Choosing the right ecommerce fulfillment partner can make or break your ecommerce business. The best fulfillment companies don’t just warehouse and ship products—they become a strategic asset that helps you scale, satisfy customers, and stay competitive.

But with hundreds of fulfillment providers making similar promises, how do you identify the right partner for your unique needs? We’ve analyzed and compared the top fulfillment companies of 2025 to help you make an informed decision.

This guide examines each provider’s:

- Specialties and limitations

- Minimum requirements

- Accuracy rates

- Warehouse locations

- Technology capabilities

- Pricing structures

Whether you’re shipping heavy items, managing subscriptions, or scaling rapidly, you’ll find detailed insights to help you choose a fulfillment partner aligned with your business goals.

Best fulfillment companies: quick comparison

| Service | Best For | Key Features |

|---|---|---|

| Red Stag Fulfillment | Heavy, fragile, oversized items | Money-back guarantees, specialized handling |

| eFulfillment Service | New sellers | No minimums, no long-term contracts |

| Fulfillment by Amazon (FBA) | Amazon sellers | Dedicated fulfillment for Amazon platform |

| SaltBox | Small ecommerce stores | In-house fulfillment support |

| ShipBob | Small to mid-sized businesses | Small to medium-sized parcel shipping |

| Shipfusion | Food and sensitive cargo | FDA-compliant, cold chain transportation |

| ShipHero | Enterprise sellers | High order volume handling |

| ShipMonk | Subscription businesses | Subscription box management |

| ShipNetwork | Enterprise-level shippers | Large order volume management |

| Whitebox | High-volume sellers | Combined fulfillment and marketplace management |

NOTE: You may have noticed we put ourselves (Red Stag) at the top of this list. That’s not because we’re the best fit for everyone.

In fact, we’re very selective—we only work with less than 5% of businesses who contact us. Our sweet spot is companies shipping big, heavy, bulky products (over 20 pounds) or smaller items with low SKU counts.

However, even if we’re not a perfect fit, you should still reach out. We’ll have an honest conversation about your business needs and challenges.

If we’re the right partner—fantastic. If not, we’ll connect you with a 3PL better suited to your needs. We know the strengths and weaknesses of most fulfillment companies in the industry, and we’re happy to share that knowledge.

Ready to find the right fulfillment partner for your business? Reach out today.

How to compare the best ecommerce fulfillment services

The best order fulfillment company for you depends on multiple factors related to your business. Consider your specific needs, like the products you ship, your order volume, and your inventory management processes. Also, look at your need for ecommerce fulfillment services like kitting, labeling, dropshipping, cold storage, custom packaging, and managing returns.

Collectively, the details you uncover about your news will determine the order fulfillment process that’s most likely to deliver the results you’re looking for.

A good place to start is by assessing your current business operations and goals. Ask yourself some questions:

What are your short- and long-term goals?

Are you trying to scale your operations?

Are you hoping to break into a new market?

Are you preparing for increased product demand?

Do you need special services?

NOTE: This list is not exhaustive. It’s just meant to give you an idea of what you need and the types of questions you might ask a top ecommerce fulfillment service company.

Once you’ve answered all of the relevant questions, take a look at how your top choices stack up against each other. Compare various metrics, requirements, and facts, such as:

Parcel weight limits

Order volume minimums

Accuracy rates

Fulfillment center locations

SKU breadth requirements

Parcel weight limits

How large are your products?

Most ecommerce packages weigh less than 10 pounds. So, if you sell products bigger than that, you likely need a fulfillment service provider that knows how to safely store, pick, pack, and ship large products.

Other products may have specific storage and handling requirements, like refrigeration. In these cases, the best fulfillment services will accommodate your needs with the right warehouse space and box sizes.

Order volume minimums

How many packages do you ship each month?

Order minimums are not a judgment of your business. Instead, consider them a good indicator of each 3PL’s strengths. If you ship high volumes of product each month, search for a fulfillment center set up to accommodate your needs. And if you have lower order volume, the best fulfillment services are the ones designed for smaller businesses like yours.

