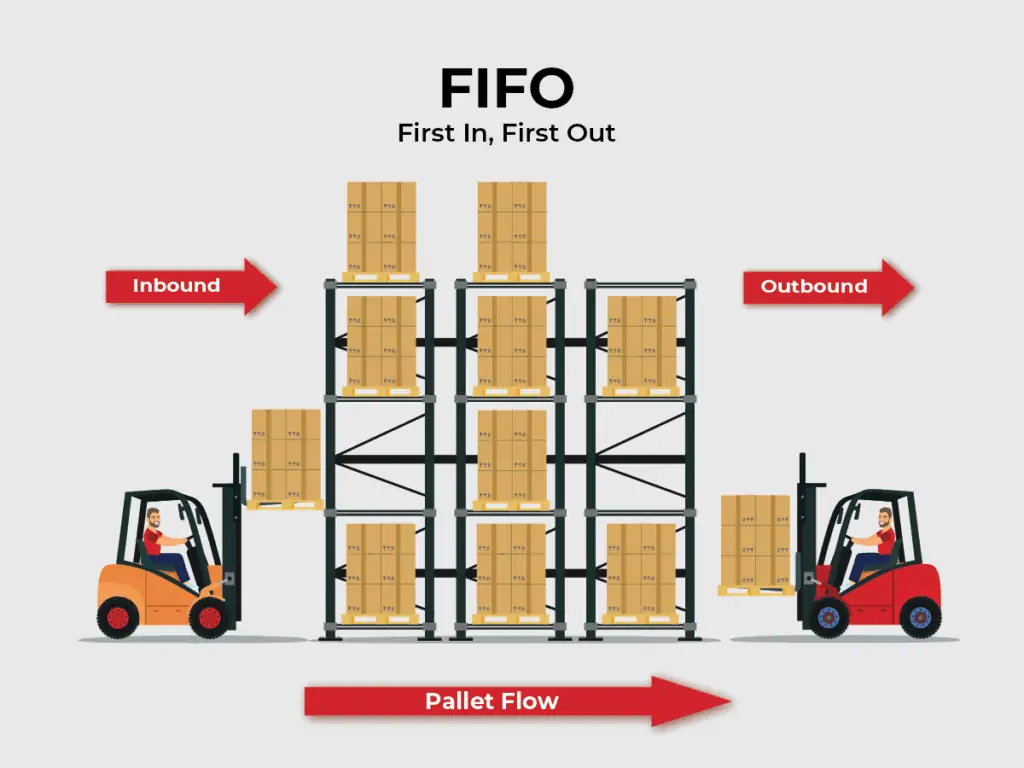

First in, first out — or FIFO — is an inventory management practice where the oldest stock goes to fill orders first. That way, the first stock purchased/received is the first to leave. FIFO is also an accounting principle, but it works slightly differently in accounting versus in order fulfillment.

Inventory management is critical to managing your eCommerce business. Smart inventory planning can make a big difference in your cash flow and profit margins. So, understanding the concept of FIFO is essential. The FIFO method can help you more accurately account for the cost of goods sold (COGS). It could also help reduce your eCommerce fulfillment costs.

What is first in, first out (FIFO)?

FIFO is a way of handling goods in a fulfillment warehouse, but it’s also a method of accounting for the movement of goods sold in and out of inventory. Here’s a breakdown of these two types of FIFO.

FIFO in cost of goods sold accounting

As an accounting method, FIFO assumes that the first raw materials you buy are the first ones you manufacture your product with. That matters because material and production costs can fluctuate over time, so you need a consistent way to allocate the cost of inventory in your financial statements.

According to Red Stag Fulfillment Financial Analyst Mitchell Arnold, the question that FIFO accounting should answer is, “How do you allocate material cost when that cost fluctuates?”

At the end of the year, you’ll need to account for your cost of goods sold by subtracting your beginning inventory from your ending inventory. However, the materials you bought in January might have had a smaller price tag than those purchased in December.

Using the FIFO method to account for your COGS is a simple way to track inventory flow. It can also help keep your balance sheets clean.

The FIFO method in warehousing and fulfillment

You have probably seen the FIFO method for managing the flow of inventory in practice at your local grocery store. When grocery employees restock perishable foods, they put the newest items on the back of the shelf and the oldest inventory in the front. That makes it more likely that inventory items will be sold before their expiration dates. FIFO grocery stocking keeps the store from losing money and food from spoiling.

In an eCommerce fulfillment center, a FIFO model for physical inventory management rotates incoming items to the back. It then moves the oldest products at the front of the warehouse shelves. When a customer places an order, the picker picks the older inventory items first, so stock moves out of the warehouse in roughly the same order in which it was received.

