Ecommerce logistics directly impact your profitability. By understanding the dynamics, you can control landed costs, make fulfillment more efficient, and improve customer satisfaction, leading to increased loyalty and higher revenue. Read on to learn about strategies, tactics, and key performance indicators (KPIs) that can help your business grow.

Why ecommerce logistics matters

There are two sides to every ecommerce business—digital and physical. Managing both with equal skill earns you competitive advantages, but not everyone can master the physical side of logistics. It can be a complicated undertaking.

Logistics as business infrastructure

You have to spend cash on inventory, transportation, and fulfillment before you can profit from online sales. And if you mismanage those logistics, you can sink your business quickly.

Even established businesses can suffer from missteps. Failing to adapt to new market demands or supply chain conditions has caused plenty of companies to burn cash and collapse.

But when you get things right, you can leverage your ecommerce logistics for cost control and rapid growth.

Logistics, customer satisfaction, and profitability

Your business can benefit by identifying clear connections between logistics, satisfied customers, and profitability. In fact, this can be a powerful way to connect the digital and physical sides of your ecommerce business.

Meeting customer expectations

With most customers, the expectations are clear. If you don’t deliver orders accurately and on time, they’re disappointed. There may be times they’re willing to wait, like if you offer a niche or customized product, but marketplaces like Amazon have raised the bar. Timely delivery is common on millions of items.

Customer satisfaction metrics

Get strategic about how meeting customer expectations impacts your financial performance. Start by studying common key performance indicators for ecommerce brands.

- Customer lifetime value is the total revenue a customer creates for your business. This is an ongoing measurement that includes the value and frequency of their purchases.

- Churn rate is the percentage of customers who stop buying from you in a given period.

- Customer acquisition cost measures the amount you spend to earn a new customer.

These can all shine some light on how eager people are to buy from you and can help you uncover multiple ways to keep customers happy. Some of that will come before a customer’s first order, but much of it is determined by what happens after an order is placed.

Increase customer lifetime value

Offering fast, reliable shipping options is a crucial step toward meeting customer expectations. Transparent tracking and good communication can also build trust and confidence in your brand, which can increase the odds that customers will return for future purchases.

At a higher level, effective ecommerce logistics lets you optimize your entire supply chain, potentially leading to faster order fulfillment. When your business reaches certain sales volumes, you may be able to negotiate lower shipping costs, which you could pass on to customers.

These tactics can help reduce churn and maximize customer lifetime value, driving sustainable growth in an increasingly competitive market.

Reduce customer acquisition costs

Customer acquisition costs can be one of your most important KPIs because when it costs you less to acquire customers, you can increase your profit margins.

Strong lifetime values across a high percentage of your customers correspond with a low churn rate. In turn, this can keep customer acquisition costs lower, which often keeps marketing costs lower as a whole. That’s because nurture activities, like sending emails, typically cost less than acquisition activities, like running ads.

Your costs are also dependent on how you choose to grow. For instance, if you want to expand your customer base, you can increase your acquisition budget for activities like ads. However, businesses find it more cost-effective to build loyalty with existing customers by making sure their logistics process supports and delivers the service customers want.

Managing landed cost

Consider this metaphor. If you think of customer satisfaction as a vitamin, optimizing landed cost is a painkiller. One helps grow your business. The other mitigates a challenge—in this case, your logistics costs. Keeping logistics costs under control is another crucial way to support your profitability.

What is landed cost?

Landed costs are what you probably think of as your ecommerce logistics costs. They’re the sum of expenses associated with getting a product from your suppliers to your customers.

Depending on your ecommerce supply chain, your landed cost can include several expenses, like:

- International shipping from overseas suppliers

- Customs costs at U.S. ports, based on product classifications, tariffs, and fee schedules

- Inland transportation, such as trucking, rail, and drayage from ports to warehouses

- Warehouse storage and inventory management, also known as carrying costs

- Fulfillment services, including picking and packing

- Packing materials, including boxes, infill, tape, labels, and branded stickers and inserts

- Final-mile delivery to customers from order fulfillment warehouses

- Returns, including reverse logistics, shipping, and inventory management.

Each of these steps is dependent on the step before it and impacts the outcomes of the steps after it. A mistake, delay, or other exception could quickly multiply your costs.

Cost versus speed

You can mitigate runaway costs by analyzing the value of each step in your ecommerce logistics process and making decisions around cost and speed.

The balance can be delicate. Market conditions are dynamic, with equipment, labor, and warehouse availability influencing rates and timelines, especially upstream in the ecommerce supply chain.

You don’t necessarily want the cheapest landed cost. If you cut costs too much, you can create other supply chain problems and expenses when services fail to meet your demands. Instead, look for the most optimal landed cost for accurate, on-time deliveries. This is the key to creating the widest profit margins possible.

