A 3PL is a fulfillment and logistics partner that helps ecommerce and other companies store and move products for sale.

This article provides pretty much everything you need to know about 3PLs, so you can find the one that fits best with your business. You’ll learn what a 3PL does, how they support your supply chain operations, how a fulfillment center works, and more.

3PL meaning

A 3PL, or third-party logistics provider, is a partner that helps companies optimize their supply chain and logistics operations.

They specialize in services such as inventory management, warehouse storage, order fulfillment, returns processing, and transportation.

You may also hear 3PL companies called by other names:

Fulfillment company

Order fulfillment companies

Fulfillment warehouse

Fulfillment center

Not all 3PLs offer the same services, but their main goals are to serve your fulfillment and warehousing needs so you can streamline your supply chain management.

What does a 3PL do?

A few key roles of 3PLs are to store and manage inventory and fulfill orders. This lets you leverage the cost-efficiencies of a centralized inventory and strategic distribution model.

3PLs also provide transportation services, managing the movement of inventory between various points in the supply chain. This includes coordinating shipments from vendors and customers, optimizing delivery routes, and providing real-time updates.

Some 3PLs can also help you with global supply chain matters, such as import, export, and customs procedures.

Why do you need a 3PL?

A 3PL for ecommerce companies can reduce the operational burdens of running supply chains. By letting a 3PL handle inventory and logistics, you can focus your resources on growth activities, like identifying new customer bases or developing new product lines.

NOTE: Some ecommerce companies may also work with 4PLs or fourth-party logistics providers. These providers act as consultants and managers, helping to design, run, and optimize your supply chain and logistics. They may help you source and manage 3PLs, too.

What is 3PL logistics?

Third-party logistics refers to the services described above. But there’s some interplay between terminology here, and it’s helpful to understand it so you can speak confidently about the role of 3PL services at your company.

What is 3PL terminology?

Third-party logistics is a field of operations. It’s the inventory management, order fulfillment, and transportation mentioned above. The term is often abbreviated to 3PL when speaking and writing and mentioned when referring to operations providers.

If your 3PL helps coordinate transportation, you may also hear the term freight forwarders. Freight forwarders manage the movement of inventory and may help provide cost savings.

3PL services

As a service, a third-party logistics company provides ecommerce fulfillment services, taking logistics operations off your hands.

Most third-party logistics services focus on warehouse operations. Your 3PL warehouses probably serve multiple ecommerce companies, reserving or allocating warehouse space for storage of each client’s inventory. Then, as you receive orders, warehouse staff pick and pack products from the warehouse to ship to your customers.

Third-party logistics may also encompass a variety of additional services. Depending on which ecommerce 3PL providers you choose, you may have access to the following:

Shipping and receiving

FTL and LTL freight shipping

Freight forwarding

Reverse logistics (returns)

Specialized 3PL services

Some 3PLs specialize in specific types of warehousing and fulfillment. That’s because certain products have their own storage and shipping requirements to satisfy compliance regulations or preserve product integrity.

For example, some products have to be kept at exact temperatures. Supply chains that deal in these products are known as cold chains. They require refrigerated warehouse space and transportation equipment, sometimes called “reefers” in common conversation.

Other 3PL companies are set up to store and ship products that qualify as hazardous materials. Products in this category may include everyday items, like perfume or batteries, but their supply chains are highly regulated. In some instances, 3PL staff may need specific certifications to handle these materials for you and your customers.

Another example is large or bulky products. Only a limited number of 3PLs are able to handle and ship these products safely and accurately. If you sell products like furniture, appliances, outdoor equipment, and other large items, you need an experienced 3PL partner that can help ship large or heavy items without excessive costs.

How do 3PL warehouses work?

Your 3PL provider owns or rents the warehouse where your products are stored, along with a variety of specialized equipment, like shelving, forklifts, and robotics.

3PLs also hire, train, and manage their own warehouse and staff. If your products require specialized handling, the 3PLs make sure the warehouse team knows and follows the proper protocols.

Warehouse management software lets your 3PL warehouse teams know where to put inventory or pick it from. That software may also keep your ecommerce website up to date so customers see available inventory in real time when they shop with you.

Security measures, both physical and digital, help protect your inventory and maintain the integrity of the inventory management system. Physical security may include in-person and camera surveillance and controls like passwords or biometric data to access warehouse space. Digital security may include data encryption, access restrictions, and other measures.

When a fulfillment center receives your products for storage, 3PL warehouse staff verify receipts against shipping documentation. Documents may include packing lists or bills of lading, which help determine the chain of custody for items. This verification ensures deliveries include the right quantities of the right products. They’ll also inspect for damages.

