You’re paying too much for shipping insurance—or you’re not using it when you should be.

Most ecommerce sellers make one of two costly mistakes: they either buy expensive carrier insurance on every package (eating into margins), or they skip protection entirely and absorb devastating losses when high-value shipments disappear.

The reality? Third-party shipping insurance costs significantly less than carrier options and often provides better coverage. But here’s what most guides won’t tell you: for many packages, you don’t need insurance at all.

The stakes are real. A single lost high-value package can wipe out the profit from dozens of smaller orders. But buying unnecessary insurance on low-risk shipments can cost you serious money annually.

This guide cuts through the confusion with a simple decision framework: exactly when to buy insurance, which type to choose, and how to slash your costs while actually improving protection.

What you’ll learn

A break-even formula to decide if you need insurance

Carrier vs. third-party cost comparisons that could save you money

Step-by-step claim filing that actually gets you paid

TL;DR:

Key takeaways

Carrier liability (e.g., the “free” $100) is not the same as insurance

Third-party insurance is often cheaper and offers better coverage

Proper documentation before shipping is critical for a successful claim

Shipping insurance explained

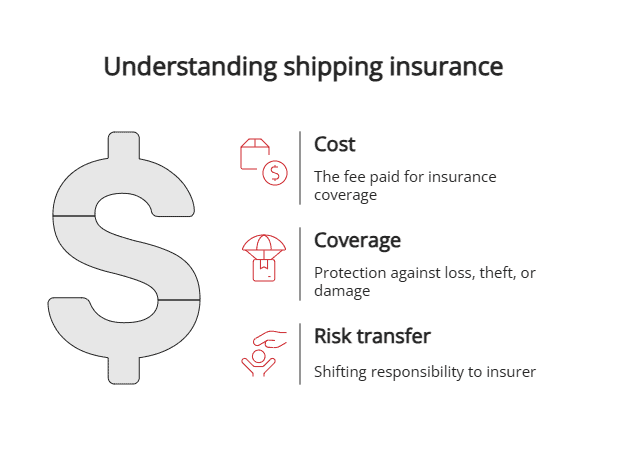

Shipping insurance is optional coverage that reimburses you if a package is lost, stolen, or damaged in transit. By paying a small fee—usually starting around $1–$3 per $100 of declared value—you transfer that risk to the carrier or a third-party insurer instead of absorbing the loss yourself.

This protection is fundamentally about transferring the financial risk of a shipment failing to arrive safely from you to an insurance provider. Many businesses find that insurance options vary significantly in both cost and coverage quality.

Explain “carrier liability”: The automatic $100 coverage from a carrier like USPS or UPS isn’t true insurance. It’s their stated liability limit and often has more restrictions than actual insurance policies. This basic coverage only applies when the carrier accepts fault, which can be difficult to prove.

Introduce the main types:

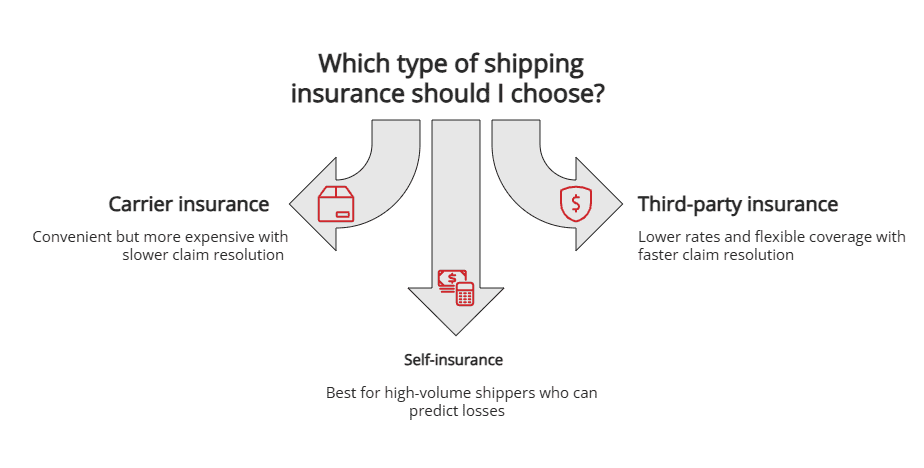

- Carrier insurance: The convenient option you can add when buying your shipping label directly from the carrier, though it’s typically more expensive than alternatives