Consider your goals, too. If you’re working toward big, fast growth, the best order fulfillment services are ready to meet your needs today, while also offering the flexibility to scale with you over time. You don’t want to quickly outgrow your order fulfillment service and start the search all over again.

Accuracy rates

How often does the 3PL ship the correct products?

Mistakes happen—but they shouldn’t happen often. Knowing that every mishap costs your business money and potentially harms customer satisfaction, be sure to ask potential fulfillment partners about their error rate.

Some fulfillment service providers allow up to a 4% error rate (yikes!). But, the best order fulfillment companies in this guide boast an accuracy rate of 99% or higher.

Warehouse locations

Top ecommerce warehouses are strategically located for fast shipping

Physical warehouse locations are important because they indicate how quickly your customers will receive their orders. Based on your unique needs, find a third-party logistics company with order fulfillment centers in strategic locations that can get items out to your customers quickly, reliably, and with optimized shipping costs.

Costs associated with warehouse locations

If you ship from multiple fulfillment warehouses, you should expect additional shipping costs to get your inventory to each warehouse location. Plus, you’ll have to closely monitor your inventory management at each warehouse to make sure you don’t run out of stock.

However, the freight shipping costs will potentially be offset by the savings you see from using fulfillment centers that are close to your customers. If you offer free shipping, this can have a big impact on your margins.