Then, when it’s time to fulfill an order, staff pick items from shelves and pack them for delivery. They make sure packages are ready for pickup by carriers that complete the shipping process.

More on how 3PL services work

Fulfillment can be more complex than some people realize. When you’re looking for 3PLs, consider how outsourcing fulfillment may benefit your business.

3PL ecommerce platform integration

For seamless multichannel or omnichannel selling, a robust IT infrastructure is crucial.

Fulfillment warehouses typically use warehouse management system (WMS) software that seamlessly integrates with popular ecommerce platforms like Shopify, WooCommerce, Magento, or Bigcommerce. Custom APIs may also link to your shopping carts.

PRO TIP: An experienced third-party logistics company lets you support all sales channels and see real-time order tracking through a dashboard.

FTL and LTL freight shipping and receiving

Full truckload (FTL) and less than truckload (LTL) freight services refer to how you ship inventory based on volume. Knowing how to optimize these options may help you save money on freight.

PRO TIP: If you work with large orders in predictable cycles, FTL services can help you build volume-based cost-efficiencies. When you have urgent orders to meet demand spikes or have to split orders due to supplier timing, you may benefit more from LTL.

Residential LTL freight is also an option with some 3PLs, especially when you need to secure delivery of oversized items to customers.

A 3PL may include these services in your agreements or be able to act as a freight broker, helping you find the best deals and the correct service level for your needs.

Picking, packing, and shipping

Pick, pack, and ship services are the core of order fulfillment. When your customer orders through one of your sales channels, it goes directly to your fulfillment warehouse.

There, a picker finds the items for the order and packages the order, ensuring packing materials maintain cost efficiency. Packers are also responsible for putting the correct shipping label on each parcel and handing it off for pick up by a final-mile carrier who delivers the package to your customer.

Kitting

Kitting is when components or items are assembled into a single package before shipment. If you have a subscription-model business or require some other kitting service, it’s vital to find an experienced 3PL.

By outsourcing fulfillment to the right 3PL partner, you can streamline the packing and shipping of multiple items sold together or as part of a promotional bundle. This practice is common in ecommerce, where bundling complementary items simplifies the customer experience and adds value to the overall product offering.

Same-day shipping

Some third-party logistics providers offer same-day shipping services. With this shipping strategy, your customer orders are picked, packed, and shipped on the same day they purchase.

Same-day shipping gets your orders to your customers faster, which may lead to higher satisfaction rates. At Red Stag Fulfillment, we offer same-day shipping service.

Inventory management

With a 3PL partner, you can gain valuable support in inventory management. Account representatives often provide insights on restocking levels, supply chain management, and optimal seasonal inventory levels. This collaborative approach ensures efficient stock management without the burden of doing it on your own.

Reverse logistics

It’s crucial that reverse logistics (the handling of returns) is done as efficiently as possible. Returns already represent a loss, but you can mitigate it by working with an experienced 3PL.

Your provider examines returned items to assess damage and determine suitability for return to stock so you can resell undamaged items to someone else or take other steps as needed.

Additionally, your return rate depends on several factors—including the type of merchandise you sell—but a solid 3PL partner may be able to help reduce your rate by minimizing fulfillment errors and damage in the first place.

