Companies like yours can secure the most accurate rates for economy ground shipping by comparing standard costs with FedEx SmartPost dimensional weight pricing for their orders. This ensures you understand what you’ll pay while giving you reliable options to move low-cost goods across the U.S.

FedEx SmartPost products offer affordable ways to ship goods to customers and simplify returns, helping you build loyalty at every step. While FedEx has updated the official name, most of the industry still knows the service as SmartPost and it remains a preferred cost-effective method for small and mid-sized businesses. Here’s what you need to know about it and how dimensional weight can affect your costs. Let’s dive in now.

TL;DR:

FedEx SmartPost/Ground Economy essentials

FedEx SmartPost was renamed to Ground Economy in 2021 but remains a cost-effective shipping option for lightweight packages.

Dimensional weight calculation can significantly affect your shipping costs; calculate by multiplying L×W×H and dividing by 139.

Ideal for packages weighing 1-10 pounds with delivery times of 2-7 business days within the contiguous US.

Includes built-in returns program that leverages both FedEx and USPS drop-off locations for customer convenience.

FedEx SmartPost is now Ground® Economy

FedEx renamed its FedEx SmartPost service to Ground® Economy in March of 2021. The name change covers both last-mile and returns services, but the program’s core focus remains the same.

FedEx SmartPost is the company’s attempt to offer cost-effective ground shipping to U.S. residences. It targets businesses with high-volume and low-weight shipments where there’s leeway in delivery speed. You might succeed with this option if your average orders are lightweight and low cost, and your customers are willing to wait a little longer.

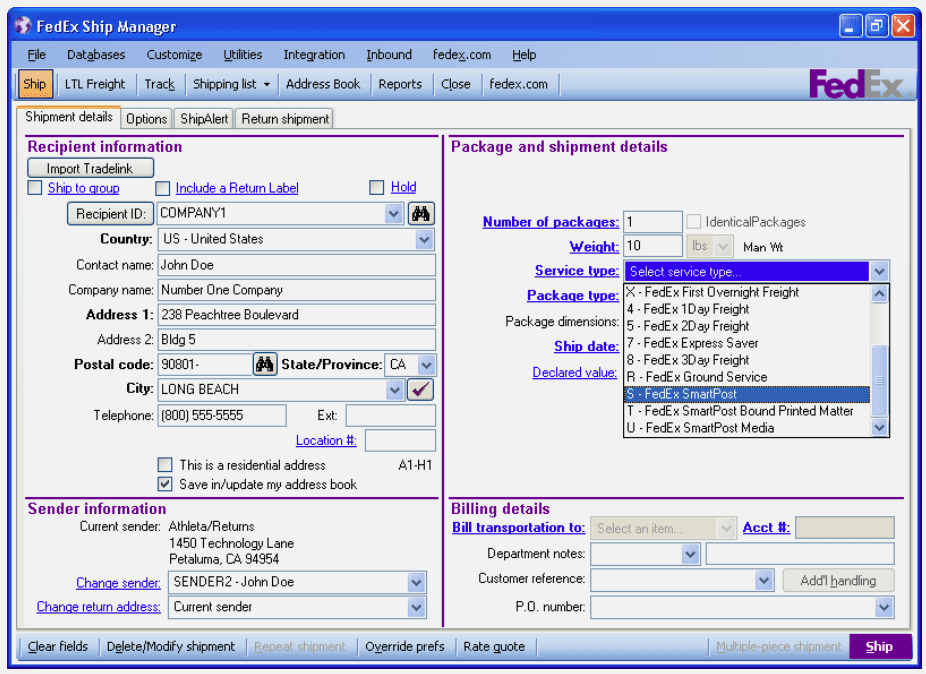

PRO TIP: You may still see it listed as SmartPost in the FedEx Ship Manager® software platform, as seen in the above image provided by FedEx.

FedEx Ground® Economy services typically utilize FedEx’s delivery network. However, the company says that USPS may complete some deliveries. Labels you create within the FedEx Ship Manager® software will have some overlap with USPS details to ensure consistent delivery.

Are there package and service limits?

FedEx SmartPost is not a fast service, so there are a few different limits to understand. Here are the most important ones for eCommerce operations.

Outbound restrictions: The package origin must be within the 48 contiguous U.S. states. You can’t use this service if you operate from Alaska, Hawaii, or U.S. territories.

Package limitations: Each package has a maximum weight of 70 pounds. The maximum length plus girth is 130 inches. FedEx says the ideal package weight is 1 pound to 10 pounds.

Delivery speeds: The typical delivery takes between two and seven business days. Speeds are slower if you’re sending outside the contiguous 48 states.

Service days: FedEx SmartPost operates Monday through Sunday, but your promised service speeds are still based on business days.

Coverage area: FedEx SmartPost serves the same areas as FedEx Ground, covering all U.S. residences, PO Boxes, U.S. territories, and Military Mail locations.

Customs requirements: You’ll need to use customs declaration forms for shipments to Puerto Rico, Guam, U.S. Virgin Islands, U.S. territories, and Military Mail destinations. The USPS requires customs forms and manages deliveries to these locations.

FedEx Ground Economy has other delivery exceptions, such as not supporting address clarification, signature proof of delivery, and appointment-specific deliveries. Hazardous materials also can’t be sent via Ground Economy.

What is FedEx SmartPost dimensional weight?