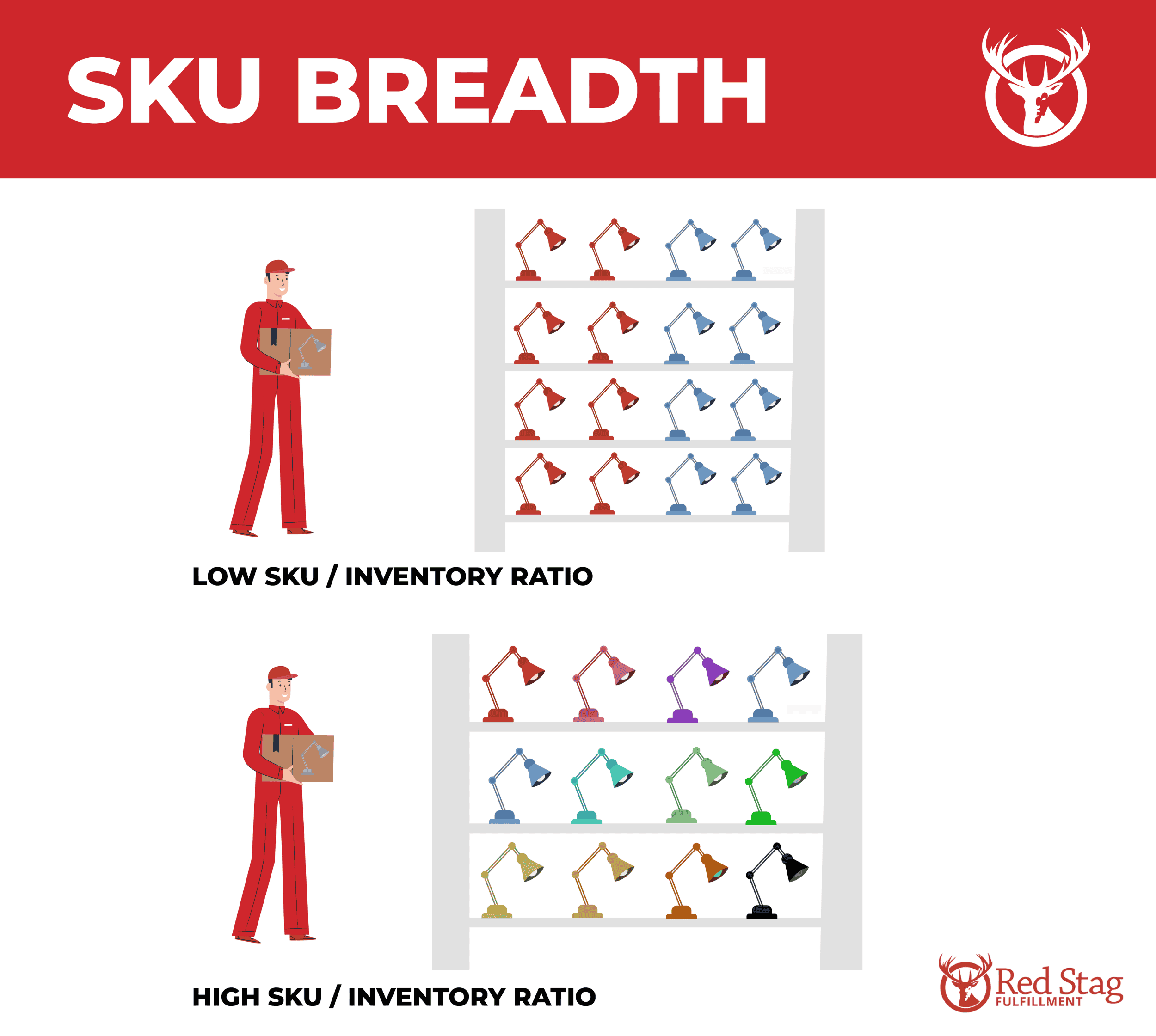

SKU breadth requirements

How many unique SKUs do you sell?

SKU breadth is the ratio of how many different items you sell to the number of customer orders you ship each month. Some fulfillment services have a minimum SKU-to-order ratio they allow.

For example, if you sell 100 different SKUs, a 5:1 SKU breadth ratio would require you to ship at least 500 customer orders each month. You don’t need to ship five from each SKU—just 500 orders overall.

Even if an order fulfillment company doesn’t have a SKU breadth requirement, the best ecommerce fulfillment services companies may still want to know your SKU breadth to help understand your business and serve you better.

Other considerations when choosing the best fulfillment company

Products, order volume, and locations are key to your 3PL decision, but there are several other factors to consider. You want outsourced fulfillment from a partner that’s easy to work with and provides the extra services you may need.

Use this fulfillment company questionnaire to help form the questions you ask when interviewing a potential ecommerce fulfillment provider. Be sure to modify the questionnaire to fit your business needs and values. Be specific and thorough.

Products, order volume, and locations are key to your 3PL decision, but there are several other factors to consider. You want outsourced fulfillment from a partner that’s easy to work with and provides the extra services you may need.

Use this fulfillment company questionnaire to help form the questions you ask when interviewing a potential ecommerce fulfillment provider. Be sure to modify the questionnaire to fit your business needs and values. Be specific and thorough.

What questions should you ask an ecom fulfillment company?

Can you handle reverse logistics?

If you need help with returns and refunds, ask an ecom fulfillment company how they handle adding the product back into your inventory, paying shipping costs, and keeping your numbers accurate.

What shipping carriers do your order fulfillment centers use?

Unexpected capacity challenges from shipping carriers can derail your fulfillment, so it’s a good idea to have shipping options beyond the major carriers. A great ecommerce fulfillment company will offer a wide range of companies you can choose from.

Do you offer customizable subscription boxes and other kitting services?

If you offer customized packages or subscription boxes, choose a partner that provides kitting services to assemble your orders—because not every third-party provider will do that.

What sales channels do you support?

Seamless connections between your online store and the 3PL’s fulfillment software are essential for effective order processing. The best fulfillment services in the U.S. and Canada will have ecommerce integrations for platforms like WooCommerce, BigCommerce, Amazon, eBay, and Shopify.

Do you offer real-time insights into inventory tracking?

The best order fulfillment services support your supply chain with frequent cycle counts and accurate inventory management. You can also ask about software that makes it easy for you to manage your orders, shipping, and inventory storage.

How does your customer support work?