- Third-party shipping insurance: Specialized coverage from companies that often provide lower rates and more flexible coverage than carriers, with faster claim resolution

- Self-Insurance: The strategic decision to absorb losses yourself, best for high-volume shippers who can statistically predict their loss rates and set aside funds accordingly

The choice between these options often depends on your shipping volume, average package value, and risk tolerance. High-volume sellers frequently discover that working with established providers offers better rates and customer service than purchasing coverage shipment by shipment.

PRO TIP: Many businesses streamline this by working with a third-party logistics company that manages the entire process, from packaging to insurance claims.

What does shipping insurance cover?

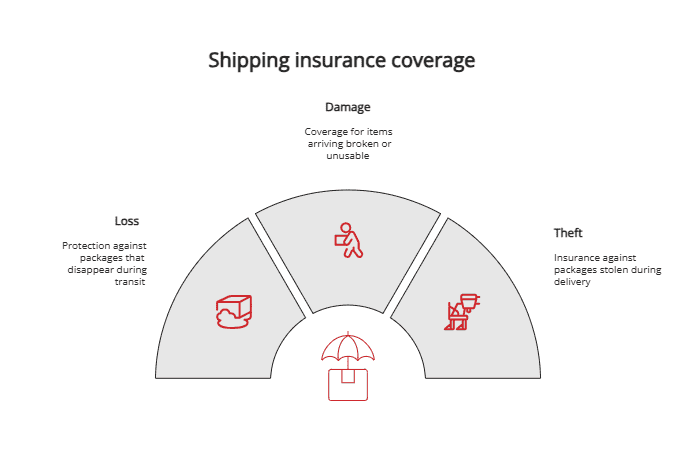

Most shipping insurance coverage protects against the three most common disasters that can happen to your shipment during transit. Understanding exactly what shipping insurance coverage includes helps you make informed decisions about when to purchase protection.

The big three

- Loss: Your package disappears completely—whether it falls off a truck, gets misdelivered, or vanishes in a sorting facility. This includes packages marked as delivered but never received by the recipient.

- Damage: The contents arrive broken, crushed, or otherwise unusable due to rough handling during transport. This covers everything from cracked electronics to completely destroyed fragile items.

- Theft: Someone intercepts your package, either from a delivery location or during transit. This increasingly common issue affects both high-value and everyday items.

Common exclusions

What’s typically not covered varies by insurer, but here’s what UPS excludes as a general industry example:

Improper packaging by the shipper

Perishable items and food products

Data storage devices and media

Jewelry and precious metals

Acts of God (natural disasters)

Electrical or mechanical failure

Wear and tear from normal handling

Items with inherent defects

These exclusions exist because they represent risks the carrier cannot control or prevent through careful handling. Items that are lost or damaged due to these factors fall outside the scope of standard coverage, regardless of the premium paid.

ALERT: Always read the fine print. What seems like comprehensive coverage often contains exclusions that could leave you financially exposed.

Do you need shipping insurance?

The decision comes down to a simple risk vs. cost analysis. For some packages, it’s essential; for others, it’s an unnecessary expense that eats into profit margins.

Risk factor checklist

Item value: Is it over the carrier’s $100 free liability?

Fragility: Is it easily broken during normal handling?

Destination: Is it going to an area known for theft or complex delivery situations?

Item type: Is it irreplaceable, custom, or a high-fraud category like electronics?

Shipping distance: Longer routes with more handling points increase risk

Seasonal factors: Holiday shipping periods see higher loss and damage rates

The break-even formula

Here’s the concept of self-insurance risk: if the total cost to replace your average items that are lost or damaged in a year is less than what you would pay in total insurance premiums, it may be cheaper to self-insure.