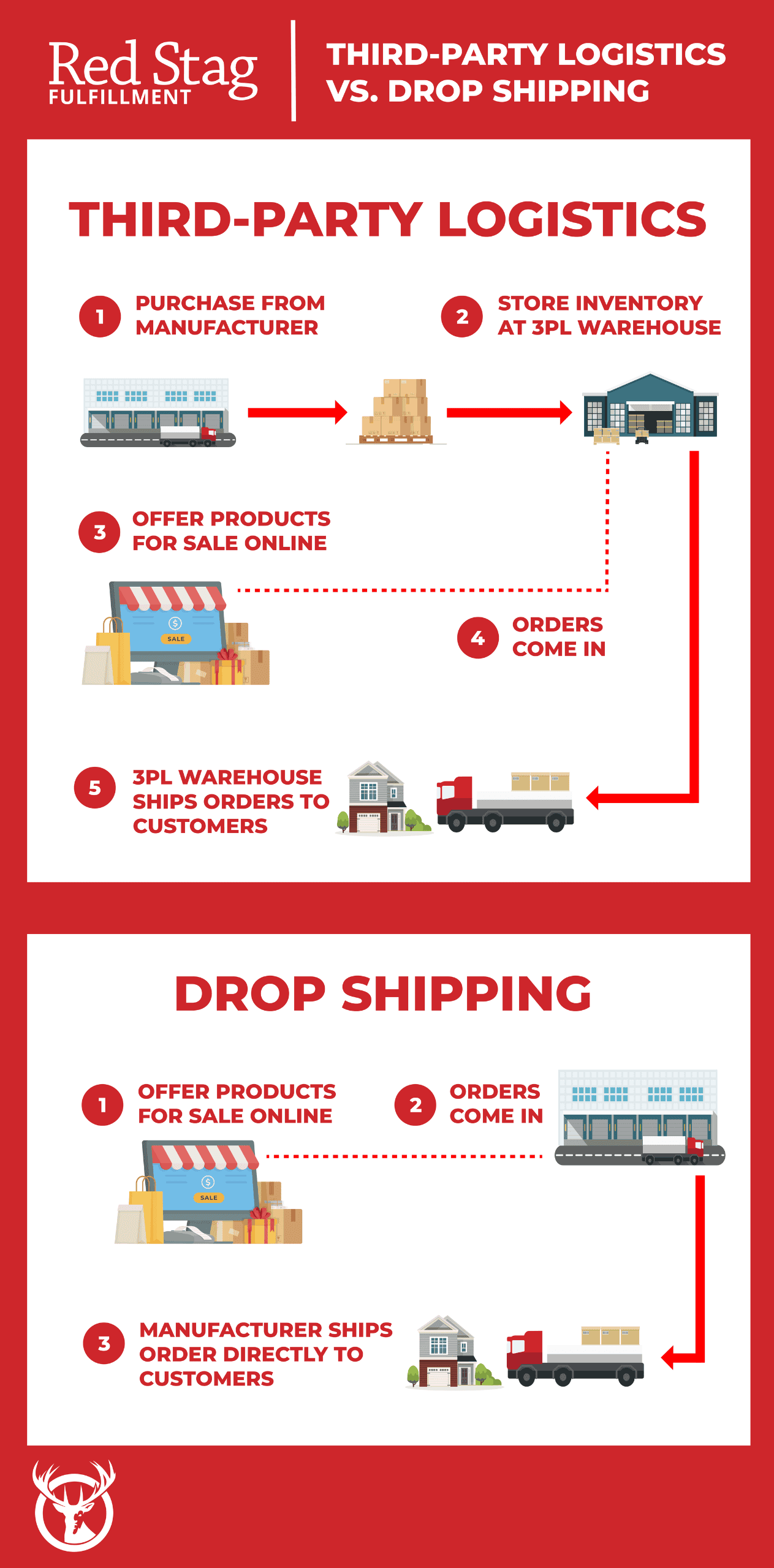

3PL services vs. drop shipping

Some ecommerce businesses use a drop shipping model instead of a 3PL. With drop shipping, you maintain an online store, but you don’t invest in inventory. Instead, you integrate your store and your supplier’s order fulfillment system, and the supplier ships directly to your customer.

This can lead to other differences, like how long it takes to fulfill orders and how much you can profit. Let’s take a closer look at each model so you can decide which works for you.

What is drop shipping?

Drop shipping is an ecommerce business model where you list SKUs for sale on your online store but only purchase inventory after a customer makes a purchase.

The drop ship business model requires little or no upfront capital investment, so it can be a great way to jump-start a new venture on a shoestring.

Drop ship order fulfillment

Once a customer places an order, a manufacturer or distributor produces and ships items directly to them. This eliminates the need to forecast demand, purchase inventory upfront, and manage inventory carrying costs.

Pros and cons of drop shipping

Drop shipping has advantages for some ecommerce businesses:

- Low capital outlay

You can start a new business and offer a large range of products with a small investment using drop shipping. Your costs may be limited to the startup of your online store and your marketing. - Low risk

You only pay for the products customers want, so you don’t end up holding stock you can’t sell or have to take a hit on markdowns. Drop shipping can also be a way to do market research and refine your product line. If something doesn’t sell, you can take it off your website without losing your capital investment. - Low overhead

You don’t have to pay carrying costs, which are the ongoing costs for warehouse space to store your inventory. With drop shipping, your supplier holds the inventory in their own warehouse until it’s sold.

There can also be some downsides with this model.

- Narrower profit margins

With drop shipping, you typically pay a higher wholesale price for products, so your profit margins are narrower. - Longer lead times

Since products are only produced or prepared on demand, lead times may be longer. Customers like fast shipping, so longer lead times may result in lower customer satisfaction, negative reviews, or a lower rate of repeat customers.