Some ecommerce businesses want to set up their ecommerce fulfillment process and then leave the rest to the professionals. Others want to be more involved while getting hands-on account management help from their 3PL. Talk with your prospective partner about the level of support you can expect and how to get it.

How much do your fulfillment services cost?

When you talk to a 3PL about storage fees, fulfillment costs, and shipping rates, make sure to get the full picture. The best fulfillment companies give transparent pricing guidance so you can forecast landed costs.

It can be tempting to choose the least expensive option, but the cheapest option isn’t always the best. Balance cost considerations with the level of service and reliability your customers and your business require.

10 best ecommerce fulfillment companies of 2025

With these considerations in mind, take a look at our recommendations for the best ecommerce fulfillment companies of 2025. You can use the table below to make broad comparisons:

| Service | Weight Limit | Order Minimum | Accuracy | US Warehouses | SKU Requirements |

|---|---|---|---|---|---|

| Red Stag Fulfillment | None | 200+ | 100%, backed by guarantees | 2 | Case-by-case basis |

| eFulfillment Service | 50 lbs | None | 99.9% | 2 | None |

| FBA | 50 lbs | None | Undisclosed | 110 | Undisclosed |

| SaltBox | 45 lbs | None | 99% | 4 | Undisclosed |

| ShipBob | 50 lbs | $275 | 99.95% | 40 | <5k SKUs: 4:1 ratio >5k SKUs: 5:1 ratio |

| Shipfusion | 50 | 500+ | 99.9% | 3 | Undisclosed |

| ShipHero | 20 | 500+ | 99% | 5 | 10:1 |

| ShipMonk | 50 | $250 | 99.9% | 8 | 2:1 |

| ShipNetwork | 30 | 250+ | 99.9% | 11 | Asked during onboarding |

| Whitebox | 50 lbs | 1000+ | 99.9% | 3 | Undisclosed |

Red Stag Fulfillment

At Red Stag Fulfillment, we have a reputation for shipping heavy, fragile, oversized, and high-value merchandise. It’s a tough niche to serve, but we like to think we’re pretty good at what we do.

We also have the best fulfillment services guarantees in the entire industry:

- Accuracy guarantee.

If an order is shipped with the wrong item or the wrong number of items, we’ll fix the mistake. You won’t pay for that shipment, and we’ll pay you $50 for the inconvenience. - On-time fulfillment guarantee.

100% of your orders will be shipped according to your chosen service level (same-day fulfillment), or else you won’t pay for that shipment—and we’ll pay you $50. - Zero-shrinkage guarantee.

If any of your inventory is damaged or missing after we receive it in our facility, we will pay you the wholesale cost of that item. Guaranteed.

While Red Stag Fulfillment doesn’t have specific order minimums, we work best with partners who are shipping hundreds to thousands of orders per month. We also specialize in heavy and bulky items, primarily shipping packages weighing five pounds or more, including high-value merchandise.