Formula: Annual replacement costs ÷ Annual shipping volume = Average loss per package

If this number is less than your insurance cost per package, consider self-insurance. However, this strategy only works if you have sufficient cash flow to absorb occasional large losses without impacting operations.

“When to always buy” scenarios

Shipping items valued over $100

Shipping fragile, one-of-a-kind, or custom-made products

Shipping internationally to certain high-risk regions

First-time shipments to new customers where trust is crucial

This is especially true for businesses focused on big and heavy fulfillment, where a single damaged item can wipe out significant profit

NOTE: The key is consistency. Either develop a systematic approach to insurance or partner with a fulfillment provider who can make these decisions based on data and experience.

How to buy shipping insurance step-by-step

Purchasing insurance is usually a simple checkbox, but knowing your insurance options and documenting your package properly makes all the difference between a smooth transaction and a denied claim.

During label purchase

Most carriers make it easy to add shipping insurance when you’re creating your shipping label:

USPS.com: Look for “Add Insurance” during checkout

Marketplaces: eBay and Amazon offer insurance options at checkout

ecommerce platforms: Shopify displays insurance as an optional add-on

Shipping software: Most platforms integrate insurance purchasing into their workflow

The process typically involves declaring the package value and selecting your desired coverage level. Higher values may require additional documentation or proof of worth.

High-volume sellers often find that a dedicated Shopify 3PL can manage and automate this process, ensuring no high-value package is missed.

Via third-party platforms

You can also buy shipping insurance separately from dedicated third-party platforms, which often integrate with your shipping software and may provide bulk purchasing options. These platforms frequently offer:

Lower rates than carriers

More flexible coverage terms

Faster claim processing

Better customer service

Coverage for items carriers exclude

Pro tip: Document everything

Before sealing the box, this step is absolutely critical:

Take photos of the item before packaging

Photograph your packaging process

Capture images of the final sealed package

Keep proof of the item’s value (sales receipt, invoice)

Record serial numbers for electronics

Document any pre-existing damage or wear

This documentation becomes your evidence for a potential claim and can make the difference between a successful payout and a denied claim.

Filing a claim: Process, timeline & documentation

If the worst happens, knowing how to file an insurance claim efficiently can mean the difference between quick reimbursement and weeks of frustration. Acting quickly and having your documentation ready determines whether you get paid.

General steps

01

Notify the carrier immediately upon discovering the issue

02

Gather your documentation (photos, receipts, proof of value)

03

File the claim online via the carrier or insurer’s portal

04

Follow up regularly until resolution

05

Provide additional documentation if requested promptly

06

Track claim status through the provider’s system

Most providers now offer online portals that streamline this process, though response times vary significantly between carriers and third-party insurers.

Carrier-specific deadlines

USPS: You must file within 60 days of the mailing date for damage or loss

UPS: You must file within nine months for domestic packages and 60 days for international

FedEx: You must file within 60 days for domestic damage and 21 days for international damage

Why claims get denied

Insufficient proof of value: No receipt or invoice showing item worth

Improper packaging: Carrier determines packaging didn’t meet standards

Missed filing deadline: Claims filed after the deadline are automatically denied

Item is on the excluded list: Product category isn’t covered by the policy

Inadequate documentation: Poor photos or missing evidence of condition before shipping

Customer error: Package delivered successfully but customer claims non-receipt

ALERT: Missing a filing deadline is the easiest way to lose your claim. Set calendar reminders immediately after shipping high-value items.

Shipping insurance vs declared value vs product warranty

These terms are often used interchangeably, but they cover very different things, and understanding the distinctions prevents costly misunderstandings.

| Term | What It Covers | Who Provides It |

|---|---|---|

| Shipping Insurance | In-transit risk (loss, damage, theft) | Insurer (Carrier or Third-Party) |

| Declared Value | The carrier’s maximum liability for a package | Shipping Carrier |

| Product Warranty | Product defects or malfunctions | Product Manufacturer |

One-sentence summaries:

Shipping insurance pays you if something happens to your package during transit

Declared value sets the maximum amount the carrier will pay if they’re found at fault

Product warranty covers defects after the customer receives a working item

The key difference is that declared value requires proving carrier negligence, while insurance typically pays out regardless of fault. Product warranties only activate after successful delivery and cover manufacturing defects, not shipping damage.