3PL order fulfillment

3PL fulfillment or third-party fulfillment involves you paying for inventory upfront, so it’s yours. In this model, inventory may be less expensive than drop ship inventory.

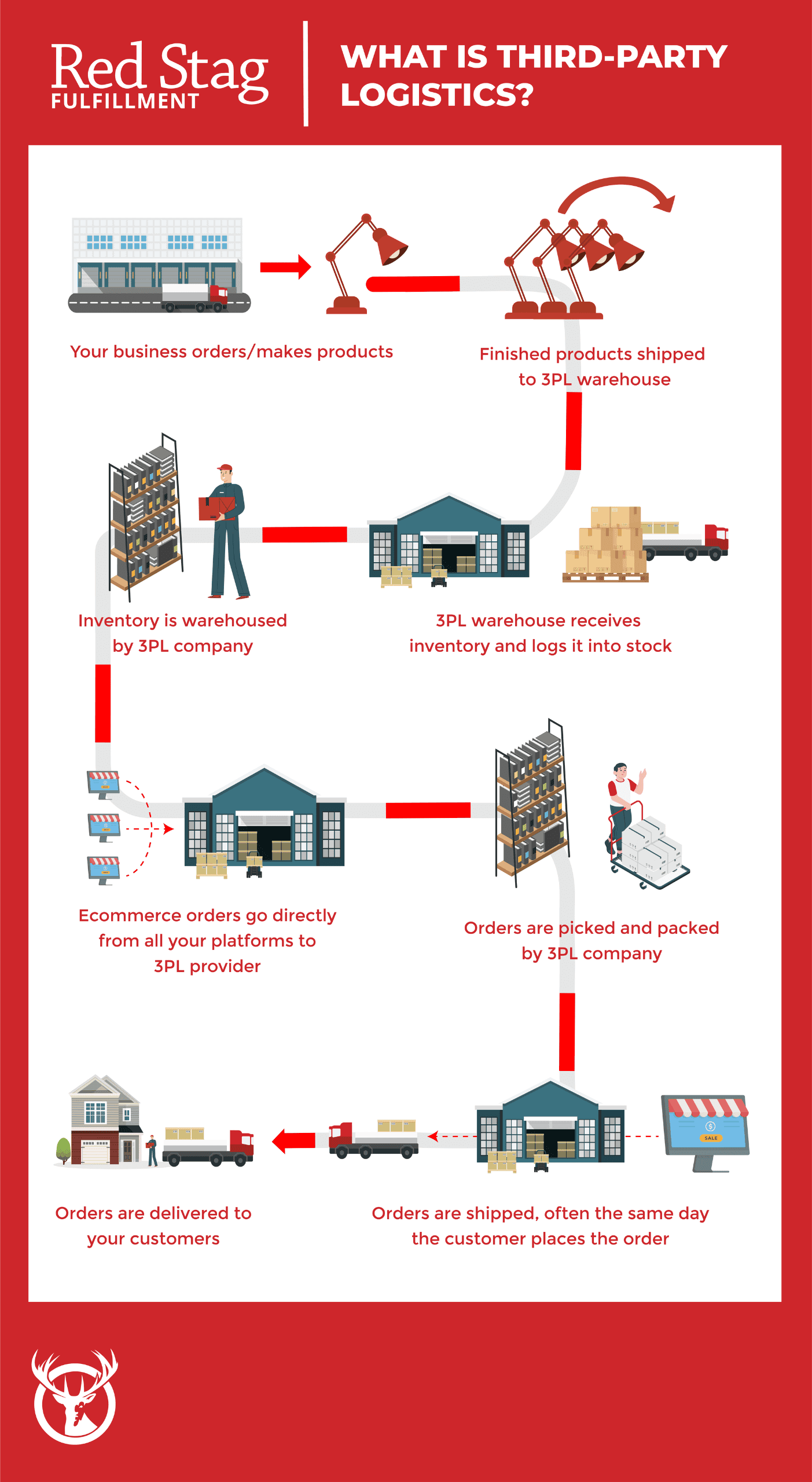

When you use 3rd-party logistics vendors, your entire supply chain looks like this.

- You source products to sell in your ecommerce shop and invest capital to purchase raw materials and/or products before you make sales.

Your merchandise ships to the order fulfillment warehouses managed by third-party logistics providers. - You put your available inventory in your online store or ecommerce platforms.

Customers place orders online. Online orders flow from your sales platforms to your 3PL warehouses. - Experienced warehouse workers pick, pack, and ship your orders from the stock you own, which is stored at the warehouse.