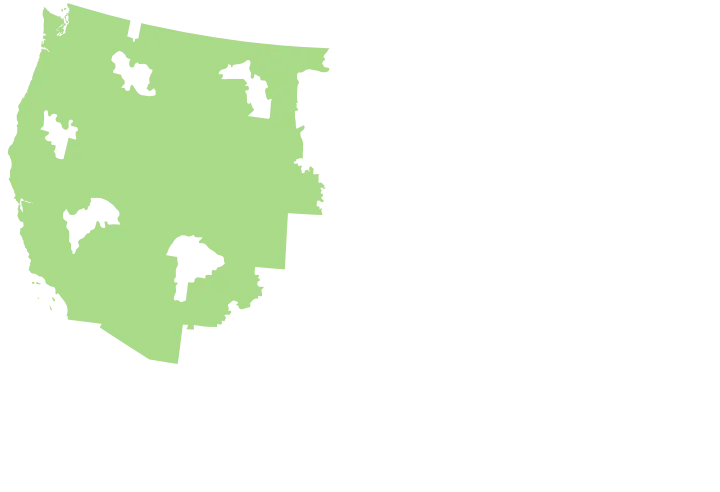

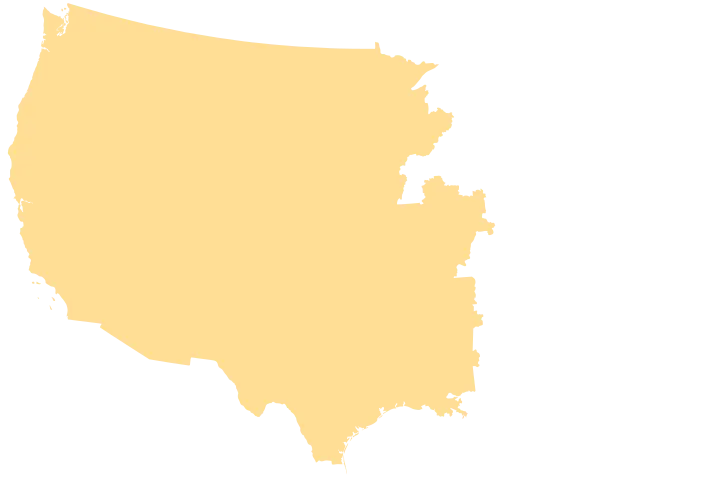

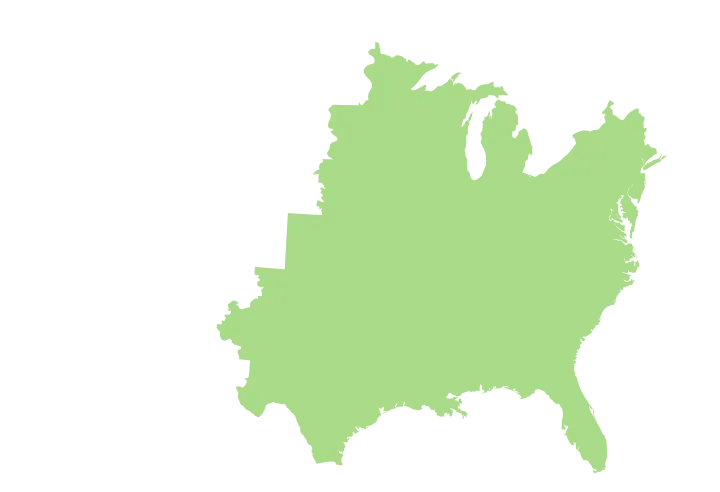

We look at SKU breadth to assess your unique situation and build a customized plan to meet your needs. And, with two U.S. fulfillment centers—in Knoxville, Tennessee and Salt Lake City, Utah—we can reach 96% of the U.S. population in two days or less.

Parcel weight limit: None

Order volume minimums: varies depending on the client (reach out for more information)

