Ever wonder why some businesses thrive while others struggle to stay afloat?

While many factors contribute to success, one crucial element is often overlooked: understanding and managing costs.

At the heart of this is cost per unit — the total expense of producing, storing, and selling a single item. This key metric helps businesses price products effectively and identify areas for improvement, playing a significant role in a company’s financial health and competitiveness.

In this guide, we’ll demystify cost per unit calculations, showing you how to account for every penny that goes into your products.

Learn how this crucial metric can reshape your pricing strategy, streamline your operations, and give you a competitive edge in today’s market.

TL:DR:

Key takeaways

Cost per unit combines fixed and variable expenses to calculate the average cost of producing one item, essential for pricing and profitability analysis.

Calculating unit costs helps businesses set prices, evaluate product lines, make informed decisions, forecast budgets, and optimize their product mix.

Per unit costs are influenced by production volume, manufacturing efficiency, and the balance of direct and indirect costs.

Ecommerce businesses face unique challenges in unit cost calculation, including higher inventory costs and complex logistics and fulfillment expenses.

Strategies to reduce unit costs include improving inventory management, investing in automation, renegotiating supplier contracts, and optimizing product design.

Components of cost per unit

No matter what you sell, there are many overhead costs involved in your total cost. This includes the more obvious factors—like direct materials and packaging costs—and expenses you may not have considered, such as property taxes.

Fixed costs

Fixed costs stay the same no matter how much you produce.

Examples of fixed unit costs include:

Rent for production facilities or warehouses

Salaries for permanent staff

Equipment purchases or leases

Property taxes and insurance

To learn your total fixed cost, review your financial statements and identify items that remain the same each month. Tally these expenses and you’ll have your total fixed costs.

Reducing fixed costs can be challenging. A higher fixed unit cost means you’ll need more revenue to reach the break-even point.

Variable costs

A variable cost fluctuates based on your production volume. Unlike total fixed costs, a variable cost offers more realistic opportunities to improve your profitability.

Common variable costs include:

Raw materials

Packaging supplies

Shipping and handling

Production labor wages

Your total variable cost will increase as the number of units produced increases.

To calculate your total variable costs, multiply the variable cost per unit by the total number of units produced.

Total units produced

The total number of units produced in a given period is required to calculate the cost per unit. This figure can be either the actual number of units manufactured or a projection based on sales forecasts and inventory needs.

The number of units produced directly impacts the cost per unit, as fixed costs are spread out over the total production volume. Generally, higher production leads to a lower cost per unit due to economies of scale.