Delivery companies take orders to your customers.

This operational flow puts you in charge of more of the process, so you can manage quality, costs, and timing at a granular level.

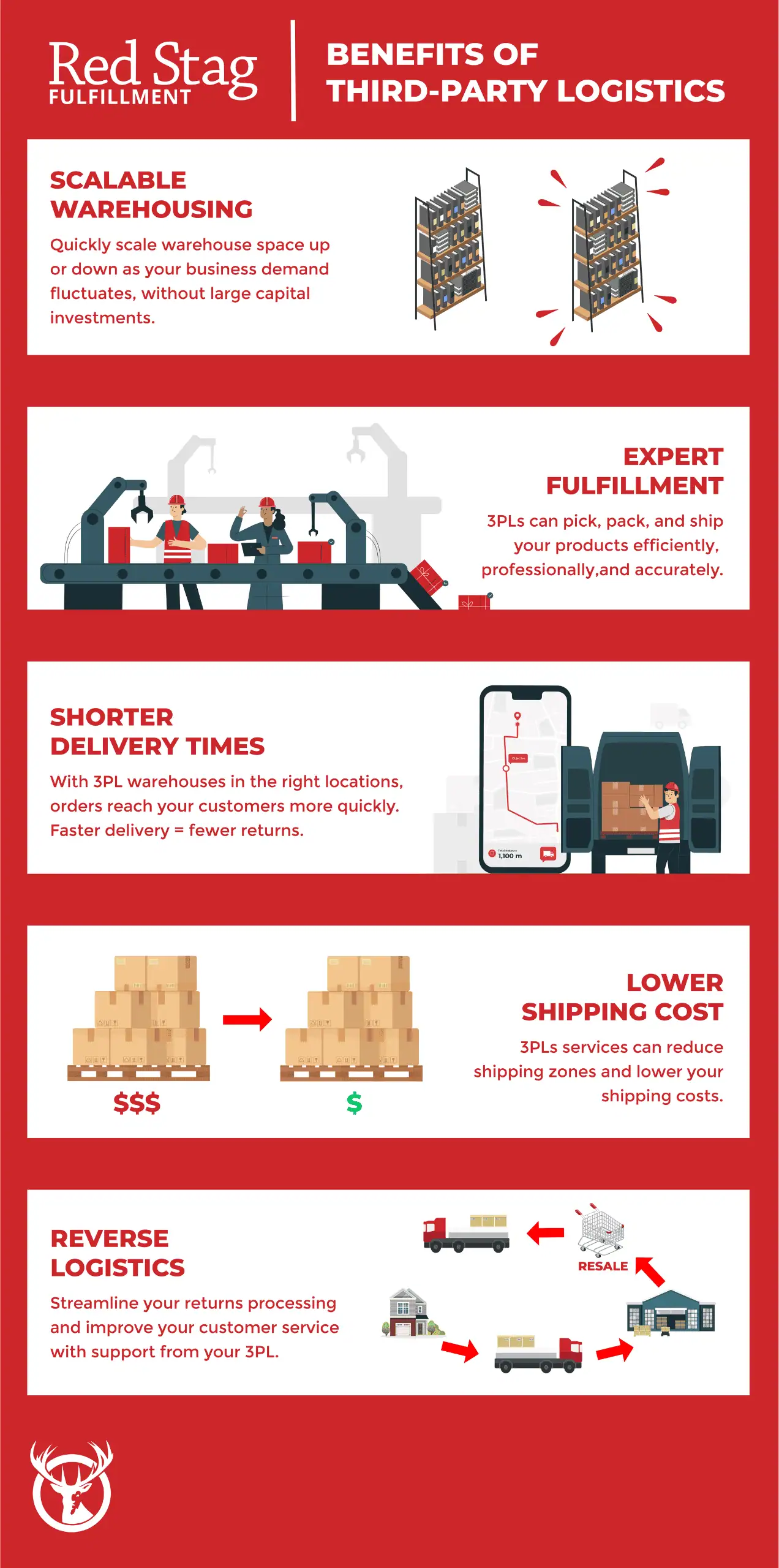

Benefits of third-party logistics

The traditional 3PL model has several benefits that you can’t always capture with drop shipping. Financial benefits can include:

- Lower cost of goods sold.

When you purchase products upfront, you pay the wholesale price. As you buy more, you may be able to receive or negotiate cost savings with volume discounts. When you lower your cost per item, you potentially increase your profit margins. - Greater cost efficiency in fulfillment.