Error rate: < 0.02%

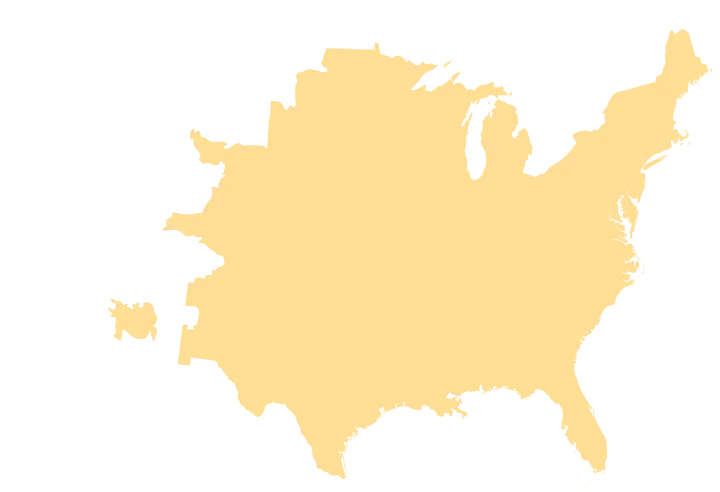

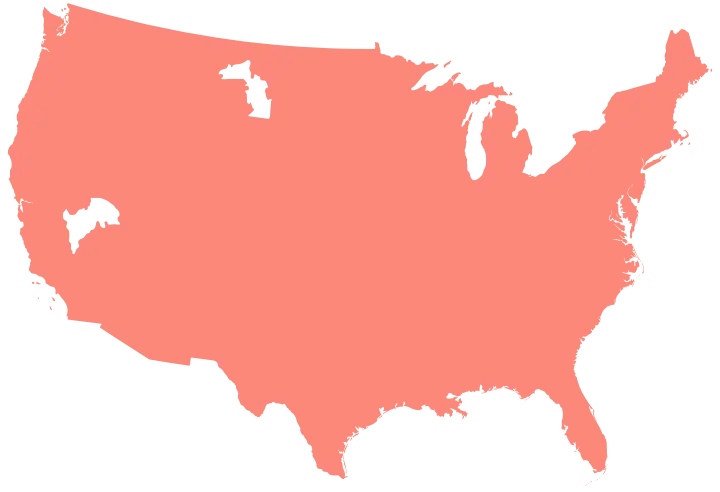

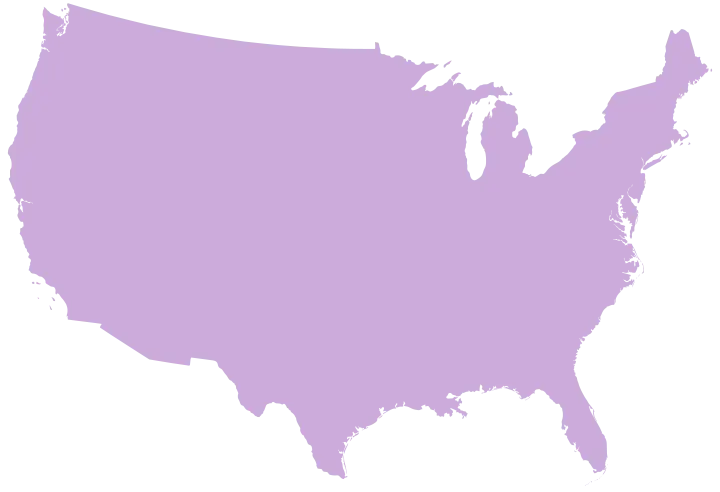

Our Locations

Select one (or both) of our strategically placed warehouse locations to see our reach.

Red Stag intentionally has only two locations.

See why that could be better for your brand.

eFulfillment Service

Located in Traverse City, Michigan, eFulfillment Service is best for new sellers because it has no minimum order requirements or long-term contracts. It doesn’t consider SKU breadth either, but it does have size requirements. It limits package sizes to 36 inches or less and must be less than 50 pounds.

Parcel weight limit: 50 lbs

Order volume minimums: None

Error rate: < 0.01%

Fulfillment by Amazon

Fulfillment by Amazon (FBA) offers dedicated order fulfillment and shipping for Amazon sellers, and it may be the best ecommerce fulfillment for those who rely on Amazon as their primary marketplace.

FBA doesn’t have minimum order minimums, making it accessible to sellers of all sizes. They ship packages up to 50 pounds, but the service is most cost-effective for smaller, lightweight parcels.

Every FBA order is eligible for Prime and shipped from Amazon’s vast network of 175+ warehouses and fulfillment centers across the U.S. for fast delivery to nearly every customer.

Parcel weight limit: 50 lbs

Order volume minimums: None

Error rate: Undisclosed

Saltbox

Saltbox is a great option for small ecommerce stores and those doing in-house fulfillment. But what makes it unique are the “workspace” office suites it offers to businesses that use the warehouses. You can opt for just a workspace, including access to the warehouse space, or couple it with fulfillment services, too.