How to calculate cost per unit

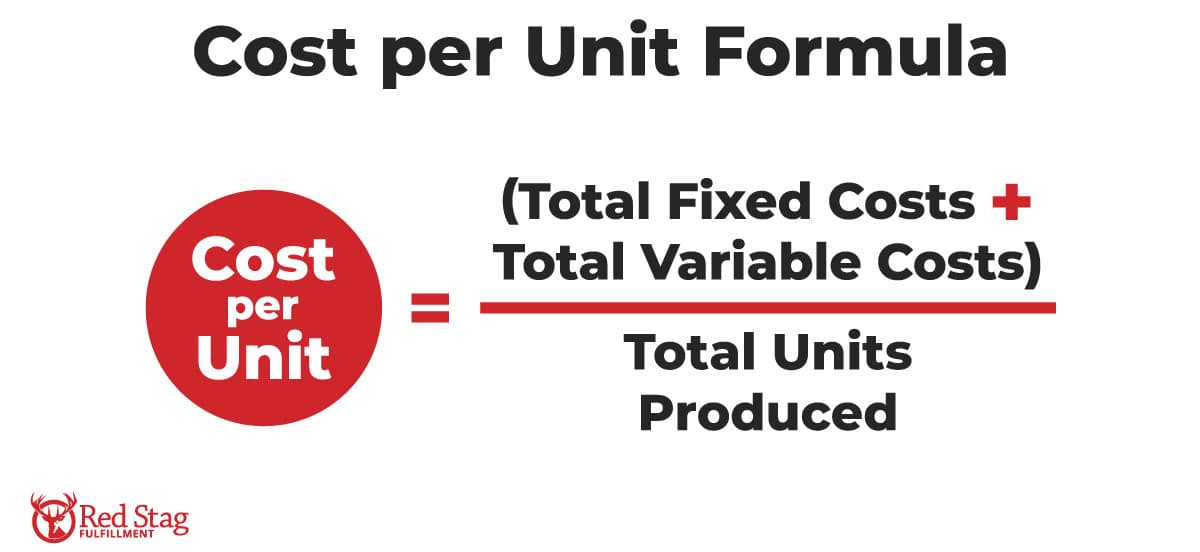

The cost per unit is a metric that helps you understand your profitability and pricing strategies. It combines fixed and variable costs to determine the average cost of producing a single unit.

Here’s how to calculate cost per unit:

Cost per Unit = (Total Fixed Costs + Total Variable Costs) / Total Units Produced

And here’s a calculator if you don’t want to do the manual work:

Cost per Unit Calculator

Step 1: Calculate total costs

Let's consider a business with the following:

Fixed costs: $10,000

Variable costs: $5,000

Total units produced: 5,000

Step 2: Apply the formula

Using the formula, it would look like this:

$15,000 / 5,000 = $3 per unit

Each unit costs an average of $3 to produce when accounting for both fixed and variable expenses.

5 benefits of calculating cost per unit

Calculating cost per unit provides several important benefits for your business.

Determine pricing and profitability

01

Understanding your cost per unit is crucial for establishing prices that yield a healthy profit margin. The profit margin is calculated as the sales price per unit minus the cost per unit.

For example, if your cost per unit is $3 and your unit price is $5, your profit margin is $2 per unit sold.

Without understanding your unit costs, it's impossible to know if your prices are sufficient to generate a profit. It's important to account for all production costs to avoid selling products at a loss.

Accurate cost-per-unit data enables you to perform a break-even analysis, determining the point at which total revenue equals total costs.

You can use this information in a few ways:

Set realistic sales targets

Decide how to price your product

Understand how changes in costs or prices affect your bottom line

Make informed business decisions using unit cost

02

A clear picture of your unit costs helps you make better business decisions. With this information, you can identify opportunities to reduce costs by optimizing production processes and finding more affordable suppliers.

Calculate profitability for your product line

03

Knowing the cost to produce each unit also allows you to evaluate the overall profitability of a product line. If your profit margins are too slim, consider discontinuing that product or looking for ways to cut costs.

Forecast and budget

04

Understanding unit costs also helps with forecasting and budgeting. You can project how changes in sales volume may impact your margins and make informed choices about where to allocate resources.

Optimize your product mix

05

Selecting and producing a combination of products can maximize your overall profitability. Unit costs are critical in this optimization process, as they directly impact profitability and resource allocation decisions.

Consider the following:

Unit costs

Resource availability

Market demand

Factors that impact per unit costs

Understanding what influences per unit costs helps you improve profitability.

Production volume and efficiency

The number of units you produce affects the cost per unit and your business's profit margins.

This relationship is often explained through the concept of economies of scale:

Fixed costs are spread over more units as production increases, reducing the fixed cost per unit.

Variable costs typically remain constant per unit but may decrease with bulk purchasing or improved efficiency.

Semi-variable costs have both fixed and variable components and may decrease per unit as volume increases.

But this relationship isn't always linear. There may be a point of diminishing returns where further volume increases provide minimal cost benefits.

PRO TIP: Manufacturing efficiency also plays a role in per unit costs. Optimizing production processes through lean manufacturing techniques and continuous improvement efforts can reduce costs by reducing waste, improving productivity, and streamlining workflows.

