The LTL industry is experiencing its biggest transformation in decades—and your shipping decisions could make or break your logistics strategy.

Major classification changes have taken effect, reshaping how virtually all freight is priced. FedEx Freight is spinning off as an independent company. Significant rate increases hit across major carriers. Meanwhile, industry-wide on-time performance remains problematic, costing the average enterprise shipper millions annually in delivery failures.

With freight networks consolidating and technology requirements evolving rapidly, choosing the wrong LTL provider doesn’t just mean higher shipping costs—it means missed deliveries, damaged goods, and frustrated customers who won’t give you a second chance.

The companies that thrive in this shifting landscape will be those that make informed LTL decisions based on data, not assumptions. This guide gives you the framework to evaluate providers strategically, understand the new pricing reality, and select partners that align with your specific shipping requirements.

What you’ll learn

How to evaluate top LTL providers based on performance data

Key selection criteria, including coverage, pricing, and reliability metrics

Understanding of NMFC changes affecting all LTL pricing

Practical framework for comparing companies against your specific needs

Strategic approaches to LTL negotiations and partnerships

TL;DR:

Key takeaways

FedEx Freight leads the industry with the largest network and daily shipments

Old Dominion maintains a premium positioning investment

NMFC classification changes impact pricing across all providers

Industry on-time delivery performance varies significantly between providers, creating an opportunity for differentiation

Regional specialists often provide superior service in specific lanes compared to national providers

Top 10 LTL providers for 2025

The LTL industry continues to consolidate as shippers demand greater reliability and technology integration. Market leaders have invested heavily in network expansion and automation, while regional specialists focus on service excellence in targeted corridors.

PRO TIP: When evaluating LTL companies, focus on their performance in your specific shipping lanes rather than overall industry rankings. A provider’s national reputation may not reflect their service quality in your geographic markets.

FedEx Freight – industry leader

FedEx Freight ranks #1 with $8,901,000 revenue, handling 85,000 shipments daily with 30,000 power units and a truck fleet. The company’s comprehensive network spans 400+ service centers with direct coverage to 99% of U.S. ZIP codes within two business days.

The provider’s technology platform provides real-time visibility and predictive analytics for freight management. Their sophisticated truck routing and load optimization systems maximize efficiency while reducing transit times. FedEx Freight will spin off as an independent company by 2026, potentially enabling more focused LTL strategies and specialized truck operations.

Key advantages include integrated logistics capabilities with FedEx’s broader network and industry-leading technology for shipment tracking and management. Their comprehensive truck maintenance facilities ensure consistent equipment reliability across all service lanes.

Old Dominion Freight Line – Premium service

Old Dominion ranks #2 with $5,814,810 revenue, maintaining 30% excess capacity in 2025. This strategic overcapacity enables consistent service levels even during demand spikes, with their truck fleet always ready for additional volume.

The company’s $575 million 2025 investment includes $300M for service centers, demonstrating commitment to network expansion and service enhancement. Their premium positioning focuses on reliability over price competition, with extensive truck fleet modernization programs supporting superior service delivery.

Their exceptionally high on-time delivery rate and industry-low damage claims reflect operational excellence that justifies higher pricing for quality-focused shippers. Old Dominion’s maintenance standards and driver training programs create consistent service experiences across its entire network.

XPO – technology-driven solutions

XPO ranks #4 with $4,899,000 revenue, positioning itself as the technology leader in LTL services. Their proprietary systems optimize routing, load planning, and truck capacity utilization through advanced algorithms that continuously monitor freight flows.

The company’s digital booking platform enables automated quoting, scheduling, and tracking. XPO’s supply chain integration capabilities extend beyond basic freight movement to comprehensive logistics solutions, with its truck fleet equipped with advanced telematics for real-time monitoring.

Their focus on technology innovation attracts shippers requiring sophisticated freight management and real-time visibility across complex supply chains. XPO’s investment in automated truck loading and sorting facilities reduces handling time and damage rates.