Saltbox doesn’t have order minimums, but it’s unable to accept products over 45 pounds. While there are 12 locations across the U.S., only four of them include fulfillment. The other eight are strictly workspaces.

Parcel weight limit: 45 lbs

Order volume minimums: None

Error rate: < 1%

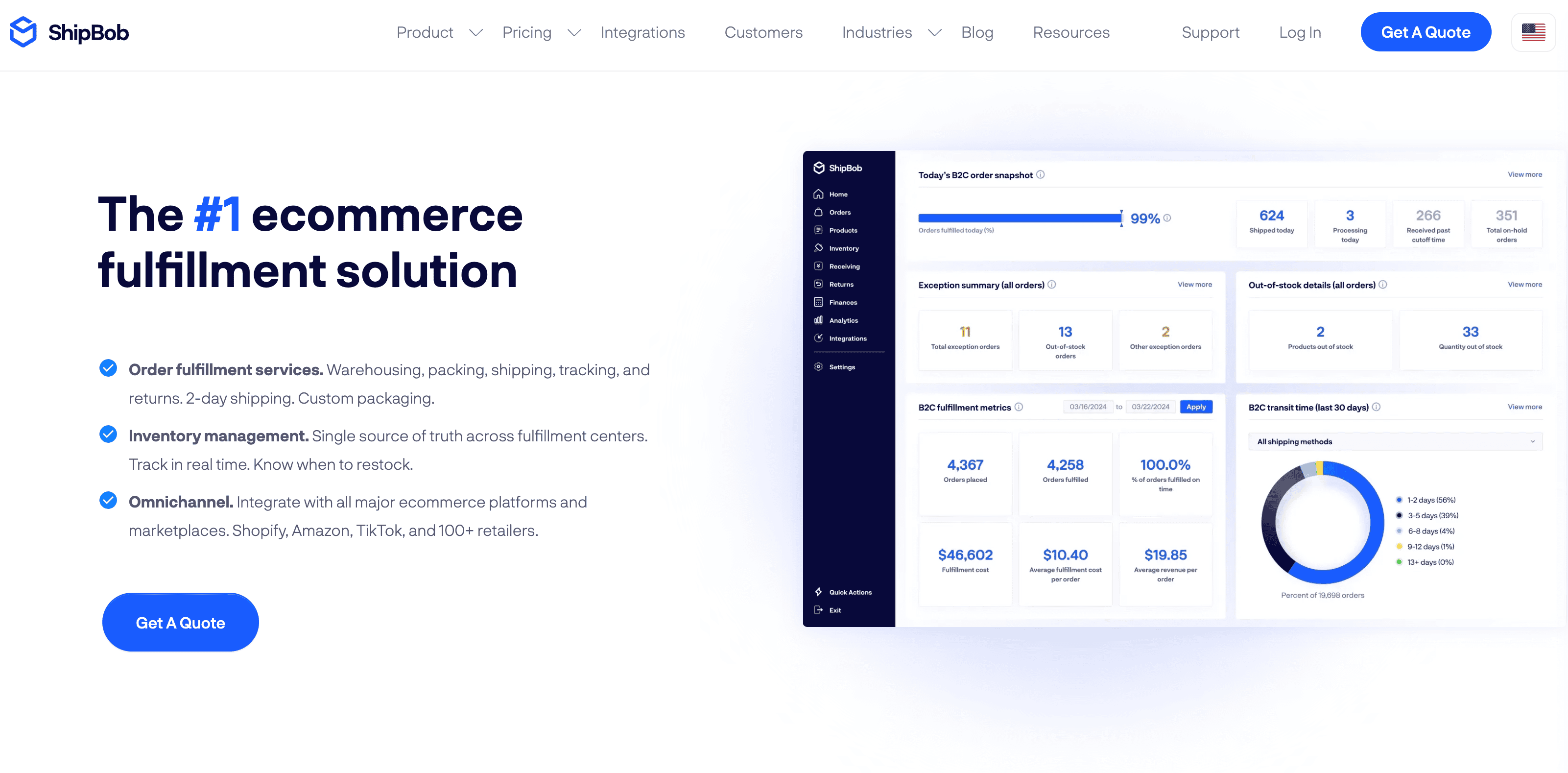

ShipBob

ShipBob is a self-described omnichannel, ecommerce fulfillment services company serving small-to-mid-sized businesses that ship smaller products. With fulfillment centers across the U.S., Canada, Europe, and Australia, it has a strong national and international presence.

