The global supply chains many hoped would be in better shape this year will continue to struggle and may worsen due to Russia’s war against Ukraine and sanctions imposed against Russia. That’s the growing consensus from logistics and government experts across the world.

The war has cut off exports from Ukraine. Russian goods and raw materials are under sanction. Global supply chains are still trying to understand how to respond and put plans into place. Unfortunately, the disruption is substantial due to the goods both countries normally supply, especially raw materials.

Modern, global supply chains are complex. Your partners may be positioned in China or Western Europe, but their suppliers often crisscross the world. You may escape any significant impact, but delays and repercussions will extend across nearly all supply chains. Some impacts that we’re likely to see on both a global and local scale include:

- Disrupted trade routes

- Declines in raw material availability

- Increased oil and energy costs

- Fluctuating or rising freight costs

- Consumer-spending knock-on effects as energy and goods prices rise

To start understanding your potential impact, let’s review the current state of affairs. Plus, we’ll uncover where to look for bottlenecks and constraints.

Most stranded ships since WWII

The impacts of Russia’s war and global sanctions on the country are far-reaching, and some elements can be surprising. The Wall Street Journal notes that incidents like port closings and missile attacks directly on vessels have stranded many ships, especially near the Black Sea. According to the paper, the hostile actions have stranded more ships worldwide now than at any point since World War II.

Some causes are direct threats and hostility to ships and their crew. Others are global supply chain delays due to the ripple effects of large shipping lines suspending activity in Russia. Your partners may be adjusting to avoid conflict areas.

Ultimately, experts suggest this may congest some shipping lanes and cause traffic to take longer routes, slowing down container traffic. Alone, this may not cause you to see a significant delay. However, when paired with the ongoing COVID shutdowns and delays in Asia, imports may face slowdowns or inconsistent transit times, making it harder for everyone in your supply chain to plan.

Does your global supply chain depend on this region?

If you’ve got a robust domestic supply chain, it may rely on Russian suppliers and have difficulty securing raw or refined materials. This is due to the complexity of global supply chains and sourcing. According to this report, roughly 560,000 U.S.-based businesses rely on Russian and Ukrainian suppliers. That’s surprising, given that Russia is our 26th largest trading partner, exporting roughly $22.3 billion in goods and services to the U.S.

Bloomberg provides an interesting example to consider. Thomson Plastics has fallen to roughly one-third of its pre-pandemic profit margin because the plastic industry relies on oil and natural gas liquids (used to make plastic resins). Inflation, a doubling in natural gas costs, and squeezed suppliers have increased its costs. Businesses will feel increases in the automotive, lawn, garden, and recreation industries. That comes on top of some automotive and trucking equipment shortages.

Many of the finished products in those spaces are heavy and bulky when shipped to customers. That means they were already hit multiple times with higher rates in pre-production through final assembly. They face yet another surcharge for fuel and added fees for being oversized for last-mile delivery. As a result, businesses will either slash their margins or significantly increase costs for the final customer.

Rising fuel costs are just the first

American businesses and consumers face continued increases in fuel and energy pricing. This is a double-hit when thinking of global supply chains and your profitability. Philip Orlando, Chief Market Strategist at Federated Global Investment Management, estimates that every $0.01 increase in gasoline prices causes a subsequent $1.18 billion annual decline in U.S. consumer spending.

Global supply chains will feel the pain of higher oil prices first at the shipper and carrier levels. However, fuel surcharges and other cost pass-throughs may shift some of that pain to you. ECommerce companies and traditional retailers will likely follow suit and raise pricing or reduce offers to shift costs to end consumers. While that alleviates some pressure, it may lower consumer demand as their buying power shrinks.

Food

At the same time, Ukraine and Russia are two of the largest food exporters in the world. Globally, Ukraine accounts for roughly 41% of the sunflower oil, 8.9% of wheat, and 16% of corn exports. Russia has a 21% share of sunflower oil exports and 14% of wheat.

The war ravaging Ukrainian farms and a mix of potential sanctions and trade war retaliation by Russia could put global food supplies at risk. These issues will raise prices for consumers and compound energy and inflation pain. That pressure may not directly hit your domestic supply chain, but it could lower available consumer spending.

Nickel

Nickel prices have been highly volatile due to the war — primarily due to disruption and not direct sanctions (yet). It briefly saw the largest-ever spike in the metals market. The rise exacerbates existing harm for automakers — already struggling due to a chip shortage. Russia is the leading producer of the nickel used in lithium-ion batteries. Russian sources face significantly elevated costs and disruption threats, making reliance on nickel and palladium problematic even if no direct sanctions hit the materials or companies producing them.

