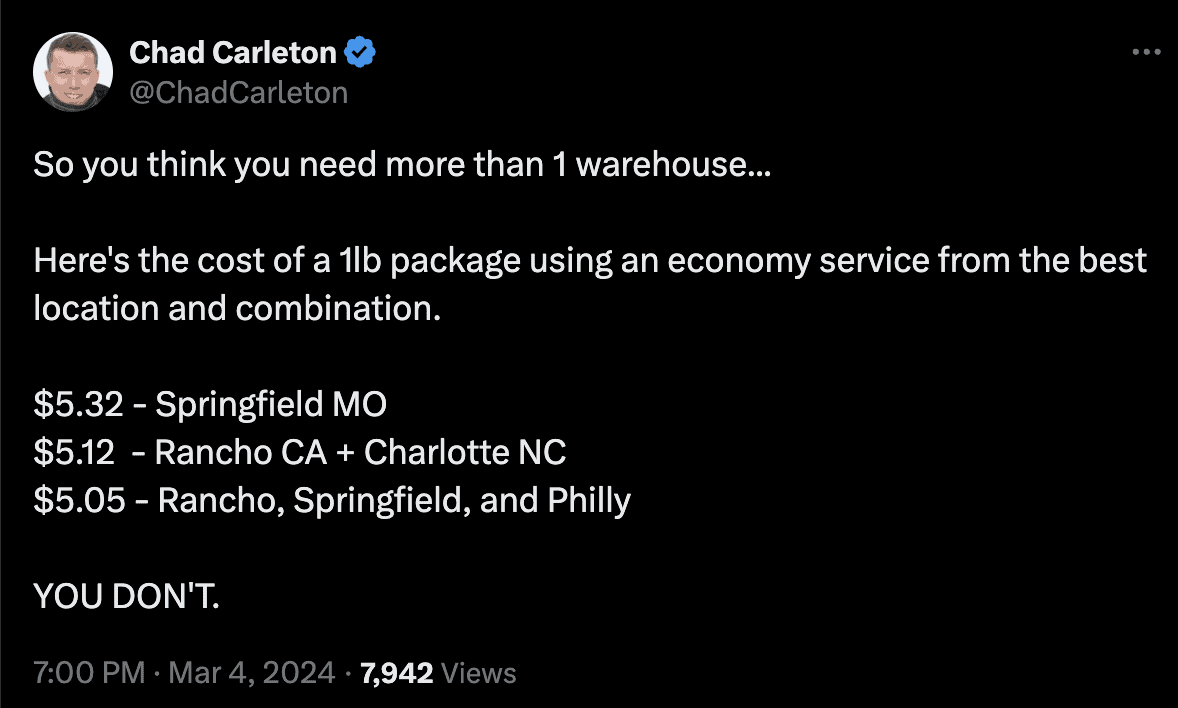

- Number/Location of Warehouses: Multiple fulfillment center locations might seem cheaper (closer to customers) but often increase fulfillment costs unless volumes are very high. Drawbacks: Higher total inventory/capital needed, inventory management complexity, increased inbound shipping (more LTL vs. full loads), complex pricing structures (varying regional costs), reduced efficiency (duplicated overhead, less scale).

Why it matters: Extra nodes drive up safety-stock, split-shipment fees and inbound LTL costs. Unless you’re consistently moving 5 M GMV+ or shipping 100 orders/day, a nationwide carrier + a centrally located 3PL will almost always beat the typical “Texas + CA + NJ” model on all-in cost.

- Service Level Agreements (SLAs): Define performance standards (order fulfillment timing, cutoff times, accuracy, shrinkage allowance). Stricter service level agreements (e.g., later cutoff times, zero shrinkage) cost more due to higher staffing/operational needs. Match SLAs to business needs and customer expectations.

Some of the cost depends on the service level that a client needs. Whether it’s going to be a same-day or next day cutoff.

Tony Runyan

Chief Client Officer

Red Stag Fulfillment

Shrinkage math: A 2 % allowance on $500 k of inventory lets the 3PL lose $10,000 worth of product each year — often more than any storage or handling discount you negotiated.

For high-value or hard-to-replace items, paying a premium for a zero-shrinkage SLA is usually cheaper than eating those losses.

- Niche Fit: Fulfillment companies specialize (small items, heavy/bulky, temperature control, apparel, HAZMAT). Choosing a logistics partner aligned with your niche leads to better rates, fewer errors, faster shipping, and processes optimized for your products.

Choosing a 3PL that fits your niche can lead to faster shipping, fewer errors, and a more streamlined fulfillment process… allowing you to provide a better overall experience for your customers.

Joe Spisak

CEO and Founder

Fulfill.com

Frequently asked questions about 3PL pricing

How much does a 3PL charge per order?

A 3PL’s charge per order varies, often involving a base pick & pack fee plus per-item charges.

While simple orders might start low ($0.20-$2.00 range), average 2025 B2C fulfillment costs are often higher, around $3.25+. Total fulfillment cost per order depends heavily on complexity, order volume, and specific 3PL pricing models.

What hidden fees should I budget for?

To budget for hidden 3PL fees, look beyond headline rates and be aware of these common culprits:

- Long-term storage penalties – 1.5–3 × the standard pallet rate after 30/60/90 days idle.

- Minimum-volume surcharges – extra handling fees when monthly order count dips below the contract floor.

- Complex receiving charges – $50–$75 per floor-loaded container or mixed-SKU pallet that must be broken down.

- Address-correction fees – $14–$19 per parcel when an invalid or incomplete address is submitted (carrier pass-through).