How to calculate the cost of goods sold using FIFO

An example is the best way to understand the FIFO approach to inventory. Let’s take the case of Garden Gnome, a (fictional) online retailer of gardening supplies and equipment. In January, Garden Gnome ordered 50 trowels at a wholesale price of $10 each. The store sold 25 trowels in January and ordered 75 more in February. For the second order, the wholesale price had risen to $11. By the end of the first quarter, the eCommerce company had sold 75 trowels and had 25 still in stock.

Using FIFO accounting, the COGS of the remaining 25 trowels is $11 each, or $275. The calculation for the COGS of the inventory that sold looks like this:

(50 x $10) + (25 x $11) = $775

In other words, using the FIFO inventory valuation method, Garden Gnome assumes that the first trowels to sell were the first ones bought, with a lower wholesale price. Once the original 50 are sold, the company records the COGS for additional trowels at the higher wholesale price. That cost method is more accurate than using the average cost to determine inventory value.

As prices fluctuate throughout the year, FIFO inventory accounting helps Garden Gnome keep track of its true cost of goods sold. That allows it to set retail prices that accurately reflect costs and maintain healthy profit margins. In addition, the company uses FIFO warehouse management. That reduces the chance of getting stuck with outdated stock if a manufacturer changes a product style.

The “bullwhip effect” and FIFO cost flow assumption

In an ideal world, demand is steady, and your supply chain moves at a predictable pace, providing a steady flow of goods from factory to fulfillment warehouse to customer. Of course, after recent supply chain disruptions, it’s abundantly clear that we don’t live in a perfect world.

Consumer demand can spike or change, causing what RSF’s Arnold calls the “bullwhip effect.” In the bullwhip effect, instead of a straight line of products being pulled toward the end consumer, your supply chain gets distorted, like cracking a bullwhip. These distortions ripple through fulfillment, transportation, and manufacturing.

The cost flow assumption built into FIFO is that you’ll sell older goods first. When you experience the bullwhip effect, that cost flow assumption may get complicated, particularly if older merchandise becomes unsalable because of changes in consumer preferences.

“The objective of any retailer, manufacturer, anyone in the supply chain, is to make the bullwhip effect as smooth as possible,” Arnold says. He notes that some amount of bullwhip effect may be unavoidable at certain times or for specific industries. Improving your demand forecasting is an excellent way to reduce this disruptive phenomenon.

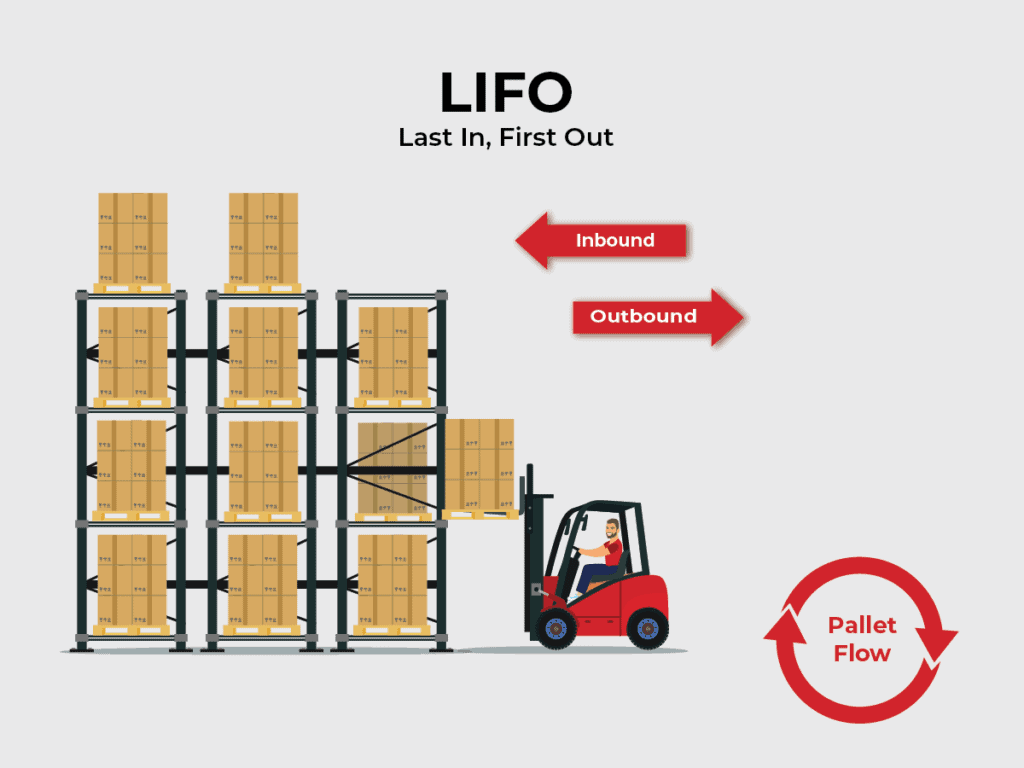

Another approach to inventory management: Last in, first out (LIFO)

Another way to handle inventory is LIFO, or last in, first out. In the LIFO inventory system, newer items are placed at the front of the shelf and picked first. Arnold points out that there are sometimes good reasons to use a LIFO model for fulfillment. For example, an electronics manufacturer might want customers to get the newest version of a device, even if that means the older stock sells at a discount. In this case, giving consumers the latest products is worth forgoing higher profit.