Estes Express Lines – regional strength

Estes ranks #3 with $4,994,000 revenue, built on regional expertise and specialized service offerings. The provider’s network emphasizes density in key corridors rather than universal coverage, with strategically positioned truck terminals maximizing lane efficiency.

Their terminal network expansion focuses on strategic markets with high freight concentrations. Estes provides guaranteed service options and specialized handling for industries requiring enhanced care, supported by specialized truck equipment for unique freight requirements.

The company’s regional approach enables deeper customer relationships and customized service solutions that national providers often cannot match. Their truck fleet specialization allows for industry-specific configurations that improve service quality.

R+L – cost-effective options

R+L emphasizes value-driven freight solutions without sacrificing service quality. Their network covers 48 states with competitive pricing structures designed for cost-conscious shippers, operating an efficient truck fleet focused on maximizing utilization.

The company offers guaranteed service options and specialized equipment for oversized freight. Their truck fleet includes specialized trailers for handling big, heavy, and bulky shipments requiring custom solutions and enhanced handling capabilities.

R+L’s pricing transparency and straightforward service model appeal to shippers seeking predictable freight costs and reliable performance. Their truck maintenance programs ensure consistent equipment availability across all service territories.

Saia Inc. – growing network

Saia captured a 12.2% tonnage increase year-over-year, opening 21 terminals in 2024. This aggressive expansion strategy targets underpenetrated markets with strong growth potential, supported by significant truck fleet expansion.

The provider implemented a 7.9% general rate increase (GRI) for 2025, reflecting strong demand and improved service capabilities. Saia’s growth trajectory positions them as an emerging alternative to established providers, with new truck acquisitions supporting network expansion.

Their investment in technology and equipment upgrades supports capacity expansion while maintaining service quality standards expected by enterprise shippers. Saia’s modern truck fleet and updated terminal facilities demonstrate a commitment to long-term growth.

ABF Freight/ArcBest – Union reliability

ABF is the only 10-time winner of both the ATA Excellence in Security and Claims Prevention awards, demonstrating consistent operational excellence. Their 5.9% GRI for 2025 reflects balanced growth and service investment across their truck network.

The union workforce provides stability and expertise that translates to superior handling and reduced damage rates. ABF’s security focus appeals to shippers with high-value or sensitive freight requirements, with specialized truck equipment for enhanced cargo protection.

Their long-term customer relationships and consistent service delivery make ABF a reliable partner for shippers prioritizing stability over innovation. The company’s truck fleet maintenance and driver training programs ensure consistent service quality.

TForce Freight – UPS pedigree

TForce Freight leverages UPS’ backing and integrated logistics capabilities across multiple service modes. The provider enables seamless connections between LTL and other UPS services, with coordinated truck routing across service networks.

Network synergies enable comprehensive supply chain solutions beyond basic freight movement. Their technology integration supports end-to-end shipment visibility and management, with truck tracking capabilities integrated across all UPS services.

UPS resources support continued investment in equipment, facilities, and technology that smaller providers cannot match. Their truck fleet standardization and maintenance programs benefit from UPS’s broader logistics infrastructure.

Southeastern Freight Lines – regional focus

Southeastern Freight Lines specializes in Southeast and Southwest coverage with emphasis on damage-free delivery. Their regional focus enables deep market knowledge and superior lane density, with truck routing optimized for regional corridors.

The provider’s quality metrics consistently outperform national averages in their service territories. Southeastern’s customer-centric approach provides personalized service that large providers struggle to deliver, supported by dedicated truck fleet resources.

Their specialized equipment and handling procedures support industries with unique freight requirements common in their geographic markets. The company’s truck maintenance and driver training programs focus on regional service excellence.

Averitt Express – comprehensive services

Averitt Express provides a full-service logistics approach, including final mile delivery options. Their diverse service portfolio extends beyond LTL to comprehensive supply chain management, with specialized truck equipment for various service requirements.