Direct and indirect costs

The types of costs your business incurs also impact the per unit cost. Since direct costs are tied to the production of a specific product, they are easy to allocate to individual units. Indirect costs, on the other hand, are expenses that cannot be directly attributed to a specific product.

These include things like facility overhead, administrative salaries, and utilities. Indirect costs are often allocated across all units produced.

Together, these expenses create an accurate picture of total production costs. If you leave indirect costs out of the equation, it can make your products appear more profitable than they really are.

How do you allocate costs?

Two common ways to allocate costs are traditional cost allocation methods and activity-based costing (ABC):

- Traditional cost allocation methods

Distribute indirect costs across products or services based on a single or limited number of cost drivers. This includes direct labor hours, machine hours, or units produced. - Activity-based costing

Allocates indirect costs more accurately by identifying multiple activities that drive costs. Then, you assign costs to products based on the extent to which each product uses those activities.

Why ecommerce businesses need to calculate unit cost accurately

Calculating cost per unit is especially critical for ecommerce businesses, as they face unique challenges that can significantly impact profitability.

Compared to a traditional retail store, an ecommerce business has much more demanding warehousing and logistics needs. As a result, calculating the cost per unit requires a few special considerations.

Inventory costs

As an ecommerce business, you likely hold much more inventory than traditional retailers.

This means higher inventory carrying costs, which include numerous expenses:

Warehousing and storage fees

Insurance and taxes on inventory

Obsolescence and spoilage of products

Opportunity cost of cash tied up in inventory

All of these carrying costs add to the total cost per unit. The longer your business holds inventory, the higher your cost per unit climbs.

Logistics and fulfillment

Getting products to customers is a core function of ecommerce, but it comes with substantial costs that directly impact cost per unit.

Packaging materials and supplies

Shipping and handling fees from carriers

Direct labor costs for picking, packing, and shipping orders

Returns processing and reverse logistics

As a business owner, you have to carefully manage these fulfillment expenses to keep per unit costs down.

There are many strategies you can use to accomplish this:

Negotiating favorable rates with shipping carriers

Optimizing packaging to minimize dimensional weight and shipping costs

Leveraging multiple fulfillment centers to store inventory closer to customers and reduce shipping zones

Automating fulfillment processes to reduce labor costs and improve efficiency

3 challenges of calculating cost per unit

Calculating production costs accurately is important for businesses, but it comes with several challenges. Understanding these challenges helps you maintain precise cost per unit calculations and provide reliable data over time.

Fluctuations in costs of raw materials and labor

01

One of the biggest challenges in calculating cost per unit is that the prices of raw materials and labor rates can vary over time due to market conditions, supply and demand, and other economic factors. This means the cost per unit can fluctuate even if the production process remains unchanged.

To account for this, businesses can:

Regularly update cost calculations using the most current figures

Stay informed about market trends and supplier prices

Negotiate long-term contracts with suppliers to stabilize prices

Use forecasting tools to anticipate future cost changes

Allocating overhead and indirect costs

02

Another challenge is allocating overhead and indirect costs across the units produced. These costs are not directly tied to a specific product, so businesses must find a fair and consistent way to assign a portion of these expenses to each unit.

Common allocation methods include:

Labor hours

Machine hours

Square footage used in production

United produced

PRO TIP: Select a method that most accurately represents the relationship between costs and products—but be consistent to preserve comparability.

Impact of inventory write-downs or adjustments

03

Inventory write-downs and adjustments can also complicate cost per unit calculations. If you have to write off obsolete, damaged, or unusable inventory, that expense needs to be accounted for in the cost of goods sold (COGS).

Similarly, if a physical inventory count results in an adjustment to the inventory value, that change flows through to the COGS and impacts the cost per unit calculation. Businesses need to be mindful of these adjustments and check that they are accurately reflected in their costing models.

By understanding these challenges, businesses can take steps to mitigate their impact and maintain accurate cost per unit calculations over time. Regular reviews and cost model updates are essential to keep this critical metric reliable and useful for decision-making.