“Clients who choose a LIFO model have to reassess their older inventory,” he notes. That might mean periodically marking it down or otherwise clearing it out.

Using the LIFO method for inventory accounting usually assigns a higher value to the cost of inventory than FIFO. That’s because the last items purchased often have higher prices (though sometimes the reverse is true, and the most recent costs are lower). LIFO may reduce your taxable income, but it will also make your P&L statement look less favorable. In addition, showing higher inventory costs on your balance sheet will decrease your profits, at least on paper.

It’s okay to mix and match FIFO and LIFO. For instance, some businesses use a LIFO model for fulfillment but use FIFO for inventory accounting.

A critical goal of FIFO vs. LIFO inventory management models is to avoid incurring storage fees for dead stock. Whether you pick and pack orders from the most recent inventory (LIFO) or the oldest inventory (FIFO), optimizing stock levels is essential to keep the total cost of inventory storage low.

Choosing between FIFO vs. LIFO for inventory management

“FIFO vs. LIFO is always trying to optimize costs or movement of goods,” Arnold says. You should use whichever method works best for your business.

Advantages of FIFO include:

- Tracks changes in wholesale pricing

- Increases the chances that products will fill orders before they become obsolete or go out of style, or perishable goods expire

- Provides a straightforward method for ongoing inventory tracking and accounting, which may be helpful to small business owners

Advantages of LIFO include:

- Increases the amount you can deduct for inventory costs

- Ensures that customers get the latest product model at the time of their order

- Reduces your net income

Of course, a disadvantage of LIFO is that you could end up with unsalable stock or products that have to be put on sale. If you sell items with a defined shelf life, FIFO is the best inventory method, even though that can result in higher income taxes.

How FIFO affects long-term storage costs

“Inventory that has not been produced in a timely manner to satisfy demand is an improper use of funds,” Arnold says. “On the macroeconomic level, in the grand scheme of things, dollars should be deployed where they’re actually generating value.” He notes that companies holding too much stock are “penalizing themselves by not deploying that capital elsewhere.”

Failing to rotate and turn over inventory can hurt your bottom line by incurring long-term storage fees. Some 3PLs charge higher rates for stock that stays on the shelf for more than 180 days, or more than 365 days, as an incentive for clients to optimize inventory and storage.

For example, if the Garden Gnome online store has 50 trowels in stock and has sold a total of 150 over six months, it won’t incur long-term storage fees because its stock has turned over three times. That’s true even if it uses the LIFO method and a few of those trowels have been at the back of the shelf for a long time. On the other hand, if Garden Gnome only sold 30 trowels in 180 days, its 3PL might charge a long-term storage fee for the 20 extra trowels on hand. Plus, that excess stock could be a sign that the online garden shop should keep no more than (and maybe less than) 30 trowels in inventory.

Red Stag Fulfillment helps eCommerce companies keep storage costs low

Inventory management is complex, and getting it right is essential to building a thriving eCommerce business. When you choose Red Stag Fulfillment as your 3PL, you add experienced professionals to your team. We can help you determine optimal inventory levels, add visibility to your supply chain to improve operations, choose between FIFO vs. LIFO methods, and keep your storage costs as low as possible.

At Red Stag Fulfillment, we know firsthand that top-notch fulfillment can help eCommerce businesses grow and scale. We’ve seen it happen for our clients. We provide worry-free warehousing and fulfillment so you can focus on expanding your business, and we’d like to tell you how it works.

More about inventory management:

- Why Is Inventory Management Important in Everything You Do?

- Inventory Planning and Control: Tackling a $1.8 Trillion Problem

- Create Your Inventory Management Plan

FAQs:

What is the meaning of FIFO?

FIFO is first in first out. It means selling the oldest inventory first in a retail or eCommerce setting. FIFO is also used in accounting for the cost of goods sold by a business owner.

What is the FIFO method rule?

The FIFO method rule is that the first inventory items put on the shelf should be the first ones taken off the shelf to fill an order. The FIFO method is particularly critical for perishable items such as food, which can go bad if not sold quickly enough.

What is FIFO and why is it important?

FIFO is the first in first out inventory management method that places inventory in order from oldest to newest on the shelves. It’s important because it prevents goods from expiring or becoming outdated before they can be sold and thus leads to higher profits for businesses.

What is the difference between FIFO and LIFO?

FIFO and LIFO are opposites. FIFO stands for “first in first out” and involves selling the oldest inventory items first. LIFO is “last in first out” and puts the newer inventory at the front of the shelf to be sold first. LIFO may be used for technology products, where consumers expect to be able to purchase the latest model or release of an item.