Pros and cons summary

Understanding both sides helps you make informed decisions about when insurance makes financial sense.

Pros:

Peace of mind for high-value packages

Financial protection against loss

Ability to quickly reship or refund customers

Better customer service when problems occur

Protects profit margins from unexpected losses

Builds customer trust and confidence

Cons:

Additional insurance cost on every package

Claims process can be time-consuming

Coverage has exclusions and limitations

May encourage less careful packaging

Adds complexity to shipping workflow

Small packages may not justify the cost

Alternatives and best practices

The best way to deal with insurance claims is to avoid them entirely. Focus on prevention to minimize risk from the start, while having backup plans for when prevention fails.

Self-insurance revisited

For high-volume sellers with low-value goods and consistently low incident rates, setting aside funds to cover occasional losses can be more cost-effective than paying premiums on every package. This approach works best when you can:

Predict loss rates based on historical data

Maintain sufficient cash flow to absorb losses

Replace items quickly to maintain customer satisfaction

Track and analyze loss patterns to improve prevention

Prevention tips

Use new, high-quality boxes and proper protective fill

Apply labels that are clear, correct, and secure

Use reliable shipping services with good tracking

Choose appropriate packaging for your product type

Consider signature confirmation for valuable items

Ship to business addresses when possible to reduce theft

For many businesses, the ultimate best practice is to partner with one of the best 3PL companies, as their expertise in packaging minimizes damage from the start

Frequently asked questions

Is third-party shipping insurance cheaper?

Usually, yes. Third-party insurers specialize in this risk and don’t have the overhead of a shipping carrier, so their rates are often 30-50% lower than carrier insurance options. They also typically offer better customer service and faster claim resolution.

Can you add insurance after shipping a package?

No. Shipping insurance must be purchased before the package is handed off to the carrier. You are insuring the future transit, not an event that may have already happened.

What’s the difference between declared value and shipping insurance?

Declared value is simply you stating a package’s worth, which sets the carrier’s maximum liability if they are found at fault. Shipping insurance is a separate policy that pays out based on the policy terms, which can offer broader coverage and more reliable payouts.

Citations

- EasyPost. “How Much Does USPS Insurance Cost?” 2024. https://www.easypost.com/blog/2024-05-01-how-much-does-usps-insurance-cost

- ShipBob. “Shipping Insurance by Carrier: USPS, FedEx, & UPS (2025).” 2025. https://www.shipbob.com/blog/shipping-insurance/

- Refund Retriever. “FedEx Declared Value: What You Need To Know.” 2025. https://www.refundretriever.com/blog/fedex-declared-value-what-you-need-to-know

- Refund Retriever. “UPS Declared Value: What You Need To Know.” 2025. https://www.refundretriever.com/blog/ups-declared-value

- UPS. “Revised Rates for Value-Added Services and Other Charges.” 2024. https://www.ups.com/assets/resources/webcontent/en_US/Accessorial_Preview.pdf

- FedEx. “2025 changes to FedEx surcharges & fees.” 2025. https://www.fedex.com/content/dam/fedex/us-united-states/services/surcharge_and_fee_changes_2025.pdf

- UPS. “UPS® Tariff/Terms and Conditions of Service.” 2025. https://www.ups.com/assets/resources/media/en_US/claims_legal_action.pdf

- FedEx. “File a claim online.” 2025. https://www.fedex.com/en-us/customer-support/claims.html

- USPS. “DMM 609 Filing Indemnity Claims for Loss or Damage.” 2025. https://pe.usps.com/cpim/ftp/manuals/dmm300/609.pdf