The provider’s technology platform integrates multiple service modes for seamless freight management. Averitt’s logistics expertise appeals to shippers seeking single-source solutions for complex requirements, with truck fleet versatility supporting diverse service offerings.

Their commitment to innovation and customer service creates partnerships that extend beyond basic freight movement to strategic supply chain optimization. Averitt’s truck fleet includes specialized equipment for temperature-controlled and hazardous materials shipping.

| LTL provider | Annual revenue | Daily shipments | Network coverage | Specialty focus |

|---|---|---|---|---|

| FedEx Freight | $8,901M | 85,000 | National | Technology integration |

| Old Dominion | $5,815M | N/A | National | Premium service |

| Estes Express | $4,994M | N/A | Regional | Guaranteed service |

| XPO | $4,899M | N/A | National | Technology solutions |

| Saia Inc. | N/A | N/A | Growing | Network expansion |

NOTE: Many shippers combine LTL providers with third-party logistics providers to optimize their freight management strategies across multiple modes and companies.

How to choose the best LTL provider for your business

Selecting the right LTL company requires a systematic evaluation of multiple factors beyond basic pricing. The complexity of LTL services means that the lowest-cost option often becomes the most expensive when service failures and claims are factored into the total cost of ownership.

NOTE: LTL selection should align with your supply chain strategy and customer service requirements. A provider that works well for one shipper may be inappropriate for another based on different priorities and shipping patterns.

Evaluate service coverage areas

Geographic reach must align with your shipping lanes and frequency. Companies with strong terminal density in your key markets provide better service than those serving your routes as peripheral coverage. Their truck routing efficiency depends heavily on terminal proximity and lane density.

Direct service eliminates interline transfers that increase transit times and damage risk. Evaluate each provider’s terminal locations and determine which provides the most direct truck routing for your primary freight lanes.

Consider both inbound and outbound shipping requirements when assessing coverage. An LTL company strong in your shipping origins may be weak in your delivery destinations, creating imbalanced service levels and inconsistent truck availability.

Regional providers often excel in specific geographic corridors where they maintain high terminal density and dedicated truck resources. National providers offer broader coverage but may lack the specialized focus that improves service in particular markets.

Compare pricing structures and tariffs

Most major providers implemented mid-single-digit GRIs in 2025: FedEx at 5.9%, Saia at 7.9%, Old Dominion at 4.9%. Understanding these baseline increases helps evaluate the real cost impact of provider selection and truck transportation pricing trends.

LTL pricing extends far beyond base rates to include numerous accessorial charges that can significantly impact total costs. Evaluate each provider’s complete fee structure, including liftgate, residential delivery, and notification charges that can exceed base freight rates.

Discount structures vary significantly between providers based on your shipping volume and freight characteristics. The best LTL option for your business may not offer the lowest published rates, but it provides the most favorable discount structure for your specific shipping profile.

Fuel surcharges and additional fees continue evolving as truck operating costs fluctuate. Understanding how each provider structures these variable costs helps predict total freight expenses and budget accuracy throughout the year.

Assess transit times and reliability

Industry average shows 82% on-time delivery rate, with 1 in 6 shipments arriving late. This performance gap creates a significant opportunity for providers that can deliver superior reliability through optimized truck routing and scheduling.

Poor transit time performance costs average enterprise shippers $6.1M annually in OTIF failures. Reliable providers justify premium pricing through reduced inventory costs, improved customer satisfaction, and operational predictability that benefits overall supply chain efficiency.

Evaluate performance in your specific lanes rather than overall network statistics. Transit times and reliability can vary dramatically between different geographic corridors within the same provider’s network, depending on truck availability and terminal efficiency.

Service consistency matters more than occasional exceptional performance. Look for providers with consistent truck scheduling and predictable service levels rather than those with highly variable performance that complicates logistics planning.

Review technology and tracking capabilities

Real-time visibility enables proactive freight management and customer communication. Companies with superior technology platforms reduce administrative burden while improving shipment control and truck tracking accuracy throughout the transportation process.