4 strategies to reduce per unit costs

You can employ several strategies to reduce your cost per unit.

Improve inventory management

01

Effective inventory management is crucial for keeping per unit costs down.

Overproducing leads to excess inventory that ties up cash and increases inventory holding costs. Accurate demand forecasting will help you align production with expected sales.

PRO TIP: Implementing just-in-time practices, such as ordering materials only when they're needed and minimizing on-hand stock, can significantly reduce inventory carrying costs.

Invest in technology and automation

02

Investing in technology and automation can help streamline production processes and reduce per unit costs.

Automated systems, like a warehouse management system and pick-and-pack robots, can minimize labor costs, improve efficiency, and reduce waste of raw materials.

Using manufacturing and fulfillment automation where possible allows you to improve your operations and reduce variable costs per unit.

Review and renegotiate supplier contracts

03

Periodically evaluating supplier performance and renegotiating contracts can lead to cost savings.

Assess vendors based on cost, quality, and reliability.

Negotiate volume discounts or more favorable payment terms to reduce the cost of raw materials and supplies.

Explore alternative suppliers to secure competitive pricing.

Streamline product design

04

Look for ways to reduce material requirements or simplify assembly processes to reduce labor and material costs.

Minimizing packaging (without reducing product protection) can also help improve your per unit costs.

Cost per unit and pricing decisions

Your cost per unit sets the floor for your pricing. If you price a product below its unit cost, you will lose money on every sale. Prices must exceed the unit cost to generate a profit.

Ideally, you want to set prices that cover your costs and provide a healthy profit margin (aiming for between 30% and 35% in many cases).

This creates a buffer to account for unexpected expenses or market shifts. It also allows you to reinvest in the business, fund growth initiatives, and provide returns to stakeholders.

Pricing strategies

Businesses use several common pricing strategies, which all rely on a clear understanding of unit costs. It’s important to understand all of your options to choose the most advantageous method for your business.

Cost-plus pricing

This involves adding a fixed percentage markup to your unit cost. For example, if your cost per unit is $10 and you use a 50% markup, your selling price would be $15. This allows for a consistent margin but doesn't account for market conditions.

Competitive pricing

Aligning your prices with those of competitors helps make your offerings more appealing to customers. For example, if your competitors sell a similar product for $20, you might price yours at $18 to gain a competitive edge.

When using this strategy, it's crucial to know your unit costs. This knowledge allows you to determine whether matching or undercutting competitors' prices remains financially viable for your business.

Value-based pricing

This approach sets prices based on the product's perceived value to the customer rather than the cost of production.

For example, a premium skincare product might be priced at $100, even if its production cost is only $20, due to its perceived value to customers. Understanding unit costs safeguards against pricing too low and eroding your margins.

Dynamic pricing

This strategy involves adjusting prices based on real-time market demand. Prices may fluctuate due to seasonality, competitor actions, or supply and demand.

While dynamic, prices still need to cover unit costs to be profitable.

Balancing profit and sales volume

Pricing is a balancing act between driving profit and sales volume. In general, lower prices stimulate higher demand and sales volume. But if prices are too low, the incremental sales may not generate enough total profit to justify the strategy.

Higher prices typically mean lower sales volumes but more profit on each unit sold. Luxury brands often employ this strategy. With higher margins, they can generate substantial profits on fewer sales.

The key is to find the optimal price point that maximizes total profits. This requires a deep understanding of your target market, price sensitivity, and unit economics. By calculating your cost per unit and modeling different pricing scenarios, you can identify the sweet spot for your business.

Improve your logistic operations to control costs

Knowing your cost per unit is an important first step in improving profitability. Next, you’ll want to refine your logistics and inventory management to lower variable costs and improve efficiency.

Red Stag Fulfillment offers inventory planning and management assistance to help you control costs and achieve a consistent ROI.

Ready to learn more about our inventory planning and warehouse management services? Reach out to us to start a conversation about improving your inventory and fulfillment today.