Carriers use a dimensional (DIM) weight to ensure you’re paying enough for their service. FedEx applies this to all Ground options, so you may pay a FedEx SmartPost dimensional weight price if your package is especially large or lightweight.

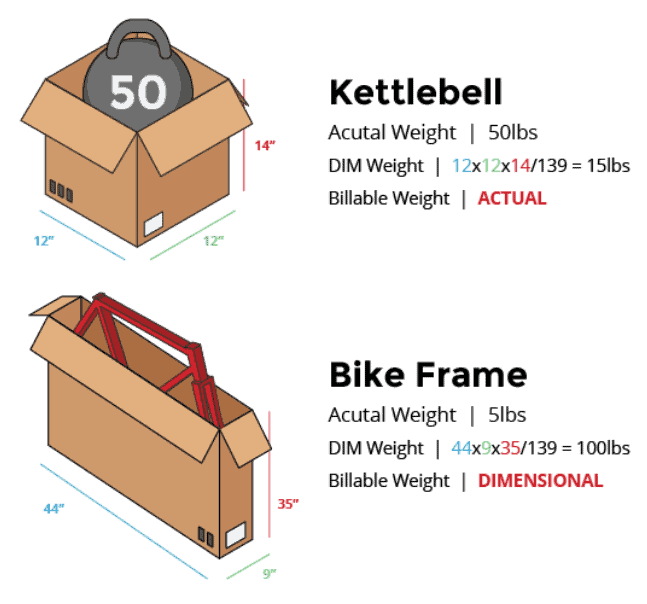

DIM weight calculations determine the cost to ship your package based on its volume and density. Carrier vans and trailers can only physically hold so much. DIM weights ensure that you pay appropriately based on how much available room your packages use. You pay whichever is greater between the actual weight and dimensional weight, so you’ll want to use a DIM weight calculator to check these weights and prices.

You calculate FedEx SmartPost dimensional weight the same way as all other FedEx DIM weights. Multiply the package’s length, width, and height (in inches) and then divide by the set DIM factor of 139. Round sides up to the nearest whole inch and round up the final DIM weight you receive. FedEx bases its pricing on that rounded number.

ALERT: Please note that if either the actual or dimensional weight is above 70 pounds, FedEx will charge an additional per-pound rate that starts at $0.61 per pound. The program typically has a 70-pound weight limit, so you’ll want to verify — either within the FedEx Ship Manager or by taking your package to a FedEx location — that you can use Ground Economy.

Oversized items may cause you to shift options

You may want to reconsider this option for products and packages that are substantially heavier than 70 pounds or have a length plus girth above 130 inches. Ground Economy surcharges for larger weights and dimensions can make it more expensive than FedEx’s Home Delivery® service. You may also have trouble getting these oversized items delivered when using Ground Economy.

Businesses can benefit from moving to Home Delivery because transit times are faster (one to five business days), and you can request evening or appointment deliveries. That may benefit customers who want to be home to receive more expensive products. The same is true for big, bulky, and oversized deliveries that customers may need help receiving.

FedEx Home Delivery supports packages up to 150 pounds, 108 inches in length, or 165 inches in length plus girth. Calculate girth by adding the two smallest dimensions and multiplying this number by two. FedEx Freight will likely give you the best pricing option if you’re shipping something larger.

When should you use FedEx SmartPost dimensional weight calculators?

Key Takeaway: We recommend using calculators for every order. DIM and actual weights compare volume against physical weight, which can change significantly from order to order. You may have the same SKUs in two orders but run out of smaller boxes, making the second order physically larger and more likely to have DIM weight billing.

The company runs FedEx SmartPost dimensional weight calculations for every order and package you submit. Doing the same on your own helps ensure you’re paying the correct amount initially and aren’t hit with fees or charges later. That keeps your accounting accurate and makes forecasting more dependable. Plus, accurate data here can help you track trends and look for ways to improve boxes or packaging. For example, if you realize that you’re charged the DIM weight for orders, you can switch to a stronger infill that reduces potential product damage without impacting shipping costs.

FedEx SmartPost returns

One of the advantages of using SmartPost/Ground Economy is that it has a built-in returns program. The solution gives customers an easy way to return products via prepaid labels included in the original package. You can generate these from your FedEx account and use the tracking dashboard to monitor the status of any returns. FedEx offers emailed status updates for returns, too.

NOTE: Sellers get an added benefit from the USPS inclusion here. Your customers can drop off the return at a nearby FedEx location or post office, or they can leave smaller packages in their mailbox for pickup. Updates reach your dashboard as soon as FedEx or USPS scans the package.

Like its initial delivery options, Ground Economy returns take two to seven business days. According to FedEx, customers can initiate these returns anywhere Ground Economy delivers.

What should businesses utilize?

There is no single best shipping service for all businesses or orders. You’ll want to look for services from multiple carriers and always run FedEx SmartPost dimensional weight calculations to see how much you may pay. Thankfully, many tools make comparisons easy, and you can even turn to a 3PL like Red Stag to secure lower pricing options.

Finalize the selection based on customer needs and the promises you’ve made. Look for solutions that meet the delivery speeds customers expect while matching your budget. You can collaborate with us to review pricing tables, get estimates, and automate the process of selecting your shipping products. Our tools always select the option that meets your specific needs, such as choosing the lowest-cost plan that still arrives within two business days.

FedEx Ground Economy is one of many reliable options available for your business. Contact us when you’re ready to learn more and see how a 3PL can help you save across services.