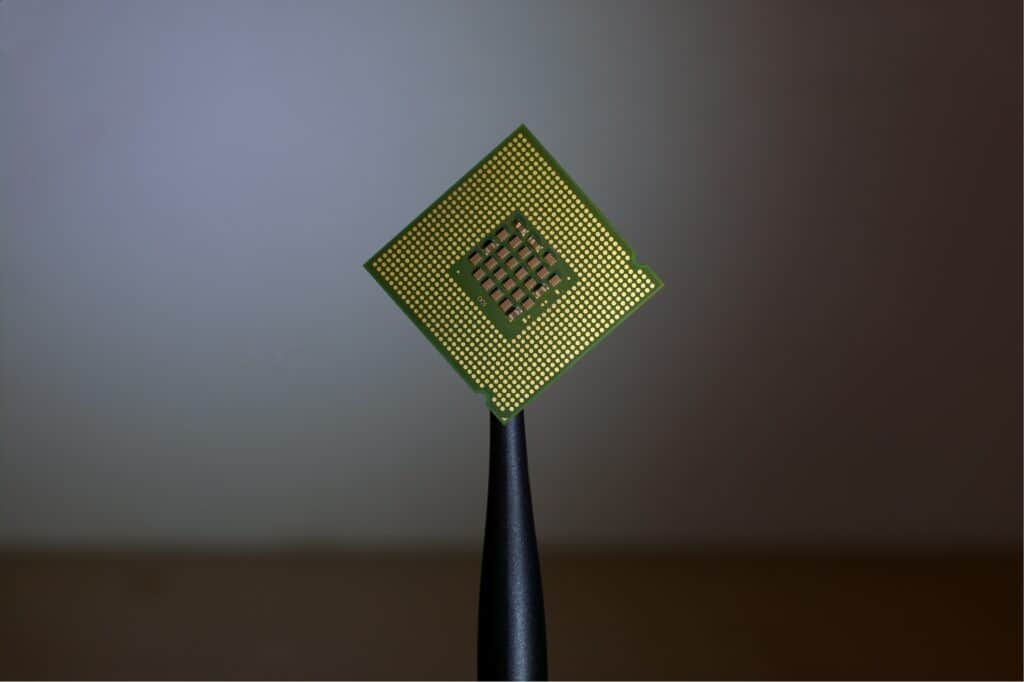

Semiconductors

According to public statements by the U.S. Trade Representative department, Russia is a leading supplier of many materials used in creating semiconductors and computer chips. Russia and Ukraine account for more than 85% of the world’s neon that these chips use and large portions of the global palladium and germanium used for semiconductors. Its cobalt supply plays a role in the industry, too.

Financial sanctions and material shortages due to the conflict may disrupt sourcing for many high-end American and European goods manufactured overseas.

More may be coming

Russian sanctions are slowly expanding and may impact global supply chains in new ways. As of the writing of this article, newer sanctions are focused on bans on new investment, restricting the use of certain banks and state-owned companies, and curtailing business relationships with government officials and family members.

ECommerce companies may also have product supply issues as luxury goods, automotive parts, art, and survival gear face increased sanctions. Your suppliers may leave Russia altogether to avoid accidentally violating sanctions or when forced to change practices to ensure payments to partners continue.

Russia is also banning exports of goods in retaliation to Western sanctions, covering many of the above goods as well as medical, forestry, and agricultural equipment. Some 200 products are on its ban, which could last through 2022. The U.S. is one of roughly 50 countries on the ban list. While a ban on sales of Russian-made railway cars may seem like a global supply chain shock, these historically have been sold and used only in neighboring countries for domestic efforts, such as Kazakhstan and Belarus.

Global supply chains exacerbate domestic shortages

Your business may face added pressure tangentially related to the ongoing conflict. As inflation, gas, and the cost of living continue to rise, workforce management becomes more challenging. Companies need to raise wages to retain workers, though many still face shortages. It’s becoming more expensive to have the team you need to meet customer demands.

Balancing rising costs for labor and materials with controlling costs to retain customers is burning the candle at both ends for many. It will be a complex calculus for companies to weather the global supply chain impacts of Russian sanctions amid domestic pressures.

Start creating a response

Even if Russian sanctions don’t directly impact your industry or supplier, it will be harder to keep global supply chains moving smoothly. The financial sanctions on Russian banks can make it more difficult to actually pay your supplier. Domestically, many businesses are cutting ties altogether under pressure from partners and consumers because of the social, reputational, and compliance risks.

Everything is coming to a head, and it will be more expensive for everyone just to do business. For you, that likely means it’s time to start exploring ways to reduce costs and shipping fees, either by changing your processes or finding reliable partners. Here are some additional items that may help you start securing those cost reductions and thinking about future protections:

- When to Outsource Inventory Management to Your 3PL

- 3 Ways to Improve 2022 Logistics: An Interview with Lorrie Watts

- What Does Safety Stock Mean in the Era of COVID-19?

- Georgia Expands Port Capacity, Here’s What to Know

- From Suez to Seattle, Global Bottlenecks Remain an Ongoing Threat to ECommerce Logistics