- Split-shipment surcharges – duplicate pick & pack when a single order ships from multiple nodes.

- Fuel & residential delivery add-ons – 10–15 % fuel surcharge and $4–$5 residential fee tacked onto every label.

- Insurance / declared-value mark-ups – 0.5–1.5 % of product value if you opt-in for extra coverage.

- Premium materials / custom packaging – non-standard boxes, inserts, or VAS work billed per unit.

Pro tip: Ask each shortlisted 3PL to model these fees using last year’s order data so they surface in the “all-in” cost comparison.

Is 3PL pricing cheaper than in-house fulfillment?

Whether 3PL pricing is cheaper than in-house order fulfillment depends on scale and efficiency. Third party logistics providers offer economies of scale, negotiated shipping discounts, and reduced infrastructure investment, potentially leading to lower costs. However, in-house provides more control. Calculate fulfillment cost for both scenarios (rent, labor costs, systems, shipping fees) for a true comparison.

How do 3PL storage fees work?

3PL storage fees typically work by charging based on the storage space your inventory occupies, calculated monthly (monthly cost). Common methods include per-pallet ($15-$40 avg), per-cubic-foot (~$0.46 avg), or per-bin ($3+ avg). Warehousing fees can vary depending on location, storage type (e.g., climate-controlled specialized storage), and duration (long-term storage fee may apply).

Are pick-and-pack fees negotiable?

Yes, pick-and-pack fees (or pack fees) are often negotiable, especially with higher order volumes. 3PLs may offer tiered pricing or volume discounts where the per-order or per-item fee decreases as volume increases. Discussing volume commitments, order profiles, and potential kitting opportunities can help secure better handling rates during contract negotiations.

Why do setup fees vary so much?

3PL setup fees vary so much because integration complexity differs greatly. A simple connection to a standard ecommerce platform might be low-cost or free. However, integrating with custom ERP/WMS systems, requiring significant IT labor, data migration, or custom development for your ecommerce business, will result in substantially higher one-time setup charges.

Does a 3PL charge fuel surcharges?

Yes. Most 3PLs pass the carrier’s fuel surcharge straight through to you. In 2025 that averages 10–15 % of the label cost and updates weekly based on national diesel prices. Ask each provider whether they add a margin on top or simply pass it through.

How do 3PL minimums work?

Every shipment has a floor price that covers the carrier’s fixed handling costs, even for tiny parcels. Typical 2025 ground minimums are $8 – $9 per package. If your negotiated discount pushes the base rate below that threshold, the carrier still charges the minimum—and your 3PL passes it through.

How to Maximize Value and Achieve Cost Savings:

- Build Strong Communication: Set clear expectations on pricing updates/notifications. Use regular reviews (monthly/quarterly) for cost analysis, forecasting order volume, and optimizing processes with your fulfillment partner. Spisak notes vague communication leads to “frustration and distrust”. Document expectations in the SLA.

- Forecast Accurately: Provide detailed historical data (shipment history, product/package details, SKU catalog) to help 3PLs optimize logistics operations and provide accurate quotes. Good inventory management forecasting is key.

- Optimize Product Packaging: Minimize package size to reduce storage and shipping costs. Use appropriate packaging materials.

- Leverage Volume/Carrier Discounts: Utilize tiered pricing and the 3PL’s negotiated shipping rates. Runyan states their rates are often better than clients get alone, helping you save money.

- Align Needs with 3PL Strengths: Understand the fulfillment provider’s capabilities and find creative solutions leveraging their expertise, even if slight process adjustments are needed. Use regular check-ins to find alignment opportunities.

Choosing the cheapest option often leads to higher costs long-term. Jon Blair learned this firsthand:

“Even though this budget 3PL had the highest discounts, stuff was not arriving on time and inventory was getting lost… those costs were racking up.”

Jon Blair

Founder

Free to Grow CFO

Runyan confirms:

“The lowest price doesn’t really mean anything if your products don’t actually get there when you expect them to. What’s the cost of a 3PL who loses your product?”

Tony Runyan

Chief Client Officer

Red Stag Fulfillment

Budget third party logistics providers cut corners via deceptive pricing models, high shrinkage (poor inventory management), minimal quality control, limited peak capacity, and outdated tech in their fulfillment centers. This leads to lost/damaged goods, late deliveries, angry customers, brand damage, higher replacement fulfillment costs, operational headaches, and even risk of the logistics partner closing.

“The difference between a budget 3PL and a premium one often goes beyond just cost. Cheaper 3PLs may… lack the scalability, technology, or customer service needed to support long-term growth… which can lead to delays, errors, or poor customer experiences.”

Joe Spisak

CEO and Founder

Fulfill.com

The bottom line: Two things matter most

- Your Total Fulfillment Cost: Calculate fulfillment cost comprehensively (all-in cost per order) for meaningful comparisons, as individual fulfillment fees can be misleading. Understand the complete fulfillment pricing.

- Your Customer Experience: The fulfillment process execution reflects directly on your online store brand. As Blair explains: “They see it as an extension of your brand.”. Flawless order fulfillment is essential.

Invest time upfront to understand true fulfillment costs. Beware of quick quotes lacking detailed cost analysis.

Ready to discuss your fulfillment service needs?

Unlike providers with “shrinkage allowances” that let them lose your inventory without consequence, Red Stag backs its promises with guarantees that align our success with yours. When you win, we win—and if we make a mistake, we pay you for it.

Our strategic warehousing locations, same-day shipping capabilities, and zero-shrinkage guarantee are designed for businesses that understand fulfillment isn’t just a cost to minimize—it’s a strategic advantage that can transform your customer experience and protect your bottom line.