API availability and EDI capabilities determine how effectively you can integrate LTL operations with your broader logistics management systems. Seamless integration reduces manual processes and improves accuracy while enabling automated truck scheduling and status updates.

Advanced analytics and reporting capabilities help optimize freight spend and service levels over time. The best LTL provider offers data insights that drive continuous improvement beyond basic shipment execution and truck utilization reporting.

Mobile applications and customer portals enhance daily freight management by providing instant access to shipment status, truck locations, and delivery confirmations. These tools reduce phone calls and emails while improving operational efficiency.

Consider specialized services

Temperature control, final mile delivery, and hazmat capabilities determine which providers can handle your complete freight profile. Specialized services often command premium pricing but eliminate the need for multiple relationships and coordinated truck movements between providers.

E-commerce focus represents 10% of FedEx Freight revenues, reflecting the growing importance of residential delivery capabilities. Companies investing in final mile capabilities better serve omnichannel shippers requiring both commercial and residential truck delivery services.

Match service capabilities to your product requirements rather than assuming all LTL providers offer identical services. Specialized handling requirements often dictate selection more than pricing considerations, particularly when truck equipment or driver training requirements are involved.

White glove services, appointment scheduling, and inside delivery capabilities expand service options but require specialized truck equipment and trained personnel. Evaluate whether providers offer these services consistently or subcontract them to third parties.

ALERT: Many shippers with specialized handling requirements benefit from providers with experience managing complex freight profiles and truck equipment configurations.

LTL comparison factors

Understanding fundamental differences between provider types and operational models helps narrow your selection before detailed evaluation. These structural factors often matter more than specific rate comparisons in determining long-term partnership success and truck service reliability.

Asset vs non-asset providers

Asset-based companies own their truck fleets and terminals, providing direct control over service quality and capacity. This ownership model enables consistent service but requires significant capital investment that affects pricing strategies and truck replacement schedules.

Non-asset providers broker freight through partner networks, offering flexibility and potentially lower costs. However, service control decreases when multiple parties handle your freight across different legs of transportation, and truck availability depends on third-party resources.

Direct control versus network flexibility represents the fundamental trade-off between asset and non-asset providers. Asset-based operations typically provide more predictable service but less routing flexibility during capacity constraints and truck shortages.

Hybrid models combine owned assets with partner networks to balance control and flexibility. These providers maintain truck fleets in core markets while using partners for peripheral coverage, offering a compromise between service consistency and geographic reach.

Regional vs national coverage

National LTL companies provide broad geographic coverage but may lack density in specific markets. Their networks optimize for overall efficiency rather than excellence in particular corridors, with truck routing designed for network-wide optimization.

Regional specialists focus resources on limited geographic areas, often providing superior service density and customer attention. These providers understand local market conditions and customer requirements that national companies may overlook, with dedicated truck resources for regional lanes.

Lane density advantages enable regional providers to offer better transit times and service reliability in their core markets. However, coverage limitations require multiple relationships for a comprehensive geographic reach and coordinated truck movements between providers.

Interline partnerships allow regional providers to extend coverage through agreements with other companies. These arrangements can provide broader reach while maintaining regional service quality, though coordination complexity increases with multiple truck handoffs.

Industry-specific expertise

Specialized handling capabilities matter when freight requires enhanced care or compliance oversight. Companies with vertical market expertise understand industry requirements that generalist providers may miss, including specialized truck equipment and handling procedures.

Compliance and certification requirements vary significantly between industries, particularly in regulated sectors like healthcare and automotive. LTL providers with industry expertise navigate these requirements more effectively than generalist companies lacking specialized truck configurations or certifications.

Vertical market specialization enables deeper customer relationships and customized solutions. However, specialized providers may charge premium pricing for their expertise and may have limited capacity during peak periods when truck availability becomes constrained.