Orders that include products from multiple suppliers can ship in the same box, saving on shipping costs and improving customer experience. - More control over logistics.

With a 3PL model, you choose your order fulfillment partner to provide the level of service your customers expect. This equals cost control, too.

Operational benefits are likely to focus on speed and streamlining. They could include:

- Greater flexibility in sourcing.

When using an ecommerce fulfillment business model, you can source products from multiple manufacturers and design your own custom goods. - Faster order fulfillment.

You can pick a third-party logistics service with warehouse locations to deliver your orders quickly. 3PL order fulfillment may provide greater customer satisfaction than drop shipping, too, because orders may be delivered more quickly. - Easier returns processing.

The third-party logistics warehouse that shipped your products can provide customer service and seamlessly process returns, improving customer satisfaction and letting you put products back into inventory quickly.

Drop shipping and 3PL ecommerce differences

In summary, the differences between 3PL fulfillment and drop shipping relate to ownership and control of inventory.

Drop shipping involves the ecommerce store passing customer orders directly to a manufacturer, wholesaler, or another retailer, who then ships the product directly to the customer. It eliminates the need for businesses to store inventory, reducing upfront costs, but it relinquishes control over stock levels and order fulfillment.

In 3PL fulfillment, businesses send their products to a third-party logistics provider (3PL) where inventory is stored, and the 3PL manages the picking, packing, and shipping of orders. This model grants businesses more control over inventory and order processing.

Summary of third-party logistics benefits

Outsourced fulfillment services help ecommerce businesses grow and thrive. Here is a quick list of some of the benefits of using a 3rd-party logistics provider.

You don’t have to lease warehouse space. When using third-party logistics, you can scale warehouse space, saving money on storage and making expansion easier.

You can place your products closer to customers by choosing a 3PL based on their warehouse locations. That means faster delivery and lower shipping costs.

Your 3PL partner may be able to save you money on shipping. Fulfillment warehouses are volume shippers, so they may have reduced shipping prices with major carriers. This may be especially true if you ship oversized, bulky, or heavy products.

You gain access to value-added services that can enhance your business, including kitting, package consolidation, and freight shipping.

You gain an expert partner. Your third-party logistics provider can help you choose the best packaging, shipping, inventory management, and reverse logistics options for your company.

Fulfillment professionals provide top-notch picking, packing, and shipping for your customer orders. This can help drive customer satisfaction and loyalty.

You free your team to focus on your business’s core competencies, allowing you to focus on product development, marketing, and sales.

Poor fulfillment risks customer satisfaction and profitability, but an experienced 3PL can help you scale your business for predictable growth.

3PL service and ecommerce growth

The efficiency and scalability provided by 3PLs enable businesses to handle increased order volumes, adapt to market dynamics, and enhance overall operational agility.

Additionally, 3PLs often provide advanced technology solutions, including inventory management systems and real-time tracking. These can contribute to streamlined processes and improved customer experiences.

With ongoing logistical support, 3PLs reduce operational burdens for ecommerce companies and contribute to the scalability, flexibility, and growth potential of online businesses in a competitive market landscape.

How to find the best third-party logistics providers

Finding the best third-party logistics provider for you involves matching your needs with a 3PL’s capabilities. Start by assessing the 3PL’s experience and expertise in your industry, ensuring they understand any unique challenges and requirements.