While ShipBob doesn’t have order minimums, it does have a minimum fulfillment charge of $275 per month and works best with packages under 50 pounds.

It’s also worth mentioning that ShipBob is one of the order fulfillment companies that has specific SKU breadth requirements. Sellers with fewer than 5,000 SKUs will have a 4:1 monthly order-to-SKU ratio, while those with more than 5,000 SKUs will have a 5:1 ratio.

Parcel weight limit: 50 lbs

Order volume minimums: None

Error rate: 0.05%

Shipfusion

Shipfusion is a 3PL that focuses on scaling ecommerce companies. It stands out for serving businesses with sensitive cargo. It has three U.S. locations in Los Angeles, Las Vegas, and Chicago and has plans for new locations coming to Texas and New Jersey. They may have the best fulfillment centers for you if you need FDA-compliant, food-grade storage.

Shipfusion has a monthly order minimum of 500, with a 50-pound parcel weight limit.

Parcel weight limit: 50 lbs

Order volume minimums: 500+

Error rate: 0.1%

ShipHero (now LVK Logistics)

ShipHero is a top ecommerce fulfillment provider for enterprise-level sellers and ecommerce businesses with at least 10,000 orders per month and a monthly shipment-to-SKU ratio of 10:1 across five U.S. fulfillment centers. It also has a relatively lighter parcel weight limit of 20 pounds.

Parcel weight limit: 20 lbs

Order volume minimums: 10,000

Error rate: 1%

ShipMonk

ShipMonk is a startup-friendly, ecommerce fulfillment company well-suited for shipping subscription boxes. It has no order volume minimums but does impose a monthly minimum pick-and-pack fee of $250.

With eight locations across the country, ShipMonk allows parcels up to 50 pounds, but it’s best for shipping small packages and lightweight goods. It also has a 2:1 monthly shipment-to-SKU ratio.

Parcel weight limit: 50 lbs

Order volume minimums: $250 min. fee

Error rate: 0.1%

ShipNetwork

ShipNetwork (formerly Rakuten Super Logistics) works mostly with enterprise-level shippers with high order volumes. However, its order volume minimum is only 250 per month. Packages of all sizes ship from its 11 locations across the U.S. with a 99.9% accuracy rate.

But it works mostly with lighter-weight goods. There are no SKU breadth requirements, although ShipNetwork will want to know your SKU-to-volume ratio during the onboarding process.

Parcel weight limit: 30 lbs

Order volume minimums: 250+

Error rate: 0.1%

Whitebox

Whitebox Commerce has warehouse locations in Las Vegas, Memphis, and Baltimore. It may be the best order fulfillment provider for high-volume sellers with smaller products who need additional marketplace management services. It has a minimum monthly requirement of 1,000 orders and a parcel weight limit of 50 pounds.

Parcel weight limit: 50 lbs

Order volume minimums: 1000+

Error rate: 0.1%

Ready to choose your fulfillment provider?

Hopefully, you now have a short list of fulfillment providers to evaluate. If you need more guidance, check out our guide on how to choose a 3PL.

For quick reference, here are the best ecommerce fulfillment companies to consider based on your company size and the products you ship:

If you exclusively sell on Amazon, FBA may be your best choice.

If you are a high-volume seller, WhiteBox or ShipHero might be better.

If you ship heavy parcels, Red Stag is likely your best option.

If you sell sensitive cargo, Shipfusion may be the way to go.

We’d love the chance to help you find the best fulfillment service provider for you—even if it’s not us. Seriously, reach out with any questions.