Equipment specialization includes temperature-controlled truck trailers, specialized loading equipment, and enhanced security features. Industry-focused providers invest in truck configurations that support specific freight requirements rather than general-purpose equipment.

NOTE: Understanding comprehensive logistics services helps shippers combine LTL providers with other supply chain solutions for optimized freight management and truck utilization strategies.

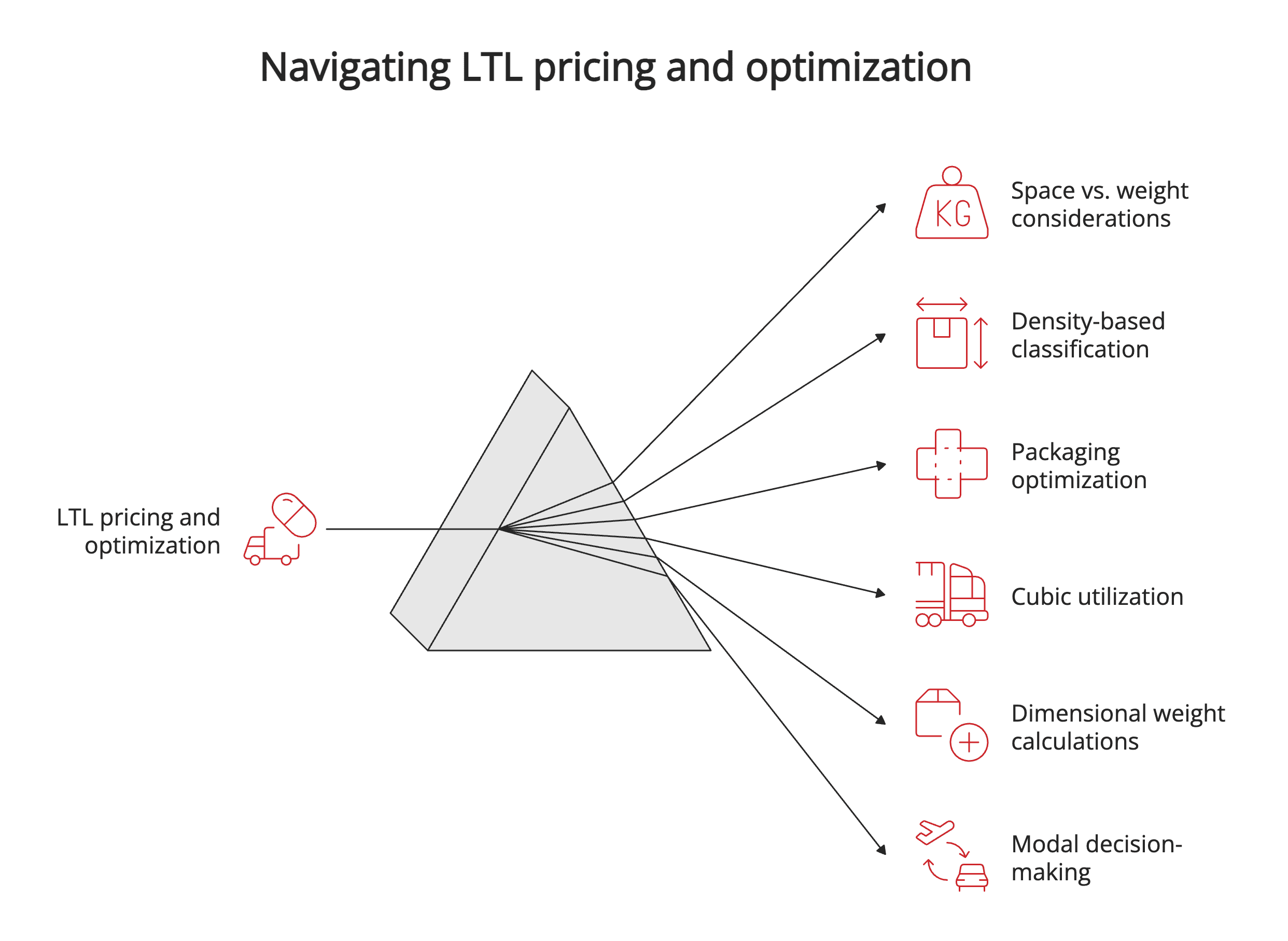

Understanding LTL pricing and classifications

LTL freight rates depend on complex classification systems and numerous accessorial charges that can significantly impact total shipping costs. The National Motor Freight Classification (NMFC) system underwent major changes in 2025, affecting how virtually all LTL freight is priced and handled across truck transportation networks.