Additionally, a robust ecommerce logistics network, including multiple carrier and routing options, can help you avoid delays and minimize last-minute costs. Since these networks can take time to develop and manage, some companies outsource to ecommerce supply chain experts, like freight forwarders and third-party logistics providers (3PLs).

By partnering with a 3PL, you can access the fulfillment capabilities and carrier relationships to help manage costs while satisfying your customers’ expectations.

Optimizing your fulfillment

Fulfillment refers to specific ecommerce logistics processes, such as inventory management at the SKU level and customer order processing. Optimizing these processes is an ongoing task with activity levels based on market conditions, customer demand, sales volumes, and growth objectives.

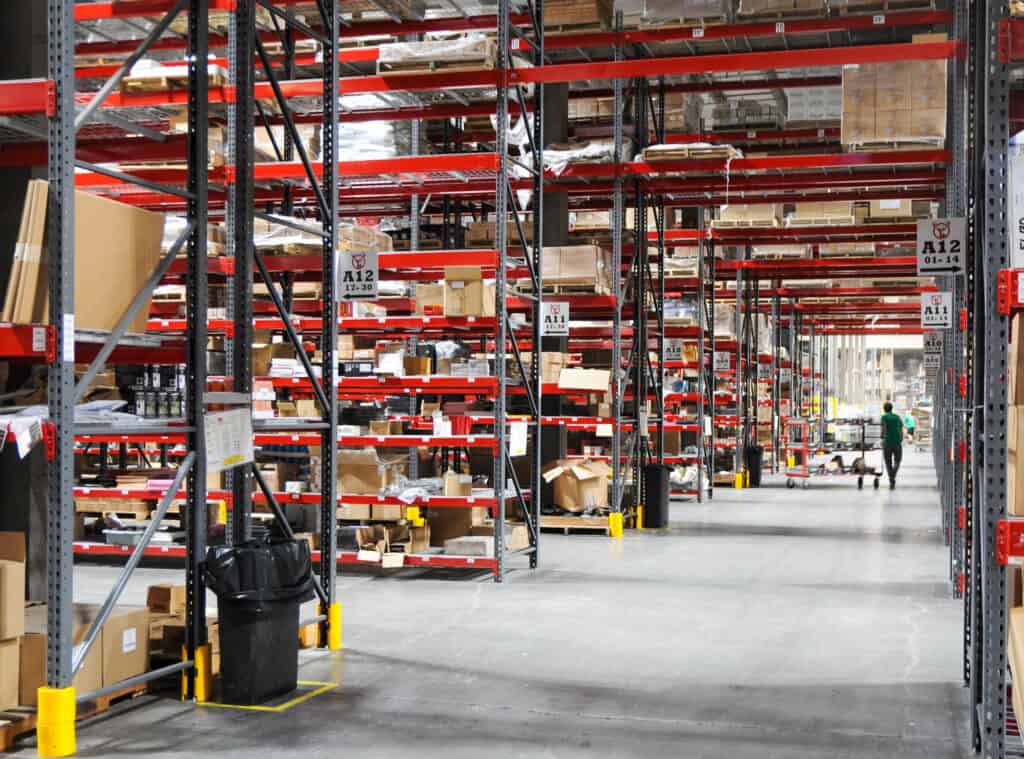

Warehousing

Having the right warehouse locations can make a big difference in the financial health of your ecommerce business. Getting closer to your customers reduces shipping times. And this, in turn, helps lower your landed costs.

The number of warehouses can make a difference, too. Maintaining stock across many locations can tie up capital and hinder your cash flow. That can be a real problem for startups, and many companies find that they don’t need as many warehouses as they think.

In fact, Red Stag’s centrally located warehouses in Knoxville and Salt Lake City can help you reach 96% of U.S. addresses within two days or less.

Receiving

Efficient warehousing begins with fast, accurate receiving, and your staff plays a critical role. A warehouse management system can match bills of lading and other receiving documentation with scanned freight labels, but human checks are essential for verifying the correct product attributes and conditions. The right workforce can also limit inventory loss due to damages or shrinkage, which jeopardizes both your capital investments and projected profits.

Stocking and slotting

Warehouse organization, known as slotting, is crucial to efficient fulfillment. Where staff place your products helps them minimize travel and search times when picking inventory.

Optimal slotting includes tactics like separating visually similar SKUs to avoid confusion and strategically spacing popular items to prevent congestion. Giving staff clear path instructions for the fastest route to an item can further reduce errors.

Specialty storage

If you sell large or bulky items or products that may be classified as dangerous goods, your storage needs change. These items require specific stacking configurations, manual or digital monitoring systems, and certified staff to get it right.

Owning, renting, and managing specialty warehouses and equipment can require a lot of cash from you. That’s why some ecommerce businesses choose to work with an experienced ecommerce logistics partner. A 3PL can take those responsibilities off your plate.