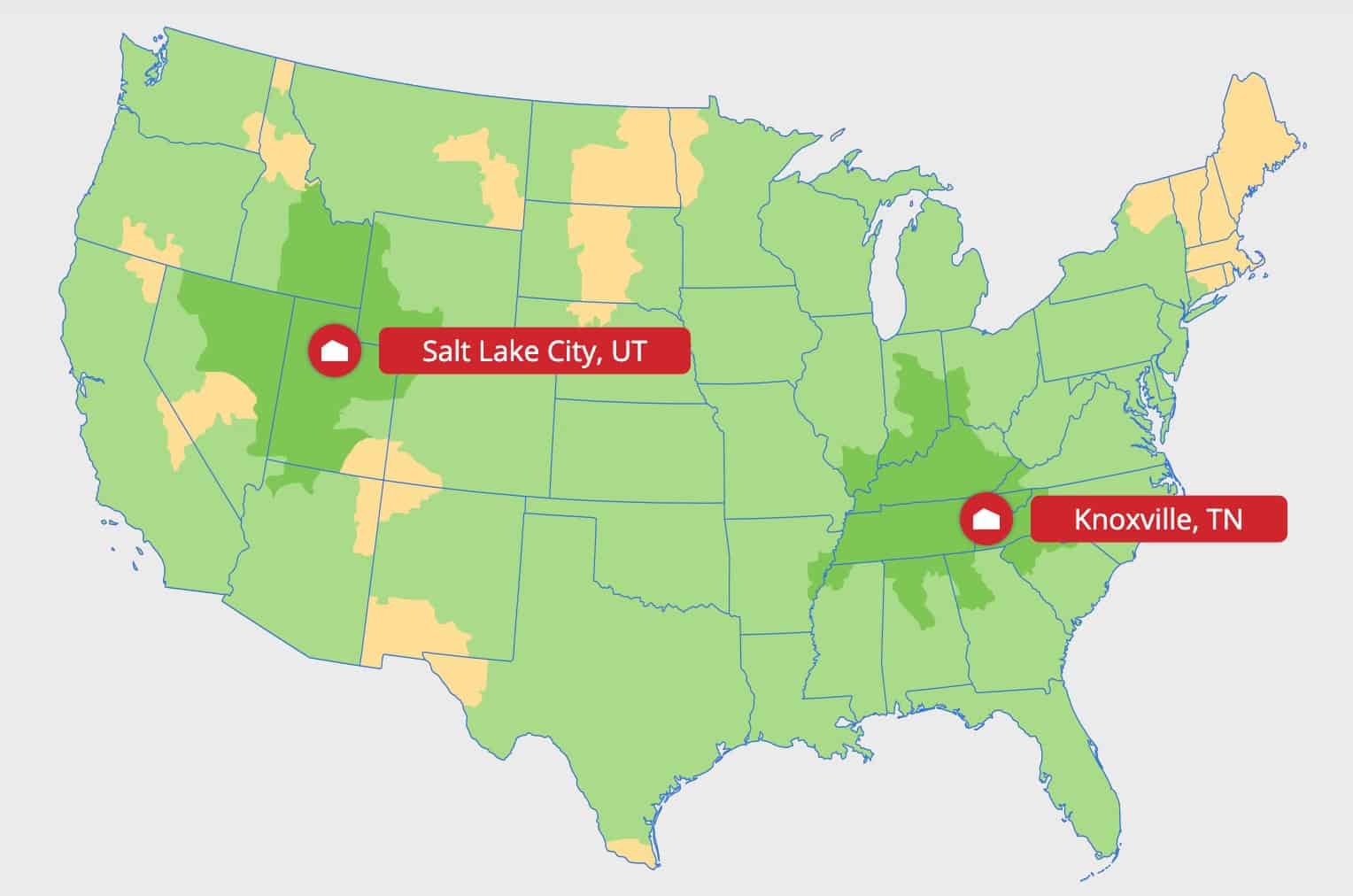

Consider the geographical distribution the 3PL can achieve within one to three days with a focus on your target markets. Many customers prefer deliveries as fast as possible, so this may be crucial to customer satisfaction.

Inquire about operational capabilities like scalability, responsiveness, and ability to adapt to change. This can help create the foundation for a long-lasting relationship, even as your business grows.

Ultimately, the best 3PL company for your business will be the one that can communicate how its value propositions align with your needs while backing up its promises with proof points and guarantees. Let’s go into more detail about some of the considerations.

3PL services expertise

Not all 3PLs can fulfill every type of order. Depending on the products you sell, you might need to prioritize specific expertise. Look for a proven track record in areas such as warehousing, order fulfillment, transportation management, and inventory optimization.

Choose a 3PL with industry-specific experience and advanced technological capabilities. This helps ensure a tailored and efficient logistics solution that supports your growth and adapts to evolving industry dynamics.

3PL warehouse locations

Focus on warehouse locations to ensure optimal distribution. Having a small number of your fulfillment centers and warehouses in the right locations positions your products close to all your customers for faster national fulfillment.

Assess their network coverage and proximity to key transportation hubs to enhance the speed and reliability of order fulfillment. Choosing a 3PL with warehouses where you need them supports geographic alignment with your customer base, contributing to streamlined logistics and improved service levels.

3rd-party logistics customer support

Look for a 3PL company that offers responsive and transparent communication and provides a dedicated account representative or customer support team. Assess their ability to address queries, resolve issues, and provide real-time updates on your logistics operations. Effective customer support is crucial for maintaining a seamless supply chain, especially during unexpected challenges.