LTL pricing fundamentals

Base rates calculate shipping costs using freight class, weight, and distance as primary factors. Companies apply these base rates before adding numerous accessorial charges that can double or triple the final invoice amount, particularly for specialized truck services or delivery requirements.

Distance factors use ZIP code-based zones similar to parcel shipping, but with different zone structures for each provider. Weight breaks create pricing tiers where small increases in shipment weight can trigger significant rate increases, affecting truck load planning and freight consolidation strategies.

Minimum charges ensure providers recover basic handling costs regardless of freight size. LTL freight shipments below minimum thresholds pay the minimum charge rather than weight-based pricing, affecting the economics of small shipments and truck utilization efficiency.

Cubic capacity considerations increasingly influence LTL pricing as providers optimize truck-trailer space utilization. Dimensional weight pricing applies to lightweight, bulky freight that consumes truck space disproportionate to its actual weight.

NMFC freight classes explained

Major NMFC changes took effect July 19, 2025, transitioning to density-based classifications affecting nearly 100 commodity groups. This represents the most significant classification overhaul in decades, impacting how truck loads are planned and priced.

The new density scale ranges from Class 50 (50+ lbs per cubic foot) to Class 400 (less than 1 lb per cubic foot). Dense, compact freight receives favorable classification while lightweight, bulky items face higher classes, affecting truck capacity utilization and loading efficiency.

Classification based on four factors: Density, Handling, Stowability, and Liability. However, density now dominates the classification process more than previous factors, simplifying but also changing how freight is categorized and how truck space is allocated.

Over 2,000 commodity descriptions were reorganized in the 2025 NMFC update, requiring shippers to verify their freight classifications and understand potential cost impacts from reclassification. These changes affect truck loading patterns and freight consolidation strategies across the industry.

Example classifications under the new system:

Class 50: Dense metals, machinery parts (optimal truck space utilization)

Class 70: Food products, automobile engines (good truck loading density)

Class 100: Boat covers, car accessories (standard truck space usage)

Class 150: Auto sheet metal parts (moderate truck space consumption)

Class 200: Auto engines, cast iron stoves (higher truck space requirements)

Class 300: Wood cabinets, setup furniture (significant truck space usage)

Class 400: Deer antlers (maximum truck space with minimal weight)

Common accessorial charges

Residential delivery charges apply when freight is delivered to non-commercial addresses, adding significant costs to shipment totals. This charge covers the additional time and specialized equipment required for residential access.

Liftgate services add substantial costs per shipment when receiving locations lack dock facilities. Many businesses underestimate liftgate requirements, leading to unexpected charges and delivery delays.

Inside delivery, notification services, and appointment fees can add considerable costs to shipment totals, depending on requirements. These charges often exceed the base freight rate for small shipments.

Limited access delivery applies to locations with restricted truck access, adding significant surcharges. Construction sites, schools, and residential areas often qualify for limited access charges that can double freight costs due to specialized truck routing requirements.

ALERT: Always verify your freight’s NMFC classification before shipping. Using incorrect class codes can result in reclassification charges that are often significantly higher than the original shipping cost.

Density rules and cubic capacity

Packaging optimization can significantly impact freight class and shipping costs. Reducing package dimensions or increasing density through better packing can move freight to lower classes and reduce costs while improving truck utilization efficiency.