Geographic considerations can also play a role. Inland warehouses often provide more cost-effective options for storing large items compared to coastal facilities, where space is limited and congestion risks are higher.

Inventory management

Inventory management looks at your stock in storage and how quickly it sells so you can refine forecasting, order details, and pricing. There can be many moving parts to inventory management, depending on how many products you sell across categories, and you may benefit from a supply chain partner, like a 3PL, to help keep track of everything.

Stock monitoring and allocation

Regularly monitoring stock levels helps prevent stockouts or overstock situations. Both are inventory imbalances, but they have different impacts on your business.

Stockouts result in lost sales and disappointed customers. If this happens to you, try automating replenishment orders or implementing an omnichannel strategy that pools inventory for sales on any channel.

Overstock ties up capital and incurs unnecessary storage costs. This matters because older inventory comes with higher SKU-level carrying costs, which means reduced profit margins on those items. You could limit excess inventory with a first-in-first-out (FIFO) strategy that focuses on selling the items you’ve stored the longest.

SKU analysis and inventory turnover

SKU management can be complex, but it’s critical to cash flow. Analysis provides insights into individual products’ performance, so you can make informed decisions about pricing, promotions, order quantities, and supplier negotiations.

One way to determine SKU performance is by looking at inventory turnover, a financial metric that shows how quickly inventory is sold and replaced. Turnover rates don’t just relate to products, though. They tell you how quickly cash flows through your business so you can maximize profitability.

Pick and pack fulfillment

Pick and pack happens once a customer places an order. At this stage, customer expectations become more pressing. If you have an issue further upstream in the supply chain, it’s easier to resolve without customers ever realizing anything is amiss. If you have an issue with pick and pack, you risk returns, negative reviews, and customer churn.

Picking processes

Picking processes involve selecting items from inventory for order fulfillment. Efficient picking can significantly boost warehouse productivity, helping to support fast packing and handoff for last-mile delivery.

Make sure your warehouses use flexible picking strategies that adapt to fluctuations in order volume and demand. Effective slotting tactics during receiving also help prioritize items based on demand, value, or urgency.

Packing optimization

Strategically arranging items within packaging optimizes space utilization and minimizes shipping costs. With the proper packing techniques, you help prevent damages by securely holding items in place during transit.

Using the right packaging also supports cost control by avoiding both overpayment and underpayment for materials. This matters because overpayment leads to unnecessary expenses, while underpayment may result in low-quality packaging that increases damage claims and returns.

Dimensional weight

Dimensional weight is a pricing technique used by carriers, where shipping costs are determined based on package volume rather than weight alone. Optimal packing practices play a crucial role in reducing dimensional weight charges.

By efficiently packing items to minimize package volume, businesses can lower shipping costs and improve cost-effectiveness across their fulfillment. Strategic packing also contributes to a smoother shipping process, which can help keep online shoppers satisfied.

Shipping and delivery

Delivery concludes the order fulfillment process. Getting this stage right is essential to meeting customer expectations, but it can come with risks. That’s because once a parcel leaves the warehouse, it’s also too late for you to fully control any issues. It’s up to the shipping carrier now.

Carrier selection is important for cost control, too. Be sure to do your homework on various shipping rates and routing options that may contribute to delivery cost and speed.

You may have the opportunity to negotiate volume discounts with certain carriers if you ship enough product. If you don’t meet volume requirements, you can work with a 3PL that can pass their discounts on to you.

Outsourcing ecommerce logistics

You may consider an ecommerce logistics partner as your business grows. By acting as an extension of your team, logistics providers can provide the operational abilities to scale your fulfillment while also helping you meet demand during busy periods.

3PLs provide expertise in supply chain, inventory management, transportation, and distribution. Their specialized knowledge can lead to more efficient logistics operations, lower landed costs, and happier customers.

Logistics network benefits

Outsourcing can also provide your business with access to a broader network of transportation and distribution channels. With these networks, you can expand your market reach without the complexities and cash requirements of establishing or scaling your own logistics infrastructure.

Experienced 3PLs often have robust risk management strategies, ensuring continuity and resilience across networks, which can be challenging to achieve independently.

Growth support

3PLs often offer scalable solutions, allowing businesses to adjust services based on fluctuating demand. This flexibility helps companies adapt to market changes, such as shifts in consumer preferences or unexpected demand spikes.

By outsourcing ecommerce logistics, you can reallocate resources towards core growth activities like product development, inventory management, or perhaps investing in a warehouse management system. Your 3PL may also be able to help you with insights, strategies, and tactics to help overcome challenges throughout your supply chain.

Getting started with a 3PL

Want to learn more about how a 3PL can help you improve your ecommerce logistics? Reach out to Red Stag now.