Specialty 3rd-party logistics services

A 3PL with specialized experience may be especially important for regulated products that require temperature control or hazardous material certifications. It’s also important for large, heavy, or bulky products, like furniture, appliances, outdoor equipment, and others. If you require kitting, you may need a 3PL with experience in putting kits together and returning items to inventory.

Resources to help evaluate 3PLs

Once you’ve found 3PLs that look like a good fit for your ecommerce fulfillment, compile a list of questions to ask them. Here are some suggestions to help you get started.

3PL security and operational continuity

What kind of security does the 3PL offer to prevent theft or damage?

What kind of cybersecurity defenses do they have?

Are there backup systems for power and internet service?

Do they perform background checks on staff and partners?

What kind of controls are in place for shipping and receiving?

Inventory and order fulfillment costs

How are costs calculated? Are they predictable?

Do they provide variable costs for scalability?

How do they help manage longer-term carrying costs?

Who bears the cost of mispacks and shipping errors?

Do they allow shrinkage, and if so, how much?

Shipping costs

What are shipping costs for typical orders?

How can they help you control shipping costs?

How do they ensure route optimization?

How do they control costs on large or heavy items?

Omnichannel integrations

Can they integrate with all your ecommerce platforms?

What plugins, middleware, and APIs do they use?

How do you access your data? Is it real time?

3PL FAQs

What is a 3PL? What is a 3PL company?

3PL stands for third-party logistics, also known as order fulfillment. A 3PL warehouse provides a full range of ecommerce fulfillment services, including storage, order processing, shipping, and receiving.

Many 3PL warehouses provide value-added services such as returns processing, cross docking, or kitting. A 3PL service provider with high accuracy rates may also offer on-time and accuracy guarantees.

What is 3PL logistics?

3rd party logistics, or 3PL logistics companies, help you fulfill orders from a fulfillment warehouse or fulfillment center. 3PL logistics services include warehousing, inventory, warehouse management software, shipping, receiving, FTL and LTL freight, picking and packing, kitting, and reverse logistics (returns).

What is a 3PL warehouse?

A 3PL warehouse is a physical location where a fulfillment company stores products and processes and ships orders. The best 3PL warehouses are positioned in strategic areas, ideally in locations that can reach a large number of U.S. addresses in two days or less with standard shipping.

What does 3PL mean?

A 3PL is short for third-party logistics, which refers to a business that provides logistics services such as warehousing, kitting, shipping, returns, inventory management, and receiving. Third-party logistics providers can help your ecommerce company improve customer satisfaction by streamlining order fulfillment.

Summary of 3PL services

As fulfillment partners for your company, 3PLs replace the need for in-house warehousing and logistics. These functions can be cash- and labor-intensive to manage yourself, but a 3PL specializes in them.

With a 3PL, you offload the capital investment of renting or buying warehouses and hiring staff. The 3PL manages everyday operations, including the teams that do the work.

Most 3PLs store your inventory, pick, pack, and ship your products, and manage transportation. They can help you achieve high fulfillment accuracy and efficiency right away. Greater efficiency can lead to cost savings or landed cost optimization.

Some 3PLs provide specialized services like kitting or delivery of heavy and bulky items. Some act as a freight forwarder or broker, negotiating transportation discounts based on volume across their entire operations, which they can pass to you.

Some advanced 3PLs may help you align your current inventory with demand to sell through stock faster.

This extensive support lets you allocate resources so the right people do the right jobs to keep your business predictable and positioned for growth. The 3PL handles inventory, fulfillment, and logistics while you focus on business management and development.

If you’re a business owner or leader, this can free up time for data analysis that helps direct your company’s next moves. It lets you spend more time identifying new prospective customers and sourcing and introducing new products. You can invest more time in optimizing your website and other marketing activities, like advertising and social media.

3PLs can be vital partners as you approach and move through growth phases, too. Growth invariably demands capital investments in new inventory and go-to-market activities. A 3PL can help you gain more control over costs, especially if you work with one that scales carrying costs against inventory volumes. That predictability and control can help free cash flow for growth.

As you start up or grow your ecommerce company, a 3PL can become one of your most important partners, helping you connect customers with products.

Work with Red Stag Fulfillment

If your business is ready to streamline or scale, Red Stag Fulfillment can take fulfillment off your plate. By outsourcing to a 3PL, you can optimize your processes, gain more control over costs, and support customer satisfaction.

Expert fulfillment staff help improve order accuracy, backed by Red Stag guarantees to pay you a fee for any mistakes. Strategically located warehouses make it possible to deliver orders to 96% of U.S. homes within two days.

Ready to see how a 3PL can help your business thrive? Start a conversation with Red Stag.