LTL freight pricing increasingly focuses on cubic utilization rather than weight alone. Shippers who optimize packaging density gain a competitive advantage through lower freight classes and reduced accessorial charges while supporting better truck capacity utilization.

Dimensional weight calculations consider package size relative to actual weight, affecting how freight consumes truck trailer space. Understanding these calculations helps optimize packaging for better classification and reduced transportation costs.

NOTE: Understanding logistics pricing structures helps shippers compare LTL costs with other transportation modes and make informed modal decisions for truck versus alternative shipping methods.

LTL selection checklist

Space versus weight considerations determine how providers price lightweight, bulky freight. The new density-based classification system makes accurate measurement critical for cost control and truck space optimization throughout the LTL network.

Systematic evaluation prevents costly mistakes and ensures your selection aligns with business requirements. This structured approach helps identify the best LTL option for your specific needs rather than defaulting to the most well-known option or the lowest-cost truck transportation quote.

Pre-selection preparation

Analyze shipping volume by lane and frequency

Document freight characteristics and special requirements

Identify current pain points with existing providers

Establish budget parameters and service level requirements

Review truck equipment needs for specialized freight

Create baseline shipping profiles showing your typical freight patterns, seasonal variations, and growth projections. This data enables meaningful discussions with potential providers and helps identify which companies can best serve your needs with appropriate truck resources.

Provider evaluation process

Request detailed service maps showing coverage areas

Obtain complete pricing proposals, including accessorial fees

Verify technology capabilities and integration requirements

Contact references from similar businesses in your industry

Assess truck fleet capacity and equipment availability

Test potential providers with small shipments before committing to major agreements. This pilot approach reveals service quality and operational compatibility without risking significant freight volume or critical truck deliveries.

The best LTL option for your business should demonstrate consistent performance, competitive pricing, and service capabilities that align with your requirements. Avoid providers that cannot clearly explain their service commitments or provide references from satisfied customers with similar truck transportation needs.

Implementation planning

Develop performance monitoring systems and KPIs

Establish regular review meetings and communication protocols

Create contingency plans for service disruptions

Plan integration timeline with existing logistics systems

Coordinate truck scheduling and delivery requirements

Set clear expectations for performance, including on-time delivery rates, damage levels, and communication requirements. The right LTL provider welcomes performance monitoring and works collaboratively to achieve your logistics objectives through optimized truck service delivery.

NOTE: Many successful shippers combine LTL providers with comprehensive fulfillment services to optimize their complete supply chain strategy and truck transportation coordination across multiple service providers.

Citations

- Transport Topics. “2025 Top Less-Than-Truckload Carriers.” Transport Topics, 2025. https://www.ttnews.com/for-hire/ltl/2025

- ATS Logistics. “Top 10 LTL Carriers in 2025.” ATS Inc., 2025. https://www.atsinc.com/blog/top-ltl-carriers-tips-for-choosing

- Transflo. “5 Key Trends Shaping the LTL Market in 2025.” Transflo, 2025. https://www.transflo.com/blog/5-key-trends-shaping-the-ltl-market-in-2025/

- Gain Consulting. “How an Independent FedEx Freight Plans to Grow.” Gain Consulting, 2025. https://www.gain.consulting/post/how-an-independent-fedex-freight-plans-to-grow-opportunities-for-u-s-shippers-in-2025

- Flock Freight. “2025 Shipper Research Study.” Flock Freight, 2025. https://www.flockfreight.com/the-need-for-speed-research-study-25

- Priority One. “NMFC 2025: What You Need to Know.” Priority One, 2025. https://www.priority1.com/nmfc-2025-what-you-need-to-know-about-the-new-freight-classification-changes/

- DTS One. “Breaking Down the July 2025 NMFC Changes.” DTS One, 2025. https://www.dtsone.com/breaking-down-the-july-2025-nmfc-changes/

- National Motor Freight Traffic Association. “NMFC Codes & Freight Classification.” NMFTA, 2025. https://nmfta.org/nmfc/